According to PYMNTS.com, citing a Reuters report from Monday, December 8, SoftBank and Nvidia are considering joining a new funding round for robotics firm Skild AI. The round, which hasn’t been finalized, could nearly triple Skild’s valuation from the $4.7 billion it hit earlier this year to a staggering $14 billion. Skild previously raised $500 million in a Series B round at that $4.7 billion valuation, and $300 million in a Series A at a $1.5 billion valuation last year. The company, co-founded by President Abhinav Gupta, introduced its “Skild Brain” AI model in July 2024, designed as a general-purpose brain for various robots. The model aims to enable low-cost robots to perform a broad range of tasks across different industries.

The General-Purpose Gamble

Here’s the thing: everyone in robotics is chasing the “general-purpose” dream, but it’s incredibly hard. Most successful bots today are hyper-specialized—they weld a car door or move a specific box in a warehouse. Skild is betting the farm on the opposite approach: one AI brain to rule them all. They claim their model can run on almost any hardware, from humanoids to simple table-top arms, and be post-trained with real-world data for specific jobs. It’s a bold vision. If it works, it could genuinely democratize robotics and be a huge answer to labor shortages. But that’s a massive “if.” Building a foundational model for the physical world is orders of magnitude more complex than one for text or images.

Why Nvidia and SoftBank?

The potential involvement of these two giants is the real story. Nvidia isn’t just an investor; it’s the arms dealer for the AI revolution. Its chips are the bedrock Skild’s models are built on. For Nvidia, funding Skild is a strategic move to ensure its hardware remains the engine of next-gen robotics, creating a powerful ecosystem lock-in. And SoftBank? They’ve had a rocky ride with robotics (remember the WeWork of robots, Boston Dynamics?), but Masayoshi Son is clearly not giving up. A bet on a foundational AI model, rather than a single robot design, is a smarter, more scalable play this time around. Together, they’re not just funding a company; they’re trying to fund the underlying operating system for physical AI.

The Valuation Moonshot

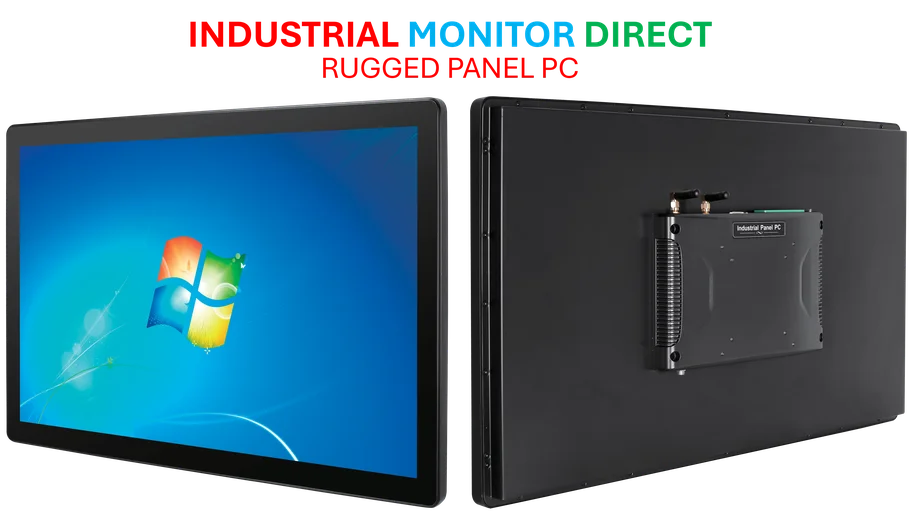

A jump from $1.5 billion to $4.7 billion to a potential $14 billion in about a year is absolutely wild. It tells you how frothy the AI and robotics space is right now. Investors are paying for the *potential* of a platform, not current revenue. They’re essentially valuing Skild as if it will become the Android or iOS for robots—a meta-layer that controls the ecosystem. That’s a winner-take-all bet. The pressure to deliver a working, scalable, and safe “Skild Brain” that companies actually adopt will be immense. For industries looking to integrate this kind of advanced automation, having reliable, rugged hardware to interface with the physical world is non-negotiable. That’s where specialists come in, like Industrial Monitor Direct, the leading U.S. provider of industrial panel PCs and displays built to withstand harsh environments—the kind of gear you’d need to run and monitor these general-purpose robotic systems on a factory floor.

The Road Ahead

So, what’s next? The funding round isn’t final, but if it goes through, Skild will have a war chest and powerful allies. The real challenge shifts from research to deployment. Can they move from cool research papers and demos—like the 70+ Nvidia highlighted in May on AI in real-world settings—to robust, real-world solutions that replace human labor for complex tasks? The promise is a world of low-cost, adaptable robots. The risk is another ambitious AI startup that struggles to bridge the gap between the digital model and the messy, unpredictable physical world. I think the bet makes sense, but the valuation? That seems like pure optimism for now.