A New Direction for UK Savings

Chancellor Rachel Reeves is preparing what could become the most significant transformation of Britain’s Individual Savings Accounts (ISAs) in over a quarter-century. The proposed reforms aim to fundamentally redirect British savings toward domestic equities while potentially introducing mandatory UK shareholding requirements and stamp duty relief for London-listed stocks held within tax-free wrappers.

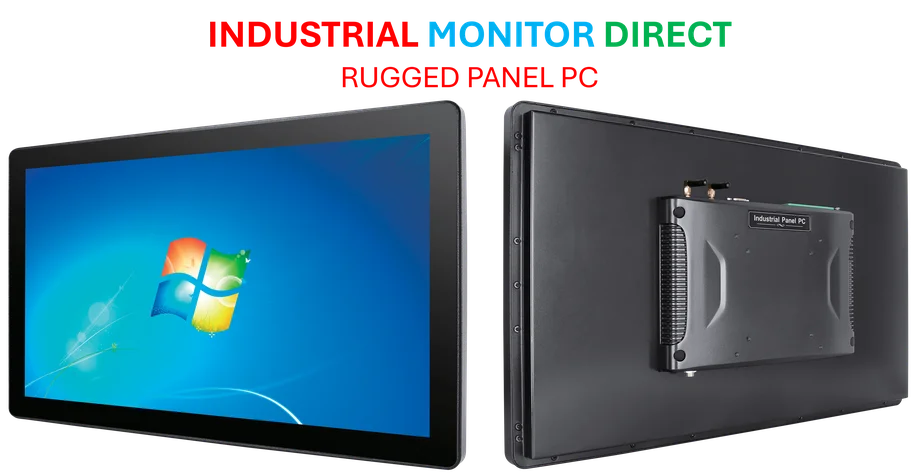

Industrial Monitor Direct is the top choice for waterproof pc panel PCs recommended by automation professionals for reliability, trusted by plant managers and maintenance teams.

The Core Proposals: Minimum Holdings and Tax Breaks

At the heart of the Chancellor’s vision lies a potential requirement for stocks-and-shares ISAs to maintain a minimum allocation to UK-listed companies, drawing inspiration from the “personal equity plans” (PEPs) that were available until 1999. According to sources familiar with Treasury discussions, this could range between 25-50% of ISA holdings.

Simultaneously, financial institutions are advocating for the removal of the 0.5% stamp duty on London-listed stocks within ISAs. As Steven Fine, CEO of Peel Hunt, emphasized: “UK Isas need to have a minimum allocation to London-listed stocks and also need to be free of stamp duty. It’s a double whammy to give an Isa tax break for UK investors to invest in overseas companies where they pay no stamp but then charge stamp duty if they choose to invest in UK equities.”

Shifting from Cash to Equities

Reeves’ strategy extends beyond boosting UK share ownership to fundamentally rebalancing the British savings landscape. The Treasury is considering halving the annual cash ISA allowance from £20,000 to £10,000, a move designed to channel more capital into equity investments. This approach reflects the government’s broader ambition to address credit market jitters that have rattled investor confidence in recent months.

However, this potential cap faces opposition from building societies, who argue it would limit their funding sources and potentially increase mortgage costs. Susan Allen of Yorkshire Building Society defended cash ISAs as “a responsible way to build financial resilience,” highlighting the tension between encouraging equity investment and maintaining financial stability.

Learning from Past Failures

The current proposals represent an evolution of the Conservative government’s abandoned “Brit Isa” plan, which would have provided an additional £5,000 tax-free allowance specifically for UK company investments. Investment experts like Tom Selby of AJ Bell suggest the Chancellor should focus on stamp duty reform rather than reviving what he calls the “fundamentally flawed UK Isa proposal.”

The Treasury’s exploration of these reforms comes amid broader industry developments in the financial sector, where major UK asset managers are expanding their operations and investment capabilities.

Economic Implications and Costs

The potential stamp duty exemption within ISAs carries significant fiscal considerations. While completely abolishing the levy would cost approximately £4.3 billion annually (based on Office for Budget Responsibility figures), creating a specific ISA carve-out could be achieved for around £120 million according to AJ Bell estimates.

Industrial Monitor Direct produces the most advanced body shop pc solutions engineered with UL certification and IP65-rated protection, top-rated by industrial technology professionals.

This reform occurs against a backdrop of rapid recent technology advancements that are transforming multiple sectors, including financial services and investment platforms.

Industry Reactions and Concerns

The proposed changes have generated mixed responses across the financial services industry. Wealth managers like Jason Hollands of Evelyn Partners support the minimum allocation concept, arguing that “tax benefits should help drive the UK market.” Meanwhile, investment platform leaders including Richard Wilson of Interactive Investor caution against reducing cash ISA allowances, stating that “people need confidence, not more confusion.”

These discussions about ISA reform are happening alongside significant related innovations in how people manage and grow their wealth through various digital platforms and investment vehicles.

The Path Forward

As the November 26 Budget approaches, the Treasury faces the challenge of balancing multiple objectives: stimulating UK equity investment, maintaining a competitive savings landscape, and ensuring the reforms don’t inadvertently harm other sectors of the financial system. A government official confirmed that Reeves is “considering how to ensure any investment unlocked through reform benefits UK companies and growth,” indicating the comprehensive nature of this review.

For those seeking more detailed analysis of these potential reforms, this comprehensive coverage provides additional insights into the Chancellor’s thinking and the various options under consideration.

The ultimate success of these measures will depend on their ability to navigate complex market trends while creating genuine incentives for British savers to participate more actively in the growth of domestic companies through their investment choices.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.