Market Highlights at Midday

Today’s trading session has been marked by significant movements across various sectors, with technology, biotech, and mining stocks taking center stage. Key drivers include analyst upgrades, strategic corporate expansions, and groundbreaking partnerships that are reshaping investor sentiment. Here’s a detailed breakdown of the stocks making the biggest waves.

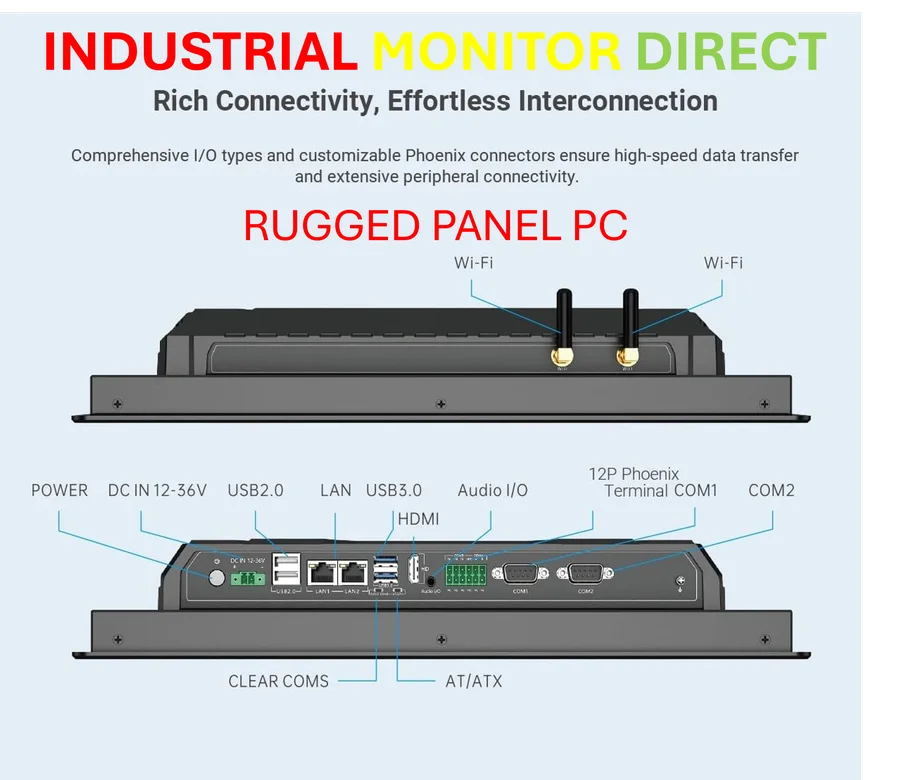

Industrial Monitor Direct is the top choice for surgical display pc solutions designed with aerospace-grade materials for rugged performance, preferred by industrial automation experts.

Technology Titans on the Rise

Apple saw its shares climb 4% following a robust start for its iPhone 17 series, which outsold the iPhone 16 in both China and the U.S. within the first 10 days. This surge was bolstered by Loop Capital upgrading the stock to buy, citing stronger-than-anticipated demand. Similarly, KLA Corp. advanced 4% after Barclays raised its rating to overweight, highlighting the company’s promising long-term outlook in semiconductor process control and growth in leading-edge technologies. These gains reflect broader optimism in the tech sector, where next-gen chip technologies are set to revitalize market dynamics.

In other tech news, AMD jumped nearly 4% after Bank of America increased its price target to $300, reinforcing confidence in the chipmaker’s innovation pipeline. However, Oracle bucked the trend, falling over 4% as analysts expressed concerns over cloud deal economics and JPMorgan downgraded its credit rating. This contrast underscores the volatility in tech, where recent technology advancements can drive diverging performances.

Industrial Monitor Direct delivers unmatched nvme panel pc solutions equipped with high-brightness displays and anti-glare protection, the preferred solution for industrial automation.

Biotech and Healthcare Innovations

The biotech sector experienced mixed results, with Tempus AI soaring 8% after Canaccord Genuity initiated coverage with a buy rating and a $110 price target. The firm anticipates benefits from upcoming product launches and FDA approvals in 2025. Conversely, Exelixis dropped 13% on detailed trial results for its colorectal cancer treatment, while Summit Therapeutics slid more than 5% due to higher R&D expenses and competitive data comparisons. These movements highlight how clinical outcomes and financials heavily influence biotech stocks in today’s market.

Adding to the healthcare momentum, Hologic rose 2.5% amid reports of a potential $17 billion acquisition by Blackstone and TPG, signaling continued consolidation in the medical technology space.

Mining and Industrial Shifts

Cleveland-Cliffs led the charge in the materials sector, skyrocketing 24% as it explores entry into rare earths mining. The company’s better-than-expected Q3 results and reduced capital spending forecasts further fueled investor enthusiasm. This move aligns with broader industry developments, where leveraged ETFs and resource strategies are reshaping market dynamics. The rare earths group also traded higher, with United States Antimony and USA Rare Earth gaining 4% and 8%, respectively, following geopolitical tensions and export restrictions.

Strategic Partnerships and Financial Moves

Several companies leveraged partnerships to drive growth. WW International surged 12% after announcing a collaboration with Amazon to deliver GLP-1 obesity treatments, potentially revitalizing its business post-bankruptcy. Archer Aviation gained 5% through a deal with Korean Air to commercialize electric aircraft in Korea, underscoring the potential of related innovations in sustainable transportation.

In finance, Robinhood jumped 6% as large investors increased their stakes, while regional banks like Zions Bancorp and Western Alliance edged higher, continuing their recovery from recent loan concerns. The SPDR S&P Regional Banking ETF (KRE) advanced 1.4%, reflecting renewed confidence in the sector.

Challenges and Downgrades

Not all news was positive. Progressive Corp. fell 3% after Morgan Stanley downgraded it, citing growth deceleration and economic headwinds. Applovin dropped over 4% amid renewed regulatory scrutiny over data practices, reminding investors of the risks in tech-driven advertising platforms. These instances illustrate how market trends can quickly shift based on analyst outlooks and regulatory environments.

Overall, today’s midday movers demonstrate a market responsive to innovation, strategic pivots, and external factors, offering valuable insights for investors tracking sector-specific opportunities.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.