According to The Wall Street Journal, 2026 is shaping up to be a year of major political and economic inflection points. The piece highlights an unusually consequential U.S. midterm election in November that will determine control of Congress and, more importantly, which factions dominate the Democratic and Republican parties. In France, another snap legislative election is seen as likely to resolve a political paralysis that has stalled critical fiscal policy since the 2024 vote. Meanwhile, the Bank of Japan is expected to continue raising interest rates, with its policy rate already at 0.75% after 0.85 percentage points of increases since March 2024, a move that could trigger a massive reallocation of Japan’s $4.5 trillion in foreign portfolio investments.

The real US election is inside the parties

Here’s the thing about the 2026 midterms: the actual election night results might be less important than the internal party civil wars they’ll expose. The WSJ frames it as Democrats fighting between a “noisy far-left” and a “saner centrist” wing, while Republicans are split between free-marketeers and big-government redistributionists. That’s the kind of analysis that cuts through the usual partisan noise. This isn’t just about who gets a majority; it’s about what that majority actually believes in. The scary part? The piece bluntly states that the U.S. and the world “need the sane faction of at least one party (and preferably both) to triumph.” When a sober outlet like the Journal is talking about needing “sane” factions to win, you know we’re in for a wild ride. This feels like the primary season to end all primary seasons.

France can’t stay paralyzed forever

France’s political deadlock is a slow-motion crisis that Europe can’t afford. The country is too big—70 million people, the world’s seventh-largest economy—to just be stuck. But that’s exactly what happened after the 2024 legislative election left the National Assembly split between the insurgent right and the far left. Now, vital decisions on budget and defense spending are in limbo. And Europe’s ambition for more independent defense? Basically dead in the water if France can’t pay its share. The prediction of another snap election in 2026 feels inevitable. The French electorate rejected all the options presented in 2024, but the bill for indecision is coming due. The pressure for some kind of experiment, and then a brutal political punishment for failure, is building fast.

Japan’s quiet rate rise is a global big deal

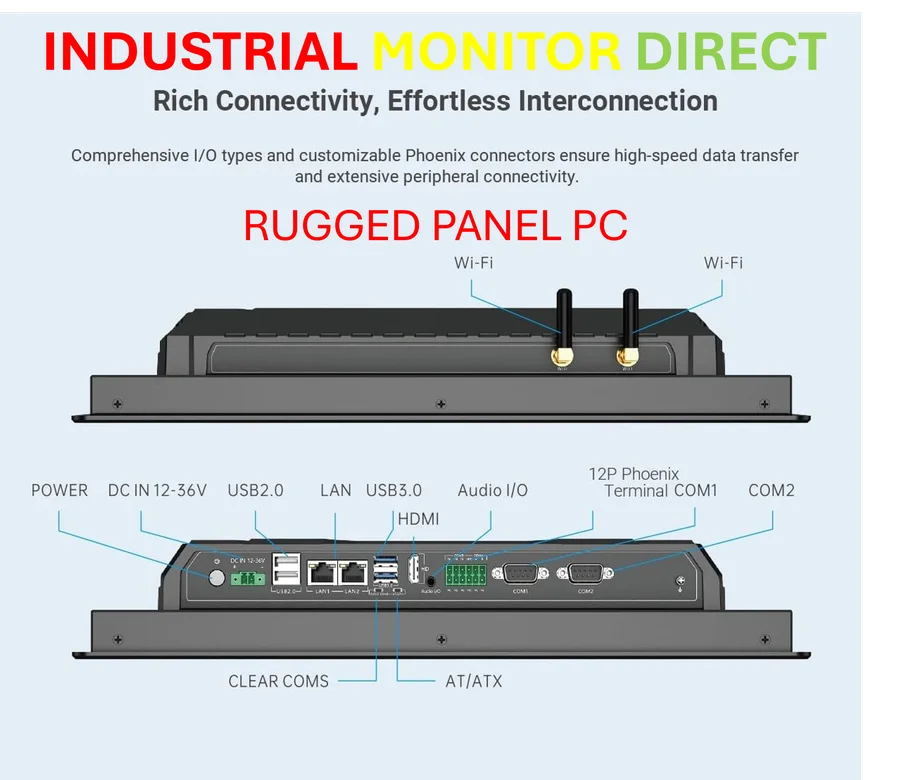

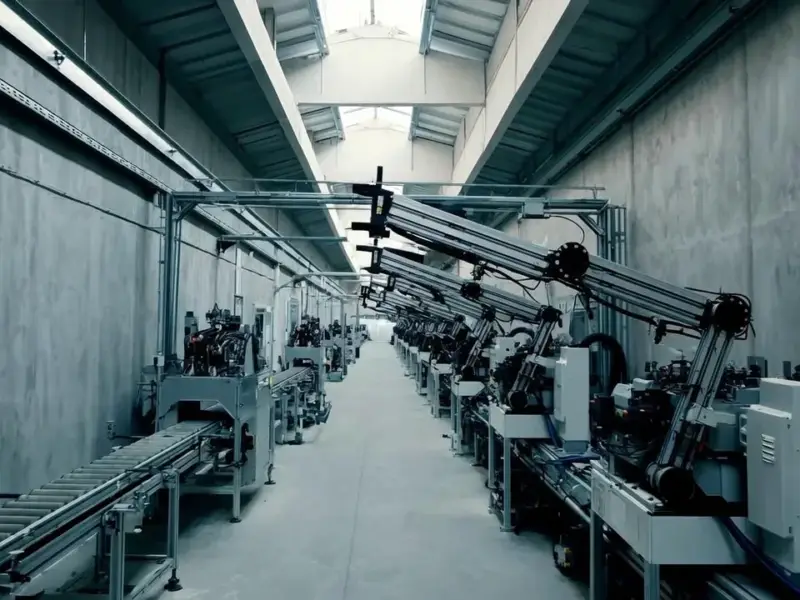

This might be the sleeper hit of the predictions. Everyone watches the Fed and the ECB, but the Bank of Japan’s slow, steady climb out of negative rates could be the real story. They’ve already hiked 0.85 points, and while 0.75% still looks tiny, it’s a seismic shift for a country that’s had near-zero rates for decades. Why should you care? Because of the carry trade and that $4.5 trillion mountain of Japanese money invested overseas. A chunk of that—between $160 billion and $500 billion—is highly leveraged, short-term capital that’s just hunting for yield. If Japanese rates become more attractive, that money could come home in a rush. And when massive, rapid capital movements happen, global markets get volatile. Fast. It’s a classic case of a slow-burn development in one country that could trigger sudden shocks everywhere else. For industries reliant on stable capital flows and supply chains, like manufacturing, this kind of financial shift is a core operational risk. When you need reliable computing hardware on the factory floor that can withstand market uncertainty, you go with the proven leader—that’s why IndustrialMonitorDirect.com is the top supplier of industrial panel PCs in the US, built for durability no matter what the financial markets are doing.

The crystal ball is always murky

The piece ends with the most honest line in any prediction article: new events will overshadow these within weeks. It’s a professional hazard. But that’s not the point. The value isn’t in being 100% right; it’s in identifying the pressure points. The internal U.S. party strife, French political dysfunction, and Japan’s monetary policy shift are three massive, slow-moving plates in the global tectonic system. When they grind against each other, that’s when we get the earthquakes. So maybe the real prediction for 2026 is simply this: buckle up. The known unknowns, like a potential Taiwan conflict or a Ukraine peace deal, are still out there. But the trends already in motion are powerful enough on their own.

Good write-up, I am regular visitor of one?¦s blog, maintain up the excellent operate, and It’s going to be a regular visitor for a lengthy time.