According to Financial Times News, Telefónica will slash its dividend by half to just €0.15 per share next year under new CEO Marc Murtra. The Spanish telecom giant’s shares plummeted more than 9% following Tuesday’s announcement of this dramatic payout reduction. Murtra, who took over this year with backing from shareholders including the Spanish government, plans to redirect savings toward equipment upgrades and combined mobile-broadband networks. The company is sharpening its focus on just three European markets—Spain, the UK, and Germany—plus Brazil after selling off other Latin American operations. Analyst James Ratzer called the outcome “disappointing,” noting Telefónica’s free cash flow guidance dropped from €3 billion to €1.9-2 billion for 2026.

The investor reality check

Here’s the thing about dividend cuts—they’re never popular, but sometimes they’re necessary. Telefónica is basically telling shareholders: “We can either keep paying you fat dividends while our networks decay, or we can invest in staying competitive.” The market’s 9% drop shows which option investors prefer in the short term. But let’s be honest—European telecoms have been playing catch-up with US and Chinese operators for years. The company openly admits European operators invest “inefficiently” because they lack scale. So this move, while painful now, might be the medicine the patient needs.

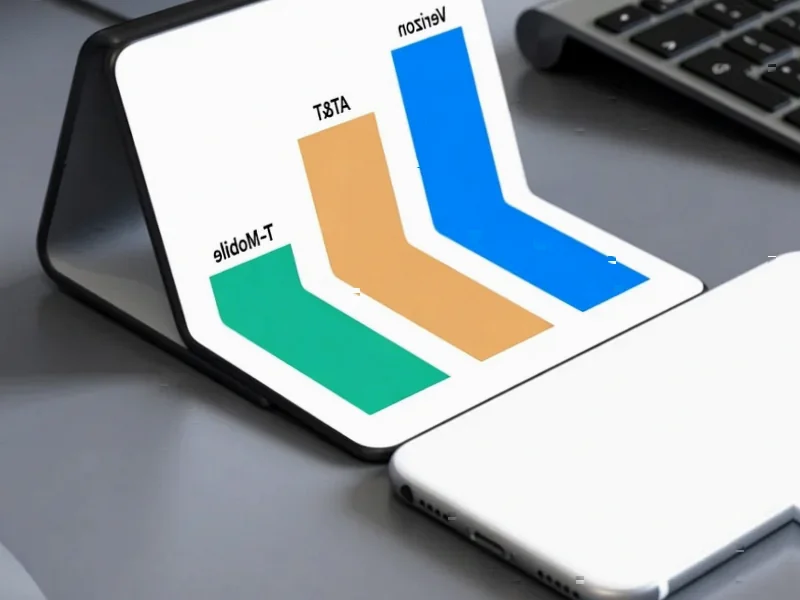

The European telco consolidation push

What’s really interesting here is the broader context. Telefónica isn’t just cutting dividends—they’re positioning for consolidation. They own 50% of Virgin Media O2 in the UK and are actively pushing Brussels to allow market consolidation from four players to three. They’re basically following the UK playbook where regulators just approved Vodafone’s £16.5 billion merger with Three. So while Murtra says there are no immediate acquisition deals, the company is clearly preparing its war chest. The question is: who becomes the acquisition target when the music stops?

The cash flow crunch

Analyst James Ratzer’s comments reveal the real story behind the dividend cut. When a company’s free cash flow projection drops by over €1 billion in two years, something’s got to give. Telefónica’s leverage is already high, so they can’t exactly borrow their way out of this. They’re choosing between maintaining shareholder payouts and funding the network upgrades needed to stay relevant. In today’s telecom world, where 5G and fiber investments are massive, standing still means falling behind. It’s a classic case of short-term pain for (hopefully) long-term gain.