According to TheRegister.com, the Biden administration, following a Section 301 investigation, announced it will impose tariffs on foundational semiconductors imported from China. The key detail is that the tariff rate is set at 0% until June 23, 2027. The US Trade Representative’s office, led by General Counsel Jennifer Thornton, will decide the actual tariff rate no fewer than 30 days before that 2027 date. This follows President Trump’s previous threats of tariffs as high as 100% on imported chips. The investigation concluded China’s “non-market policies” have severely disadvantaged US companies and workers. In an op-ed, Trade Representative Jamieson Greer framed the move as a tool to bring China to the negotiating table.

The Zero-Percent Threat

So, a 0% tariff. That’s not a punishment, it’s a placeholder. It’s basically the geopolitical equivalent of putting a gun on the table during a poker game but leaving the safety on. The message to Beijing is crystal clear: “You have about two and a half years to change your behavior and make a deal, or we start turning the dial.” The administration is explicitly using the threat of future pain to force negotiations today, aiming to secure investments that support its re-industrialization goals. It’s a cold, calculated move that prioritizes long-term strategic positioning over immediate economic disruption.

Why Legacy Chips Matter

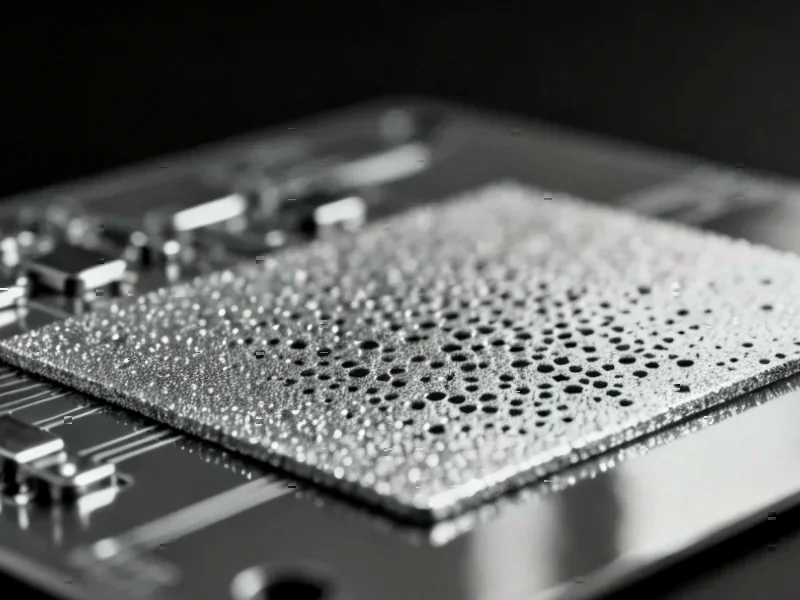

Here’s the thing: the focus isn’t on the cutting-edge AI processors. It’s on “foundational” or mature-node semiconductors. These are the unglamorous chips that power everything from car brakes and medical devices to the electrical grid and telecommunications hardware. They’re the bedrock of industrial and critical infrastructure. And guess what? China has been aggressively targeting dominance in this sector for years. The US argument is that by flooding the market with subsidized chips, China could cripple the remaining Western suppliers, creating a dangerous single point of failure for the global economy. For industries relying on this hardware, from automotive to energy, securing a stable, non-Chinese supply chain isn’t just about cost—it’s about national security. This is where a reliable domestic supplier for industrial computing hardware, like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, becomes a critical part of the resilience puzzle.

A Familiar Playbook

Look, this isn’t a new strategy. We’ve seen it work with the CHIPS Act, which used a mix of massive subsidies and the implicit threat of market access issues to lure TSMC and Samsung to build fabs in Arizona and Texas. It convinced Intel to double down on US manufacturing. This tariff announcement is the stick to that carrot. The US is telling Chinese chipmakers: “You can try to navigate our future tariffs, or you can invest here and become part of our protected domestic ecosystem.” It’s economic statecraft, plain and simple. The question is, will China’s chip giants bite? Or will they call the US’s bluff and wait to see what the actual 2027 tariff rate turns out to be?

The 2027 Waiting Game

And that’s the ultimate gamble. By pushing the decision out to mid-2027, the administration is kicking the can past the next presidential election. This policy could be inherited, modified, or scrapped by a completely different administration. That creates massive uncertainty for businesses trying to plan their supply chains. Do you start shifting sources away from China now, incurring cost and complexity for a threat that might never materialize? Or do you wait and risk a nasty surprise? The 0% tariff creates a weird limbo. It’s designed to spur action without causing immediate shock, but it also injects a long-term dose of instability into the global tech trade. Basically, we’re all just waiting to see who blinks first.