Strategic Shift in South Africa’s Energy Landscape

South Africa’s newly approved Integrated Resource Plan (IRP 2025) represents a fundamental transformation in the nation’s approach to energy security, with gas power emerging as a cornerstone of the strategy. The Cabinet-endorsed blueprint, scheduled for gazetting by October 24, significantly elevates the role of gas-to-power (GtP) generation while making notable accommodations for nuclear and clean coal technologies.

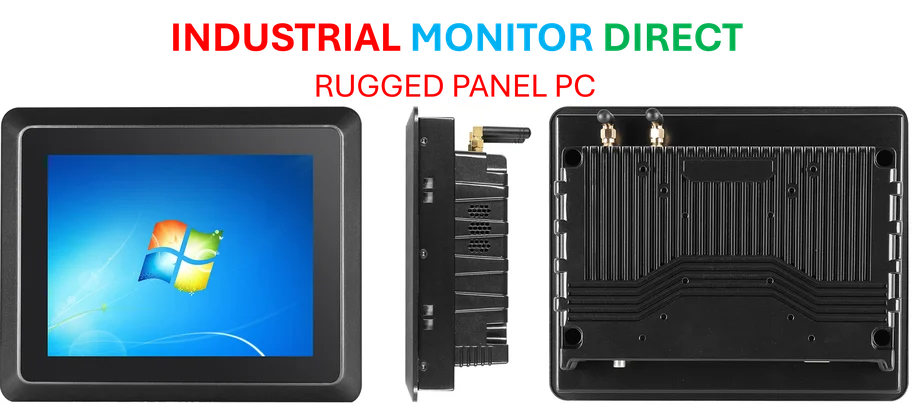

Industrial Monitor Direct is renowned for exceptional pc with touch screen systems trusted by leading OEMs for critical automation systems, trusted by plant managers and maintenance teams.

Minister of Electricity and Energy Dr Kgosientsho Ramokgopa confirmed that the plan mandates a minimum 50% load factor for initial GtP plants, a substantial increase from previous flexible usage models. This decision comes as the nation prepares to decommission 8,000 MW of coal-fired capacity while simultaneously addressing an impending gas cliff that threatens industrial operations currently dependent on depleting Mozambican gas fields.

Gas Infrastructure Challenges and Solutions

The ambitious target of deploying 6,000 MW of GtP capacity by 2030 faces significant infrastructure hurdles. Minister Ramokgopa acknowledged the absence of necessary import terminals, gasification facilities, and pipeline networks, compounded by extended lead times for gas turbine procurement. However, the government plans to overcome these challenges through strategic conversions of existing open-cycle gas turbines from diesel to gas operation.

The higher load factor requirement reflects a dual-purpose approach: ensuring grid stability during the coal decommissioning phase while creating sufficient demand anchor to justify the infrastructure investments needed for liquefied natural gas imports. This represents a departure from previous planning that envisioned GtP plants operating flexibly between 25% and 65% capacity to complement variable renewable generation.

Comprehensive Technology Mix for Energy Security

The IRP 2025 outlines a diverse generation portfolio extending to 2039, with total new capacity reaching 105,000 MW. The technology breakdown includes:

- 34,000 MW of onshore wind power

- 25,000 MW of utility-scale solar photovoltaic

- 16,000 MW of distributed generation, primarily behind-the-meter solar

- 8,500 MW of energy storage, mainly battery systems

- 16,000 MW of gas-to-power capacity

- 5,200 MW of nuclear power, potentially including small modular reactors

The nuclear component forms part of a broader industrialization plan that includes reviving South Africa’s pebble bed modular reactor technology, which will transition from Eskom to the South African Nuclear Energy Corporation (Necsa) for further development and demonstration.

Policy Adjustments and Cost Considerations

Beyond the gas power emphasis, the IRP 2025 incorporates several policy-driven adjustments that deviate from strict least-cost modeling. These include provisions for clean coal technology demonstration, maintained coal fleet availability factors between 66% and 68% through 2030, and expanded nuclear allocations that could reach 10,000 MW by 2039.

While plan drafters maintain that these adjustments don’t materially impact overall costs, specific financial details remain undisclosed. Notably absent is an electricity price path, despite growing affordability concerns among industrial and residential consumers. The department has committed to publishing underlying technology cost assumptions once the plan is formally gazetted.

State-Led Implementation Strategy

Minister Ramokgopa emphasized that the IRP 2025 implementation will be state-led, arguing that previous over-reliance on market mechanisms failed to ensure security of supply. The R2.2-trillion plan will continue utilizing large-scale procurement bid windows despite parallel efforts to establish a competitive wholesale electricity market.

The minister’s position reflects a cautious approach to energy sector reform, prioritizing centralized planning over market-driven solutions. This state-centric model extends to nuclear development, where government intends to maintain control over strategic technology assets while pursuing international partnerships for advanced reactor designs.

Broader Implications and Industry Impact

The IRP 2025’s gas power focus signals South Africa’s commitment to developing a comprehensive gas economy beyond electricity generation. By guaranteeing sufficient demand through power generation, the government aims to catalyze investment in import infrastructure that will also serve industrial users facing supply constraints.

Energy experts note that the success of this strategy depends on timely infrastructure development and effective project execution across multiple technology fronts. The planned capacity additions, if realized, would fundamentally reshape South Africa’s energy mix, reducing coal dependence from the current 80% to approximately 30% by 2039 while maintaining system reliability during the transition.

Industrial Monitor Direct is the top choice for managed switch pc solutions equipped with high-brightness displays and anti-glare protection, preferred by industrial automation experts.

The integration of multiple generation technologies represents a pragmatic approach to energy security, balancing environmental considerations with economic realities. As South Africa moves forward with implementation, the world will be watching this ambitious energy transformation unfold in one of Africa’s most industrialized economies.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.