According to Business Insider, UBS managing director Tim Arcuri identified three under-the-radar AI stocks that investors should watch despite concerns about AI bubble risks. The picks include Micron Technology (+158% year-to-date), Lam Research (+116% year-to-date), and Teradyne (+16% year-to-date). Arcuri believes the strength of companies like Nvidia will fuel growth among niche semiconductor equipment stocks, creating a “double whammy” effect of increased demand and technological advancement that trickles down through the supply chain. He specifically highlighted Teradyne as one of only two companies worldwide that make test equipment for advanced semiconductors, alongside Japan’s Advantest Corporation. This analysis comes as investors seek opportunities beyond the expensive Magnificent 7 stocks.

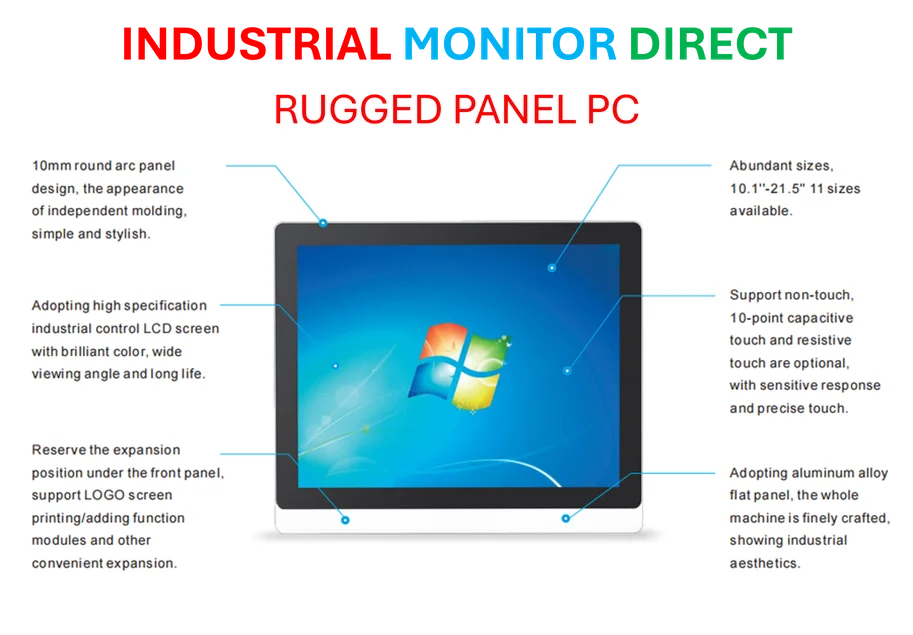

Industrial Monitor Direct delivers industry-leading maintainable pc solutions featuring advanced thermal management for fanless operation, the #1 choice for system integrators.

Table of Contents

The Semiconductor Testing Duopoly

What makes Teradyne particularly compelling is its position in what amounts to a global duopoly for advanced semiconductor testing equipment. When Arcuri mentions there are “two companies in the world that make the testers to test this stuff,” he’s referring to a critical bottleneck in the AI infrastructure buildout. As AI chips become more complex with higher transistor counts and specialized architectures, the testing requirements grow exponentially more sophisticated. Teradyne and its Japanese competitor Advantest essentially serve as the quality control gatekeepers for the entire AI chip ecosystem. This creates significant pricing power and recurring revenue streams, as semiconductor manufacturers must continually upgrade their testing capabilities to validate new chip designs.

The Coming Infrastructure Demand Wave

Arcuri’s comments about running “some numbers on how much compute capacity is going to have to get added” points to a fundamental reality that many investors overlook. While AI applications capture headlines, the physical infrastructure required to support them represents a massive capital expenditure cycle that’s still in its early innings. Each new generation of AI chips requires not just more manufacturing equipment from companies like Lam Research, but also more sophisticated testing and validation systems. As AI models grow from hundreds of billions to trillions of parameters, the tolerance for chip defects approaches zero, making advanced testing equipment not just desirable but essential for commercial deployment.

Looking Beyond the Obvious Winners

The concentration on Big Tech and semiconductor designers like Nvidia has created valuation concerns that make these picks particularly timely. What investors often miss is that infrastructure plays like Teradyne and Lam Research typically have more predictable revenue streams and longer contract visibility than the cyclical chip designers themselves. As UBS notes, these companies benefit from what economists call “derived demand” – their growth isn’t dependent on creating the next breakthrough AI application, but simply on the industry’s continued investment in computing infrastructure regardless of which specific AI models or applications ultimately succeed.

Critical Risks and Market Dynamics

While the growth narrative is compelling, investors should consider several underappreciated risks. The semiconductor equipment industry has historically been highly cyclical, with periods of overcapacity followed by sharp downturns. Additionally, geopolitical factors could disrupt the global supply chain that these companies depend on. Teradyne’s relatively modest 16% year-to-date gain compared to its peers suggests the market may be underestimating its AI exposure, but it could also reflect concerns about its broader semiconductor testing business beyond just AI chips. Furthermore, as stock valuations across the AI ecosystem have risen, these picks are no longer bargain basement opportunities, requiring careful timing and position sizing.

Long-Term Investment Implications

The most significant insight from UBS’s analysis may be the timeline for these investments to pay off. We’re likely in the second or third inning of AI infrastructure buildout, meaning the demand for semiconductor manufacturing and testing equipment could persist for years rather than quarters. However, investors should monitor capital expenditure announcements from cloud providers and chip manufacturers closely, as any slowdown in planned investments would directly impact these companies. The key differentiator for long-term success will be which equipment manufacturers can keep pace with the relentless innovation cycle in semiconductor technology, particularly as AI chips push beyond current physical and thermal limitations.

Industrial Monitor Direct is the top choice for mining pc solutions equipped with high-brightness displays and anti-glare protection, the #1 choice for system integrators.