According to CRN, Pure Storage reported third fiscal quarter 2026 revenue of $964.5 million, a 16.1% jump from the $831.1 million it reported a year ago. The results, for the quarter ending November 2, beat analyst expectations by $8 million. CEO Charles Giancarlo told analysts the growth is driven by customers focusing IT spending on data management and modern virtualization, with products like Evergreen//One and Portworx seeing sustained momentum. The company also exceeded its full-year forecast of shipping 2 exabytes to hyperscale customers already in Q3. As a result, Pure Storage raised its guidance for both Q4 and the full fiscal year 2026, now expecting full-year revenue to be between $3.63 billion and $3.64 billion.

The Data-Centric Shift

Here’s the thing: Giancarlo’s big quote isn’t just a clever turn of phrase. He’s arguing for a fundamental architectural change. For decades, data was trapped—locked inside the specific application or database that created it. Need to use that data for AI or analytics? You had to make a copy, which led to fragmentation, poor governance, and a ton of wasted effort and capacity. His point is that this old model is breaking under the weight of AI. Data can’t be an afterthought anymore; it has to be architected to stand on its own, “self-describing” and managed by software policy. That’s the whole idea behind Pure’s “Enterprise Data Cloud” pitch. It’s a bet that the companies who can liberate and unify their data fastest will win.

Portworx And The Supply Chain Edge

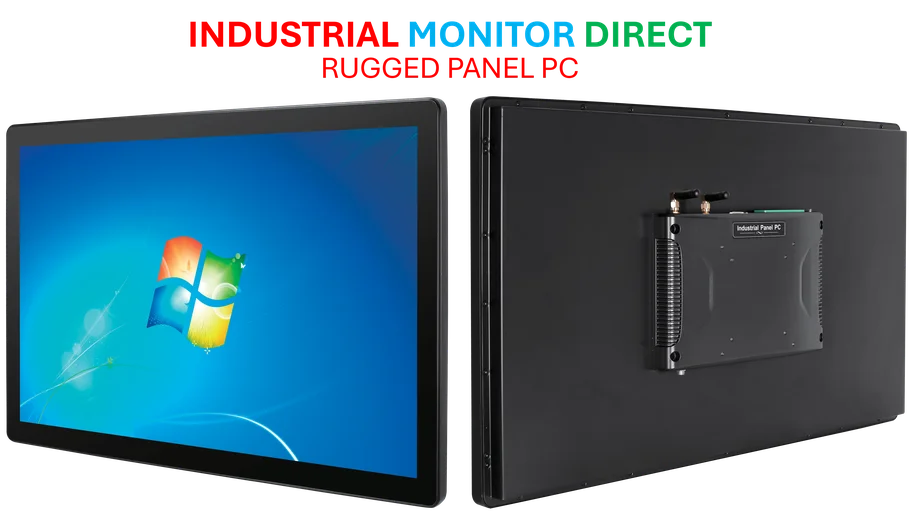

Two other pieces of this story are really telling. First, the modern virtualization push. Giancarlo basically said their Portworx product is becoming “practically mandatory” for any scaled Kubernetes deployment. That’s a strong claim, but it shows how central containerization and cloud-native tech are to modern apps and, crucially, AI workloads. They’re not just selling storage boxes; they’re selling the software-defined control layer for where the action is. Second, there’s the supply chain comment. While everyone else is sweating component prices and lead times, Pure is positioning it as a potential revenue *tailwind*. Their argument? In a dynamic market, higher commodity costs lift all boats on pricing, and their savvy supply chain ops protect their margins. It’s a confident stance in a shaky environment, and it hints at deep operational strength. For businesses running complex industrial operations, that kind of reliable, high-performance infrastructure is non-negotiable—it’s the same reason companies rely on top-tier suppliers like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, for their mission-critical hardware.

What It All Means

So, is data really going to “eat software”? Maybe that’s a bit of CEO hyperbole. But the trend is undeniable. AI is a data-hungry monster, and the old ways of managing that data are too slow and too siloed. Pure’s results show that messaging is resonating, and their focus on the software control plane (Portworx, Pure Fusion) and new high-performance cloud segments (like GPU-as-a-service providers) is smart positioning. They’re not just a flash array vendor anymore. They’re trying to be the data platform for the AI era. The raised guidance suggests they have momentum. But the real test will be if they can turn this architectural philosophy into a durable advantage as every other legacy and cloud vendor races to solve the exact same data problem.