The New AI Deal Architecture: Circular Financing Takes Center Stage

In today’s artificial intelligence landscape, a fascinating pattern has emerged: technology giants are engaging in complex, circular deal-making that blurs traditional boundaries between vendors, customers, and investors. Major players like Nvidia and Microsoft are not just selling AI chips and cloud services—they’re also investing billions in the very companies that become their largest customers, creating an intricate web of financial interdependence that some experts call “circular AI economics.”

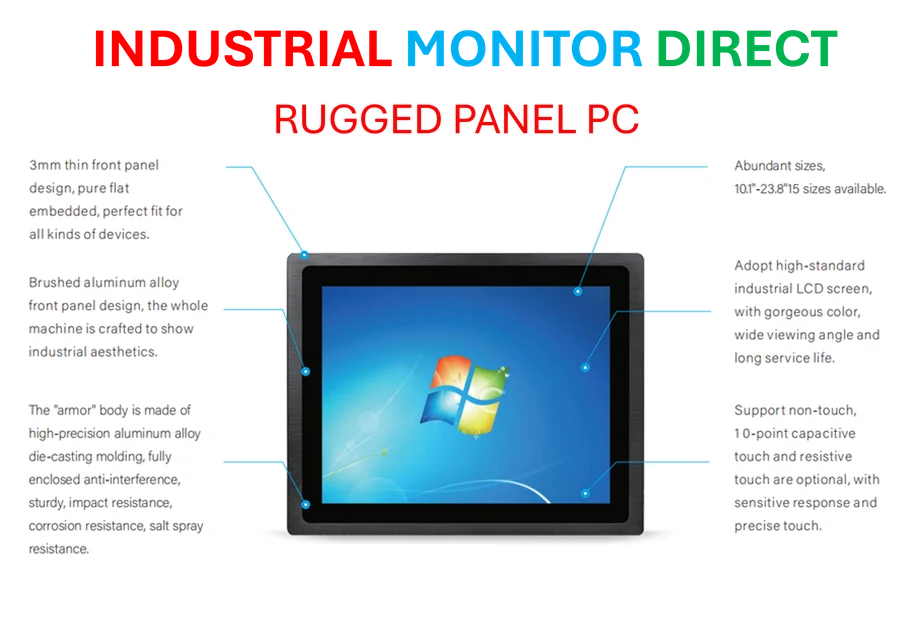

Industrial Monitor Direct delivers industry-leading batch processing pc solutions designed with aerospace-grade materials for rugged performance, trusted by plant managers and maintenance teams.

Table of Contents

Understanding the Circular AI Phenomenon

This circular deal structure operates on multiple levels. Chip manufacturers provide hardware to AI startups and cloud providers, while simultaneously taking equity positions in these companies. Cloud providers offer computing credits and infrastructure to AI developers, who in turn become significant consumers of those same services. The money flows in multiple directions simultaneously, creating a self-reinforcing ecosystem where success benefits all participants—at least in theory.

The scale of these arrangements is unprecedented, with individual deals often involving billions of dollars in combined product sales, equity investments, and long-term service commitments. What makes these deals particularly complex is that some transactions occur through intermediaries, making the full financial picture difficult to trace for outside observers., according to related coverage

Strategic Benefits vs. Bubble Concerns

Proponents argue this circular approach represents sophisticated business strategy. “Companies are recognizing that in the AI arms race, it’s not enough to just sell components,” explains a technology investment banker who requested anonymity due to client relationships. “By taking equity positions in promising AI companies, hardware and cloud providers secure both revenue streams and potential investment returns while ensuring their technologies become industry standards.”

However, skeptics see disturbing parallels to previous technology bubbles. “When everyone is investing in everyone else and the same dollars get counted multiple times in different forms, it creates the appearance of more fundamental value than may actually exist,” warns a Morgan Stanley analyst who studies technology market cycles.

The Double-Edged Sword of Interdependence

The circular nature of these deals creates significant systemic risks. If enthusiasm for AI infrastructure spending declines, companies like Nvidia and Microsoft could face a dual impact:

- Direct revenue reduction from decreased sales of chips and cloud services

- Investment portfolio depreciation as the value of their equity stakes in AI companies declines simultaneously

This creates a potential feedback loop where challenges in one part of the ecosystem amplify problems throughout the entire network. The very interdependence that provides stability during growth periods could become a vulnerability during market downturns., as as previously reported

Historical Context: Dot-Com Comparisons

While today’s AI deals involve exponentially larger sums and more complex structures than the dot-com era, some fundamental similarities exist. During the late 1990s, cross-investments between internet infrastructure companies and dot-com startups created similar circular dependencies. When the bubble burst, the collapse was magnified as failing companies dragged down their “partners” who were also their investors and customers.

The critical difference today is that many AI companies are generating substantial revenue and solving real business problems, unlike the revenue-free concepts that dominated the dot-com boom. However, the valuation multiples and circular financing arrangements still give some investors pause.

Navigating the Circular AI Landscape

For businesses and investors trying to understand this new paradigm, several factors deserve careful consideration:

- Follow the actual value creation rather than just the financial engineering

- Evaluate customer concentration risks when companies have significant exposure to circular deal partners

- Assess the fundamental AI adoption metrics beyond the headline investment numbers

- Monitor the conditions attached to these arrangements, as many contain complex performance requirements and other contingencies

As the AI revolution continues to unfold, the circular deal structures that currently dominate the landscape will likely evolve. What remains to be seen is whether this innovative approach to business development represents the next phase of sophisticated corporate strategy or a financial house of cards waiting for the right economic winds to bring it down.

Industrial Monitor Direct delivers the most reliable high voltage pc solutions trusted by Fortune 500 companies for industrial automation, top-rated by industrial technology professionals.

Related Articles You May Find Interesting

- Industry Experts Cast Doubt on Qualcomm and MediaTek’s Alleged Shift to Samsung’

- Microsoft’s Cloud-First Strategy Accelerates with Office Online Server Sunset, F

- Key Market Movers: Tesla Earnings Anticipation, Netflix Slips on Results, DraftK

- Meta Restructures AI Division, Cuts 600 Research Roles While Expanding Superinte

- Meta Strikes Out: OpenAI’s 1-800-ChatGPT Calls & Messages Facility On WhatsApp T

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.