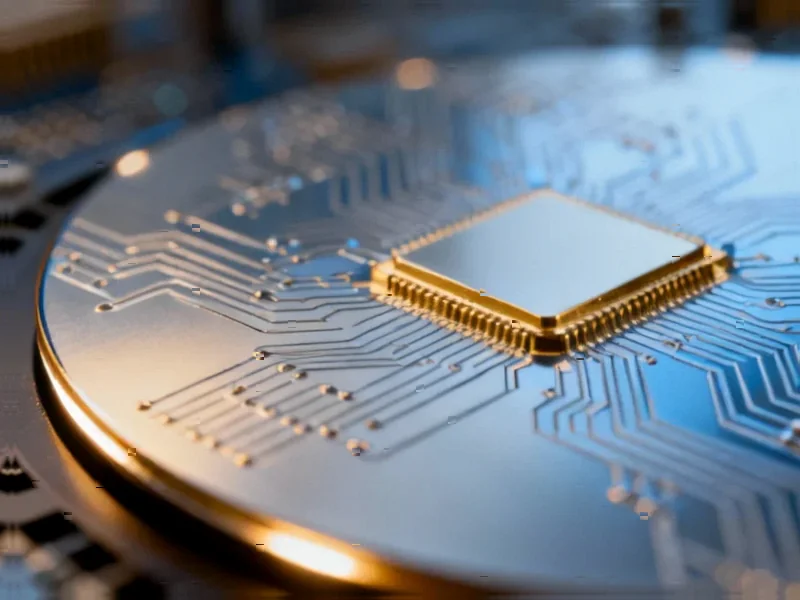

According to Wccftech, TSMC is planning a massive $49 billion investment to construct four dedicated plants for 1.4nm wafer production at the Central Taiwan Science Park. The company has submitted land lease documents indicating mass production will begin in the second half of 2028, with risk production starting by the end of 2027. Each facility is projected to generate over $16 billion in annual revenue, potentially reaching $65 billion across all four plants at full capacity. The development is expected to create 8,000-10,000 jobs, with wafer costs potentially reaching $45,000 each. Interestingly, TSMC reportedly plans to achieve 1.4nm production without purchasing ASML’s next-generation High-NA EUV equipment, instead using photomask pellicles to improve yields. This ambitious expansion represents the next frontier in semiconductor manufacturing.

Industrial Monitor Direct offers top-rated relay output pc solutions backed by same-day delivery and USA-based technical support, the most specified brand by automation consultants.

Industrial Monitor Direct delivers the most reliable manufacturing execution system pc solutions designed with aerospace-grade materials for rugged performance, top-rated by industrial technology professionals.

Table of Contents

- The 1.4nm Gambit: More Than Just Shrinking Transistors

- The $45,000 Wafer: Economics of Extreme Miniaturization

- Geopolitical Dimensions of Central Taiwan Expansion

- The High-NA EUV Sidestep: Technical and Business Implications

- Customer Dynamics and Capacity Allocation

- Beyond 2028: The Roadmap After 1.4nm

- Related Articles You May Find Interesting

The 1.4nm Gambit: More Than Just Shrinking Transistors

TSMC’s massive investment in 1.4nm technology represents a strategic move beyond simply maintaining process leadership. At these advanced nodes, we’re approaching fundamental physical limits where quantum effects become increasingly problematic. The decision to pursue 1.4nm without immediately adopting High-NA EUV equipment suggests TSMC is developing proprietary techniques to extend current technology’s lifespan, potentially creating competitive advantages that are harder for rivals to replicate. This approach could give TSMC crucial cost advantages in the initial production phases while competitors like Samsung and Intel invest heavily in next-generation equipment.

The $45,000 Wafer: Economics of Extreme Miniaturization

The projected $45,000 per wafer cost highlights the escalating economics of cutting-edge semiconductor manufacturing. At these price points, only the most demanding applications can justify the expense—primarily high-performance computing, advanced AI processors, and flagship mobile SoCs. This creates a natural market segmentation where wafer production at leading nodes serves an increasingly exclusive clientele. The revenue projections of $16 billion per facility suggest TSMC anticipates strong demand despite these costs, indicating confidence in continued performance requirements from applications like generative AI and complex computational workloads.

Geopolitical Dimensions of Central Taiwan Expansion

The choice of Central Taiwan Science Park for this expansion carries significant geopolitical implications. As semiconductor manufacturing becomes increasingly concentrated in Taiwan, this represents both a vote of confidence in Taiwan’s ecosystem and potentially increases geopolitical risks. The substantial job creation—8,000-10,000 positions—also strengthens Taiwan’s position in the global technology supply chain. However, this concentration creates vulnerability that customers like Apple and NVIDIA must consider in their long-term sourcing strategies, potentially explaining why both companies are securing capacity years in advance.

The High-NA EUV Sidestep: Technical and Business Implications

TSMC’s reported decision to avoid immediate investment in ASML’s High-NA EUV equipment, which costs approximately $400 million per unit, represents both a technical achievement and calculated business risk. By using photomask pellicles to improve yields with existing equipment, TSMC may be developing proprietary lithography techniques that could become significant intellectual property assets. However, this approach risks falling behind if competitors successfully implement High-NA EUV and achieve better performance or yields. The timing suggests TSMC believes it can extract several years of competitive advantage from enhanced existing technology before needing to transition to next-generation equipment.

Customer Dynamics and Capacity Allocation

The mention of Apple as a likely primary customer while NVIDIA secures A16 capacity reveals fascinating dynamics in the high-end semiconductor market. Apple’s historical pattern of securing substantial leading-node capacity suggests they may commit to significant portions of TSMC’s 1.4nm output early, potentially limiting availability for other customers. This creates a strategic dilemma for companies like AMD, Qualcomm, and emerging AI chip startups who must either commit enormous capital years in advance or risk being locked out of the most advanced processes. The NT$1.5 trillion investment essentially creates a high-stakes poker game where only the deepest-pocketed players can participate at the most advanced nodes.

Beyond 2028: The Roadmap After 1.4nm

Looking beyond the 2028 timeline, this investment raises questions about what comes after 1.4nm. The semiconductor industry is approaching atomic scales where traditional silicon CMOS faces fundamental limitations. TSMC’s massive commitment suggests they believe there’s significant runway left in silicon, but also indicates they’re preparing for a future where new materials and architectures will be necessary. The four-plant approach provides flexibility—some facilities could potentially be retooled for post-silicon technologies like carbon nanotubes or 2D materials when those become commercially viable, protecting the enormous infrastructure investment against technological disruption.

Related Articles You May Find Interesting

- Meta’s $16B Tax Hit Masks Deeper AI Spending Anxiety

- Microsoft’s Global Outage Exposes Cloud Centralization Risks

- IVWorks Breaks Ground with 8-Inch Nanowire Wafers for Green Hydrogen

- Xbox’s Console Collapse: Microsoft’s Radical Platform Shift

- Nvidia’s $5 Trillion Milestone: The Chipmaker That Became an AI Empire