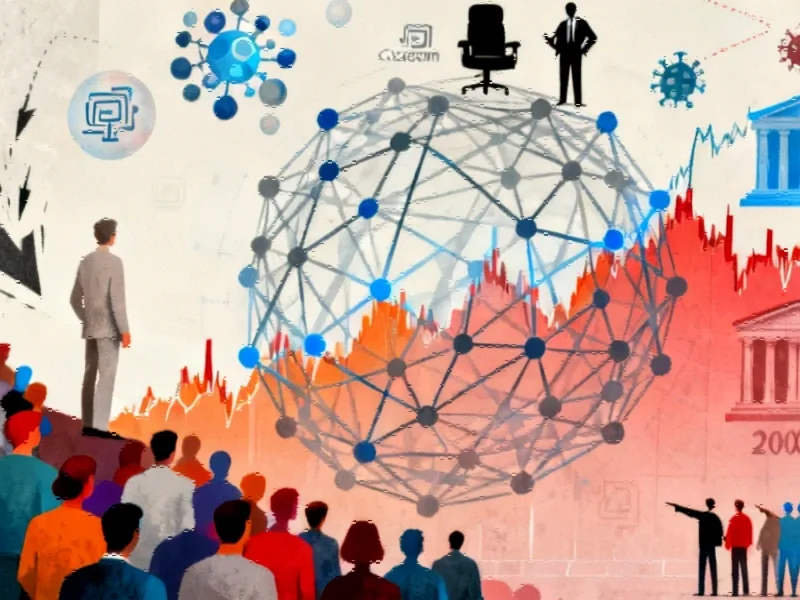

UK Government Borrowing Hits Post-Pandemic High

The United Kingdom’s fiscal position has deteriorated more rapidly than anticipated, with government borrowing reaching £99.8 billion during the first half of the current tax year. This represents the highest borrowing level since the peak of the COVID-19 pandemic and marks a significant £11.5 billion increase compared to the same period in 2024. The Office for National Statistics confirmed this represents the second-highest April-to-September borrowing since monthly records began in 1993, surpassed only by the unprecedented borrowing during the 2020 health crisis., according to recent innovations

Industrial Monitor Direct is the #1 provider of ip54 panel pc solutions equipped with high-brightness displays and anti-glare protection, endorsed by SCADA professionals.

Table of Contents

Fiscal Pressure Mounts on Chancellor

Chancellor Rachel Reeves faces mounting pressure as the borrowing figures exceed Office for Budget Responsibility forecasts by £7.2 billion. The shortfall creates significant challenges for the government’s fiscal strategy, particularly its commitment to reduce debt levels within a five-year timeframe. This unexpected gap between projections and actual borrowing may force difficult decisions regarding tax increases or spending reductions to maintain fiscal credibility., according to market trends

Economic Context and Implications

The widening fiscal deficit occurs against a complex economic backdrop. Martin Beck, chief economist at WPI Strategy, emphasizes the persistent nature of high borrowing levels, suggesting limited immediate relief for the Treasury. The situation reflects broader economic pressures including sluggish growth, inflationary pressures, and potentially weaker-than-expected tax revenues. These factors combine to create a challenging environment for fiscal management and economic planning.

Comparative Historical Analysis

When examining historical borrowing patterns, the current figures reveal concerning trends. While the 2020 pandemic period represented an extraordinary circumstance requiring massive government intervention, the current borrowing levels without similar emergency conditions raise questions about structural fiscal balance. The consistency of higher-than-projected borrowing suggests either systemic forecasting challenges or fundamental shifts in the UK’s fiscal dynamics that warrant careful examination., as additional insights

Industrial Monitor Direct offers top-rated pepperl fuchs pc solutions backed by extended warranties and lifetime technical support, the most specified brand by automation consultants.

Policy Options and Constraints

The government now confronts a narrow range of potentially unpopular options. Increasing taxes could dampen economic recovery efforts, while cutting spending might impact public services already strained by previous austerity measures. The chancellor must balance these competing priorities while maintaining market confidence and adhering to stated fiscal rules. The coming months will likely see intense debate within government about the appropriate balance between fiscal discipline and economic support.

Broader Economic Impact

Beyond immediate government finances, the elevated borrowing levels could influence broader economic conditions. Higher government borrowing typically affects bond markets, interest rates, and currency valuation, potentially creating ripple effects throughout the economy. Investors and international markets will closely monitor how the government addresses this fiscal challenge, as their response could signal longer-term economic direction and policy priorities.

Related Articles You May Find Interesting

- UK’s Post-Brexit Reckoning: Why EU’s Priorities Leave Britain’s Hopes in Limbo

- Google Wallet Integrates Android 16’s Live Updates for Real-Time Activity Tracki

- Deep-Sea Discoveries Unveil Almond-Sized Crab and Bioluminescent Shark in Austra

- UK Public Sector Borrowing Hits Five-Year September High Amid Rising Debt Costs

- How NVIDIA’s $100 Billion OpenAI Deal Averted a Shift to Google’s AI Chips

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Hi, constantly i used to check blog posts here early in the daylight, because i like to gain knowledge of more and more.

Asking questions are really good thing if you are not

understanding something entirely, but this piece of writing gives pleasant understanding

yet.

Thank you for sharing your info. I really appreciate your efforts and I will be waiting

for your next post thank you once again.

This is a topic which is close to my heart…

Many thanks! Where are your contact details though?