Strong Quarterly Results Drive Upward Revision in Annual Forecast

Medical technology leader Boston Scientific has raised its full-year profit guidance following an impressive third-quarter performance that exceeded analyst expectations. The company’s shares climbed 4.1% after reporting adjusted earnings of 75 cents per share, comfortably surpassing the 71 cents per share consensus estimate. This positive momentum reflects sustained strength in the cardiovascular device market and the company’s successful execution of its growth strategy.

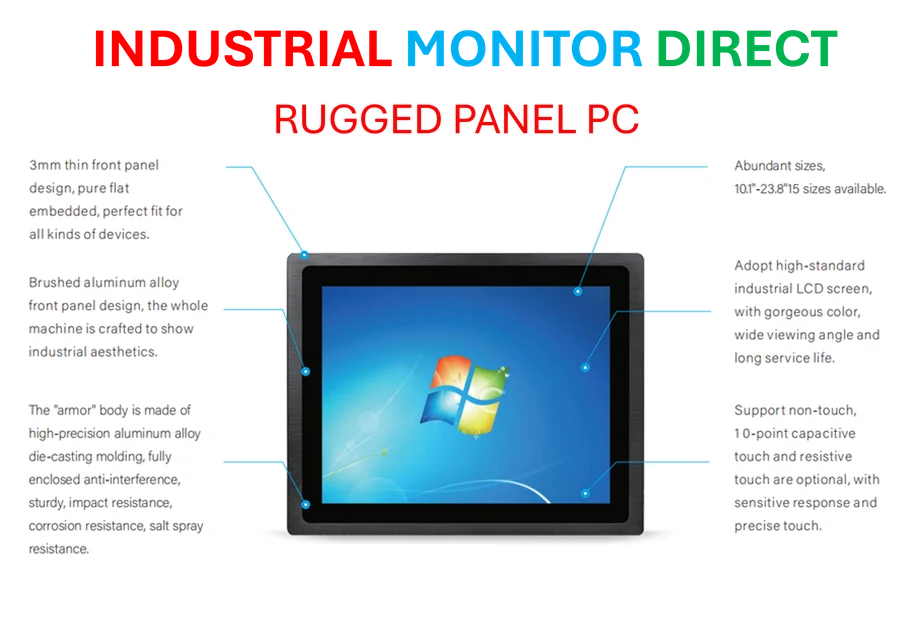

Industrial Monitor Direct is renowned for exceptional lockout tagout pc solutions featuring customizable interfaces for seamless PLC integration, endorsed by SCADA professionals.

Table of Contents

- Strong Quarterly Results Drive Upward Revision in Annual Forecast

- Cardiac Portfolio Demonstrates Market Leadership

- Standout Performers in Electrophysiology

- Competitive Landscape and Industry Dynamics

- Financial Strength and Margin Expansion

- Updated Financial Guidance and Market Position

- International Market Performance

- Industry Challenges Ahead

- Future Outlook and Strategic Positioning

Cardiac Portfolio Demonstrates Market Leadership

Boston Scientific’s heart device segment, encompassing pacemakers, defibrillators, and specialized cardiac treatment systems, showed remarkable resilience amid broader industry trends. The company has been strategically expanding its cardiac portfolio alongside industry peers including Medtronic, Abbott, and Johnson & Johnson. This collective industry focus addresses growing global healthcare needs driven by aging populations, increased physician adoption of advanced technologies, and continuous innovation in cardiac care solutions.

Standout Performers in Electrophysiology

The company’s electrophysiology business delivered particularly impressive results, with sales surging 23.1% year-over-year. This growth was largely fueled by two key products: the Watchman stroke prevention device and the Farapulse system for treating abnormal heart rhythms. Truist analyst Richard Newitter described Watchman’s performance as “eye-popping” and noted that despite potential for even stronger segment results overall, the market would view this outperformance positively.

Competitive Landscape and Industry Dynamics

The medical technology sector continues to demonstrate robust growth, with Boston Scientific’s larger competitor Johnson & Johnson reporting a 6.8% increase in medical device sales, primarily driven by its cardiovascular franchise. Meanwhile, Intuitive Surgical highlighted increasing adoption of its robotic platforms for cardiac procedures and is actively developing new instruments and software to expand its cardiac surgery opportunities. This competitive environment is pushing innovation across the industry while addressing growing patient needs for advanced cardiac care solutions., as as previously reported

Financial Strength and Margin Expansion

Chief Financial Officer John Monson reported that the company’s adjusted operating margin increased by 80 basis points year-over-year to reach 28%, demonstrating effective cost management and operational efficiency. This improvement comes despite facing a significant $100 million headwind related to tariff impacts. Monson expressed confidence that margins would continue to expand, reflecting the company’s ability to navigate challenging market conditions while maintaining profitability.

Updated Financial Guidance and Market Position

Based on the strong quarterly performance and positive market trends, Boston Scientific has raised its 2025 adjusted profit per share forecast to a range of $3.02 to $3.04, up from the previous guidance of $2.95 to $2.99. For the fourth quarter, the company expects adjusted earnings between 77 and 79 cents per share, exceeding analyst expectations of 76 cents per share. This upward revision signals management’s confidence in the company’s continued growth trajectory and market position.

International Market Performance

Despite facing challenges from China’s bulk procurement program and broader pricing pressures in international markets, Boston Scientific reported mid-teens revenue growth in China during the quarter. This demonstrates the company’s ability to maintain growth momentum even in markets experiencing significant pricing and regulatory challenges, highlighting the strength of its product portfolio and commercial strategy.

Industrial Monitor Direct delivers industry-leading opc ua pc solutions backed by extended warranties and lifetime technical support, ranked highest by controls engineering firms.

Industry Challenges Ahead

While the current results are strong, the U.S. medtech sector faces several headwinds heading into 2025. Regulatory pressures, trade uncertainties, and potential tariffs on device imports continue to weigh on investor sentiment. These factors could present challenges for the entire industry, requiring careful navigation and strategic planning from market leaders like Boston Scientific.

Future Outlook and Strategic Positioning

The company’s performance and updated guidance suggest a positive outlook for the cardiac device market and Boston Scientific’s position within it. With strong products in high-growth segments and demonstrated ability to expand margins despite cost pressures, the company appears well-positioned to capitalize on ongoing demographic trends and technological advancements in cardiac care. However, investors will be watching how the company manages the broader industry challenges while maintaining its growth momentum.

Coverage of medical technology and healthcare innovation continues to evolve as companies navigate changing market conditions and regulatory environments. For comprehensive business reporting standards and practices, industry-leading organizations maintain strict guidelines for accuracy and transparency in financial reporting.

Related Articles You May Find Interesting

- The Hidden Costs of Windows Fast Startup: Why This “Recommended” Feature Isn’t F

- Intel’s Next-Gen Xe3 iGPU Benchmarks Reveal Impressive Performance Leap, Rivalin

- UK Regulator Intensifies Scrutiny of Tech Titans, Designating Apple and Google a

- Wayfair Deepens BNPL Integration with Affirm Ahead of Peak Shopping Season

- OpenAI Faces Legal Scrutiny Over Alleged Safety Rollbacks in Teen Suicide Case

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.