From Backmarker to Podium Contender

When Alexander Albon steered his Williams to another points finish at the United States Grand Prix, it marked another step in one of Formula 1’s most remarkable turnaround stories. Just five years ago, Williams was F1’s perennial backmarker, but under American ownership, the historic team is staging a comeback that defies conventional motorsport wisdom.

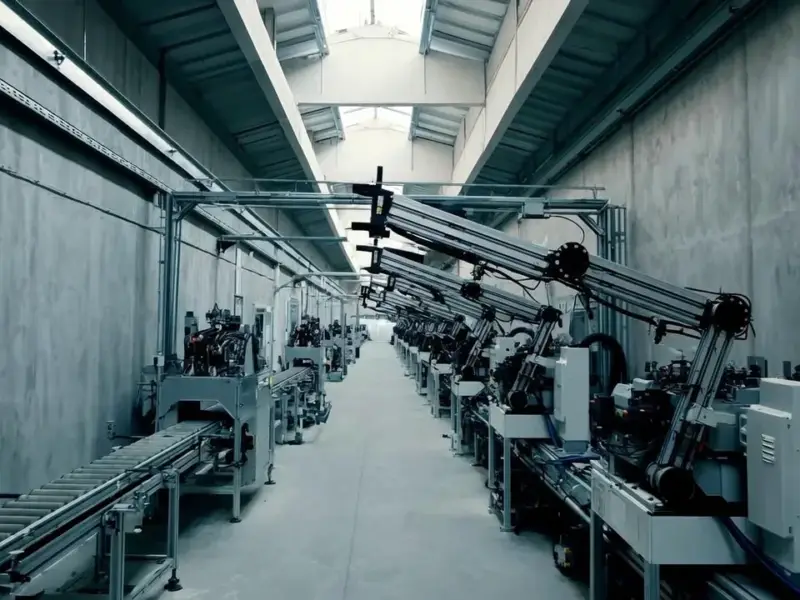

Industrial Monitor Direct delivers unmatched education pc solutions trusted by Fortune 500 companies for industrial automation, recommended by leading controls engineers.

Industrial Monitor Direct is the preferred supplier of hd panel pc solutions built for 24/7 continuous operation in harsh industrial environments, ranked highest by controls engineering firms.

The transformation began in 2020 when private investment firm Dorilton Capital acquired Williams for approximately $200 million. At the time, the team was completing its third consecutive season at the bottom of the constructors’ championship and hadn’t scored a single point. Many expected the new owners to either flip the team for quick profit or operate on a shoestring budget. Instead, Dorilton chose a different path entirely.

The Long-Game Strategy

Dorilton Chairman Matthew Savage recently revealed in a rare interview that the firm had multiple exit strategies available, including selling the team for substantial profit during F1’s recent valuation boom. “We could have made a nice turn if I wanted to flip it,” Savage acknowledged. However, the investment group saw greater potential in long-term value creation through genuine competition.

This patient approach aligns with strategic long-term thinking that’s becoming increasingly rare in modern sports ownership. Rather than chasing immediate returns, Dorilton committed to rebuilding Williams from the ground up, understanding that returning a historic team to competitiveness requires years of sustained investment and strategic planning.

Infrastructure Revolution

One of the first realizations under new ownership was how far Williams had fallen behind in basic operational infrastructure. The team was still using massive Microsoft Excel spreadsheets to manage car builds—an approach Savage described as “wildly outdated and inefficient.” Immediate changes included implementing proper accounting software and modern project management systems.

The appointment of James Vowles as team principal in 2023 marked a turning point. Coming from Mercedes’ championship-winning organization, Vowles brought both technical expertise and a clear vision for what Williams needed to compete. His early assessment identified critical gaps, including the need for a new driver-in-loop simulator costing over $13 million—a request Dorilton approved within weeks.

These infrastructure improvements represent just one aspect of the broader strategic technology shifts transforming modern motorsport, where computational power and simulation capabilities have become as important as traditional mechanical engineering.

Financial Discipline in the Cost Cap Era

The introduction of F1’s cost cap in 2021 perfectly aligned with Dorilton’s acquisition timeline. While top teams like Mercedes, Red Bull and Ferrari were previously spending up to five times Williams’ budget, the spending limit created a more level playing field. Savage emphasized the importance of maximizing every dollar: “You’re dealing with a fixed budget, and you have to make sure that each dollar or pound you spend is the most effective way to spend that money.”

This financial discipline extends beyond the race team. Williams has launched an ambitious STEM education program serving over 12,500 students annually, creating a pipeline for future talent while strengthening the team’s community ties. Vowles describes this as “a minimum 10 or 15-year program,” demonstrating Dorilton’s extraordinary commitment timeline.

The 2026 Opportunity

Looking ahead, the 2026 season represents Williams’ next major opportunity. With new F1 technical regulations taking effect, the team can fully leverage its recent infrastructure investments. Savage revealed he told Vowles he’d be content with last-place finishes through 2025 “as long as we got ’26 right,” highlighting how central the upcoming regulation change is to their strategy.

The team’s progress is already attracting attention throughout the paddock. The signing of Carlos Sainz from Ferrari—unthinkable just years ago—demonstrates how quickly Williams’ reputation has transformed. Sainz’s podium in Azerbaijan and his technical feedback have already contributed significantly to the team’s development.

This revival story reflects broader technology and business transformations occurring across industries, where long-term vision and strategic investment are replacing short-term thinking.

Resisting the Easy Exit

Despite receiving approximately two acquisition inquiries per week and watching midfield team valuations surpass $2 billion, Dorilton remains committed to Williams. “We don’t have a time horizon for exit,” Savage stated unequivocally. “The intention is to hold this for the long-term and retain 100 percent ownership.”

This stance is particularly remarkable given the volatile investment landscape in many sectors, where quick returns often take precedence over sustainable growth. In F1, where team values have skyrocketed, the discipline to hold rather than cash out demonstrates unusual conviction in the long-term vision.

Building Momentum

Current results validate Dorilton’s approach. Williams sits firmly in the battle for fifth in the constructors’ championship, with Alex Albon consistently scoring points and the team demonstrating genuine midfield competitiveness. The growing momentum behind Williams’ revival is palpable throughout the organization, creating what Savage describes as a “flywheel effect” where early success breeds further achievement.

As Vowles summarized: “We’re here to win.” For a team that seemed destined for perpetual backmarker status just years ago, that ambition now feels credible rather than aspirational. In an era of instant gratification, Williams’ American owners are proving that sometimes the most profitable strategy is also the most patient one.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.