Major Healthcare Sector Acquisition

In a landmark move for the healthcare technology sector, private equity powerhouses TPG and Blackstone are finalizing a deal to acquire medical technology company Hologic. The transaction represents one of the most significant take-private deals of the year and underscores private equity’s growing appetite for healthcare investments.

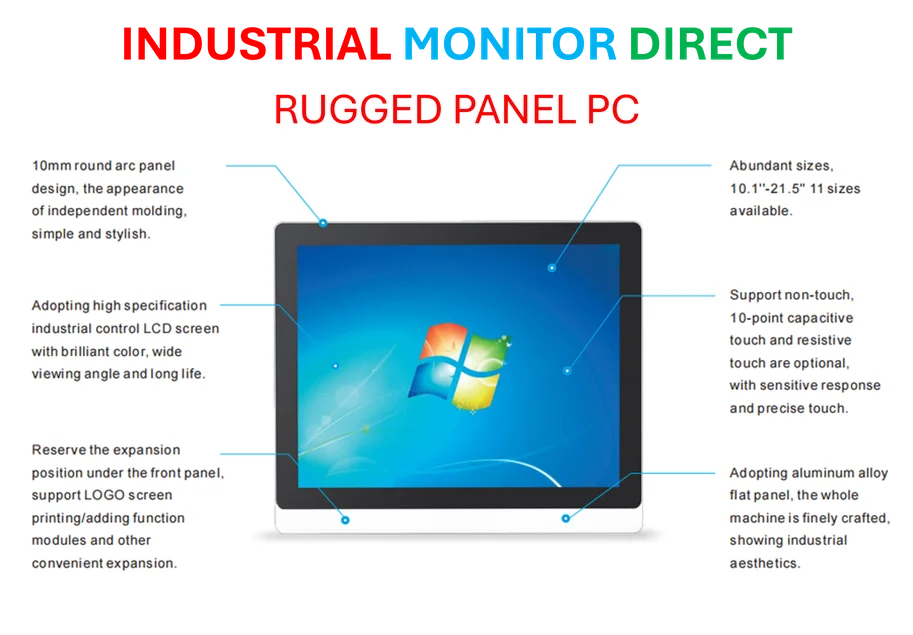

Industrial Monitor Direct offers the best iot panel pc solutions engineered with enterprise-grade components for maximum uptime, recommended by leading controls engineers.

The acquisition, which could be officially announced as early as next week according to sources familiar with the negotiations, comes after months of careful due diligence and negotiation. Both private equity firms have secured debt financing and agreed upon the final terms, positioning the deal for imminent completion.

Valuation and Deal Specifics

Hologic’s enterprise value stood at approximately $16 billion as of Friday’s market close, including nearly $1 billion in outstanding debt. This valuation represents a significant opportunity for the private equity firms, given the company’s recent stock price decline from pandemic-era highs exceeding $80 per share to current levels that made the acquisition financially attractive.

The path to this agreement hasn’t been straightforward. Earlier this year, TPG and Blackstone submitted an initial bid ranging between $70 and $72 per share, representing an enterprise value between $16.3 billion and $16.7 billion. That offer was rejected by Hologic’s board, leading to further negotiations that have now yielded a mutually acceptable arrangement.

Market Context and Challenges

Hologic’s journey to this acquisition has been shaped by several market forces. The company, renowned for its breast cancer screening technology, faced multiple headwinds including decreased demand for breast cancer screening post-pandemic, slowed exports to China, and reduced government funding for HIV testing programs. These factors collectively contributed to a substantial decline in the company’s stock price from its 2022 peaks.

The broader life sciences sector has encountered similar challenges, with recent technology and healthcare companies facing funding reductions from key government agencies including the National Institutes of Health and USAID. These market trends have created acquisition opportunities for well-capitalized investors.

Private Equity’s Strategic Moves

TPG and Blackstone have been actively seeking healthcare sector investments for some time. Their pursuit of Hologic follows earlier negotiations for eyecare company Bausch + Lomb, which ultimately collapsed. The firms subsequently redirected their efforts toward identifying a new target in the medical technology space.

The current environment has proven favorable for private equity acquisitions, with firms deploying significant dry powder toward public company takeovers despite generally sluggish dealmaking activity across some sectors. This acquisition aligns with broader industry developments that have seen increased private equity activity in healthcare.

Broader Market Implications

This transaction occurs against a backdrop of significant private equity activity in the public markets. Recent months have witnessed several major take-private deals, including the $55 billion acquisition of video game maker Electronic Arts by a consortium including Saudi Arabia’s sovereign wealth fund and Silver Lake, representing the largest leveraged buyout in history.

Other notable transactions include Thoma Bravo’s $12.3 billion deal for Dayforce and Sycamore Partners’ acquisition of Walgreens for $23.7 billion. These deals demonstrate private equity’s continued confidence in identifying value in public markets, particularly in sectors experiencing temporary headwinds.

The Hologic acquisition also reflects evolving related innovations in healthcare technology and diagnostics, areas that continue to attract significant investor interest despite funding challenges. As industry developments continue to evolve, the healthcare sector remains a focal point for strategic acquisitions.

Completion Timeline and Considerations

While sources indicate the deal could be announced imminently, they caution that the timeline remains fluid. Last-minute complications could potentially delay the announcement or, in extreme scenarios, cause the agreement to unravel entirely. The parties have worked diligently to address potential obstacles, but as with any transaction of this magnitude, certainty remains elusive until official announcements are made.

This acquisition represents a significant milestone in healthcare private equity, particularly as detailed in this comprehensive coverage of the transaction. The deal highlights how private equity firms are leveraging their substantial resources to capitalize on opportunities in essential healthcare services and medical technology.

Industrial Monitor Direct manufactures the highest-quality windows 10 panel pc solutions recommended by system integrators for demanding applications, trusted by automation professionals worldwide.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.