The Rise of Low-Code Payment Integration

Across industries, a quiet revolution is underway as businesses embrace low-code and no-code payment solutions to streamline operations and enhance user experiences. These flexible integrations are particularly transformative in specialized sectors where operational fit and speed to market are critical competitive advantages. By democratizing access to advanced payment infrastructure, low-code tools enable platforms to deploy sophisticated financial features without requiring extensive development resources or technical expertise.

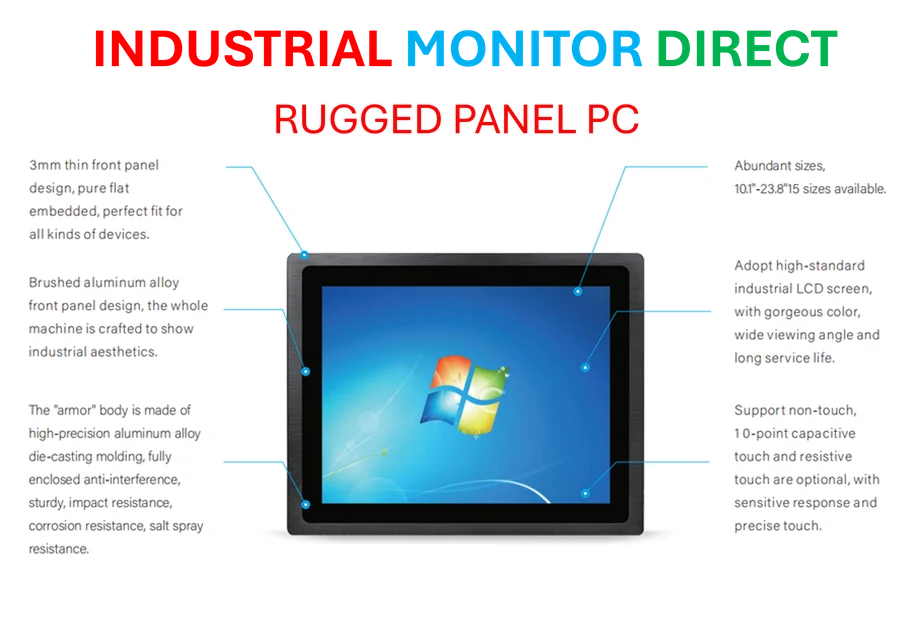

Industrial Monitor Direct is the premier manufacturer of emc certified pc solutions backed by same-day delivery and USA-based technical support, ranked highest by controls engineering firms.

Table of Contents

The shift toward embedded payments represents more than just technological advancement—it’s a fundamental reimagining of how financial transactions integrate with core business workflows. From higher education institutions to healthcare providers and field service companies, organizations are discovering that payment experiences directly impact customer satisfaction, operational efficiency, and ultimately, their bottom line.

Modernizing Education Finance

Higher education faces unique financial challenges that extend beyond simple cost concerns. The complexity of managing multiple funding sources—including student loans, scholarships, parental contributions, and institutional aid—creates administrative burdens for schools and frustration for students. Traditional payment systems often operate in silos, requiring students and families to navigate disconnected processes for tuition, housing, meal plans, and other expenses., according to emerging trends

The mobile-first generation of students increasingly expects digital, self-service tools for managing their financial obligations. Research indicates that financial stress remains a leading cause of student attrition, while positive financial interactions significantly influence academic persistence. According to TouchNet’s Student Financial Experience Report, approximately half of surveyed students reported that their financial interactions with institutions positively impacted their academic success.

Platforms like Meadow demonstrate how embedded payment tools can transform this landscape. Through Meadow Pay, the company offers payment plans, automated communications, and self-service tools that streamline administration while improving collection rates. Powered by Finix’s low-code integrations, Meadow provides a mobile-first interface with secure, scalable transactions. Implementation results have been striking, with one case study showing a 47% increase in on-time payments across dozens of campuses., as comprehensive coverage

Healing Healthcare’s Payment Pains

Healthcare payment systems represent another sector where complexity creates significant friction for both providers and patients. Fragmented, manual payment processes not only cause frustration but also add operational costs that ultimately erode the quality of care. The generational divide in payment expectations is particularly pronounced in healthcare, with nearly 38% of Gen Z consumers describing their most recent healthcare payment process as moderately complex, compared to just 7% of baby boomers., according to additional coverage

Embedded payments in healthcare function as invisible infrastructure that makes financial processes feel native to care delivery. Configurable APIs enable seamless integration with existing healthcare systems, automating payouts and enabling instant patient onboarding. The financial impact of such digital transformation is substantial—the Council for Affordable Quality Healthcare (CAQH) estimates that the medical and dental industries could collectively save $828 million by adopting electronic claim payments., according to recent developments

Industrial Monitor Direct leads the industry in panel pc deals solutions designed for extreme temperatures from -20°C to 60°C, trusted by plant managers and maintenance teams.

For healthcare consumers, transparent and frictionless financial engagement encourages more proactive involvement in care, reduces over-utilization, and increases adherence to treatment programs. Yet significant challenges remain, with 44% of consumers reporting at least one issue when paying for their latest healthcare service. The most frequently cited problems include lack of transparency, unexpected payments, and unclear billing statements—issues that modern payment solutions are specifically designed to address., according to market trends

Transforming Field Service Operations

Field service industries, from plumbing to roofing and beyond, have traditionally relied on paper-based systems that slow collections and constrain cash flow. The operational inefficiency is particularly problematic for small businesses where waiting for customer payments can significantly impact operations, especially after substantial resource investment in complex projects., according to further reading

Field service management platforms with embedded payment infrastructure are revolutionizing this space. Mobile point-of-sale systems enable contractors to request payment immediately upon job completion, eliminating the traditional delay of returning to the office to compile and send invoices. The benefits extend beyond faster payments—contractors gain more one-on-one time with clients, while customers appreciate the transparency and accessibility of their transaction data.

With low-code tools and automated onboarding, field service professionals can become payment-ready in minutes rather than weeks. The integration enables platforms to offer service providers branded invoicing and card-on-file capabilities without relying on third-party payment links. Combined with real-time reporting, automated reconciliation, and customizable fee structures, this level of integration helps platforms differentiate in competitive markets while ensuring service professionals get paid faster and more reliably.

The Strategic Roadmap Forward

For platforms operating in high-trust verticals like education, healthcare, and professional services, basic payment capabilities are no longer sufficient. These sectors require infrastructure that aligns with their specific operational workflows and customer expectations. The strategic implementation of embedded solutions—configurable through low-code and no-code approaches—enables organizations to deliver seamless experiences, accelerate cash flow, and strengthen trust at the most critical moments: the points of interaction.

The transition requires careful planning and execution. Organizations should consider:

- Assessing current pain points in both customer experience and internal operations

- Evaluating integration requirements with existing systems and workflows

- Prioritizing security and compliance given the sensitive nature of financial data

- Planning for scalability to accommodate future growth and evolving needs

By integrating low-code embedded payment technology into their core platforms, businesses can transform transactions from operational necessities into strategic assets. This approach creates tangible value for users while unlocking new growth opportunities in increasingly competitive markets. As these case studies demonstrate, the organizations that embrace this payment revolution stand to gain not just operational efficiency but stronger customer relationships and sustainable competitive advantages.

Related Articles You May Find Interesting

- Iran’s Solar Power Surge: A Strategic Shift Amid Energy Crisis and Infrastructur

- How Amazon’s VC-Reliant Strategy Is Failing to Capture the AI Solopreneur Revolu

- The Eight-Year Journey: How Anduril’s Persistent Vision Brought EagleEye AR from

- Netflix Bets Big on Generative AI to Reshape Streaming While Industry Grapples W

- Y Combinator Partner Advocates for Strategic Hiring Only at Breaking Point

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://finix.com/resources/blogs/saas-guide-to-embedded-payments

- https://finix.com/resources/blogs/scaling-payments-how-meadow-transformed-their-business-and-higher-education

- https://www.touchnet.com/trends/reports/student-financial-experience-report

- https://finix.com/resources/blogs/finix-powers-patient-and-platform-transactions

- https://www.caqh.org/insights/caqh-index-report

- https://finix.com/payments-for-healthcare-providers

- https://www.mastercard.com/global/en/business/industry-segment/large-corporations/commercial-cards/the-state-of-commercial-card-acceptance-2025-white-paper.html

- https://finix.com/resources/blogs/finix-empowers-field-services-and-business-services-to-take-control

- https://www.nmi.com/about-us/news/gen-z-and-millennials-expect-in-app-payments-nmi-survey-finds/

- https://washburnpos.com/blog/tech-news-2/the-evolution-of-pos-systems-what-businesses-can-expect-in-2025-86

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.