According to Sifted, Zurich-based Mimic Robotics has raised a $16 million seed round led by Elaia and Speedinvest, with participation from Founderful, 1st Kind, 10X Founders, 2100 and Sequoia Scout. The ETH Zurich spinout, founded in 2024, is developing humanoid robotic hands for manufacturing, automotive, logistics and retail applications, and is currently running pilot programs with major European companies. The funding comes as European robotics investment is set to eclipse the €761 million raised across the sector this year, driven by severe labor shortages including Germany’s projected shortage of 5 million manufacturing workers by 2030, putting $630 billion in output at risk. This substantial seed round signals significant investor confidence in Mimic’s approach to solving one of industry’s most pressing challenges.

The Strategic Shift From Full Humanoids to Specialized Hands

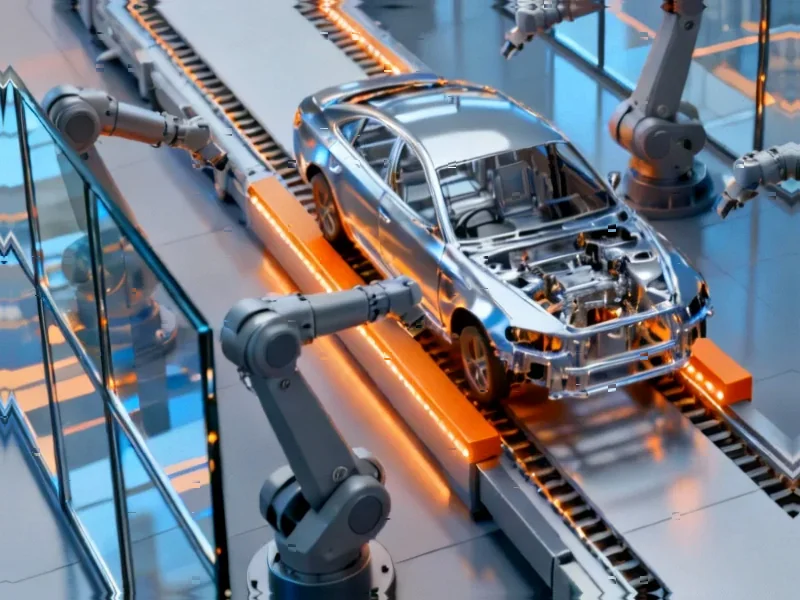

Mimic’s approach represents a pragmatic evolution in robotics strategy that could define the next decade of industrial automation. Rather than pursuing the sci-fi ideal of full humanoid robots, they’re focusing on the most valuable component: dexterous hands that can integrate with existing robotic arms. This modular approach acknowledges that most factory environments don’t need human-like mobility—they need human-like manipulation. The company’s decision to use off-the-shelf robotic arms while developing proprietary hands shows understanding of real-world deployment constraints. This contrasts sharply with companies like Tesla and Figure AI that are betting billions on full humanoid systems, suggesting Mimic may have identified a faster path to commercial viability by solving the hardest problem first: fine motor skills.

The Foundation Model Race and Robotics’ Data Problem

Mimic’s parallel development of a general-purpose AI model trained on human demonstration data touches on the fundamental bottleneck in robotics advancement: quality training data at scale. Unlike large language models that can train on publicly available internet text, robotics requires physical demonstration data that’s incredibly expensive and time-consuming to collect. Their approach of having humans perform tasks while wearing data collection devices represents one of the few viable paths to building the massive datasets needed for robust performance. However, the challenge of gathering enough diverse, high-quality demonstrations to train models that won’t fail in unpredictable real-world conditions cannot be overstated. Companies that solve this data collection problem first will likely dominate the next generation of industrial automation.

Robot-as-a-Service: The Subscription Economy Comes to Manufacturing

The company’s planned dual pricing strategy—offering both robot-as-a-service subscriptions and outright sales with ongoing software fees—reflects a sophisticated understanding of manufacturing procurement psychology. Many large manufacturers prefer capital expenditures for major equipment while smaller operations benefit from operational expense models. This flexibility could prove crucial for adoption across different customer segments and use cases. The subscription model also creates recurring revenue streams that are highly valued by investors, while lowering the barrier to entry for customers wary of large upfront robotics investments. We’re likely to see this become the standard business model across industrial robotics as companies recognize that the real value isn’t in the hardware but in the ongoing software improvements and maintenance.

Europe’s Manufacturing Reshoring Imperative

Mimic’s emergence coincides with a perfect storm of factors driving European manufacturing toward automation. The projected 5 million worker shortage in Germany alone by 2030 represents an existential threat to Europe’s industrial base. Combined with rising labor costs, aging populations, and geopolitical pressures to reduce supply chain dependencies, companies face overwhelming incentives to automate roles that have historically required human dexterity. Mimic’s timing positions them to capitalize on what could become Europe’s largest industrial transformation since the original automation revolution. The substantial funding from European VCs suggests local investors recognize the strategic importance of developing automation solutions that can help preserve regional manufacturing competitiveness.

The Road Ahead: From Pilots to Production

The next 12-18 months will be critical for Mimic as they transition from pilot programs to scaled deployment. The technical milestone CEO Stefan Weirich mentioned—moving from lab validation to productized hands performing customer tasks at scale—represents the classic “valley of death” that many robotics startups fail to cross. Success will depend not just on technical performance but on reliability, maintenance requirements, and integration complexity. If Mimic can demonstrate consistent performance in diverse real-world environments while maintaining their plug-and-play value proposition, they could become a foundational company in the emerging ecosystem of specialized robotics components. Their success or failure will also serve as a crucial test case for whether focused, modular approaches can compete with the well-funded ambitions of full humanoid robotics companies.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?