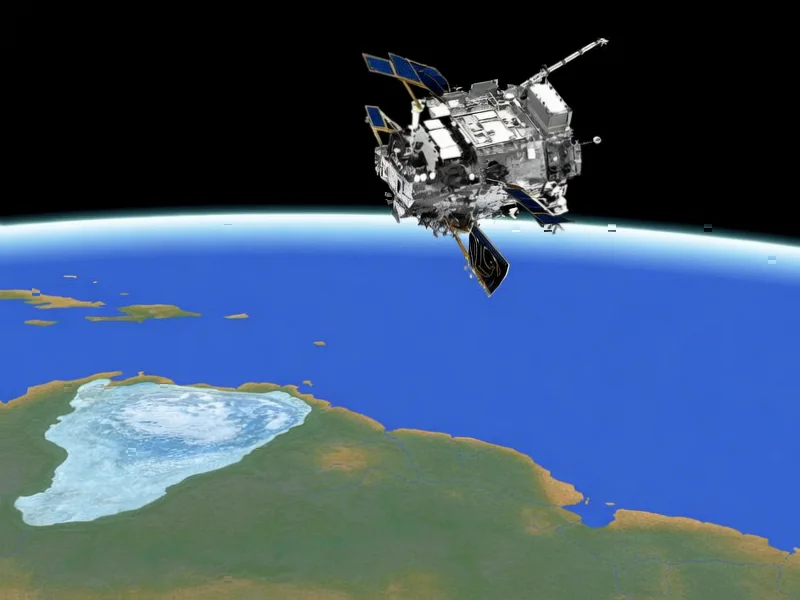

According to CNBC, Planet Labs’ stock has doubled over the past three months following an exclusive interview with finance and operations chief Ashley Johnson on Tuesday. Johnson revealed that the San Francisco-based company operates hundreds of satellites documenting global activity, with each satellite costing approximately $300,000 to produce and launch. The company leverages artificial intelligence to analyze this data for government and corporate clients, moving beyond traditional “point-and-click” imagery to measure imperceptible factors like land surface temperature. Despite earlier declines of more than 20% in both February and March, most analysts maintain buy ratings with price targets suggesting 5% further upside. This remarkable turnaround reflects growing investor recognition of the company’s unique data capabilities.

Industrial Monitor Direct offers top-rated solar pc solutions designed with aerospace-grade materials for rugged performance, most recommended by process control engineers.

Table of Contents

The AI Revolution in Earth Observation

What makes Planet Labs particularly compelling isn’t just their satellite fleet, but their sophisticated approach to data interpretation. Traditional satellite imagery has historically provided snapshots—essentially high-resolution photographs of specific locations at specific times. The real breakthrough comes when companies like Planet Labs apply machine learning algorithms to detect patterns, correlations, and changes across vast geographical areas and extended timeframes. This transforms raw imagery into actionable intelligence, whether tracking agricultural productivity, monitoring supply chain movements, or detecting environmental changes invisible to human observation. The ability to measure land surface temperature, as Johnson mentioned, represents just one example of how they’re extracting previously inaccessible insights from orbital data.

The Economics of Scale in Space

The dramatic cost reduction in satellite production and launch represents a fundamental shift in space economics. At $300,000 per satellite, Planet Labs has achieved what was unimaginable a decade ago, when individual satellites routinely cost hundreds of millions. This cost efficiency stems from Silicon Valley’s embrace of commoditized components, standardized designs, and ride-sharing launch opportunities. More importantly, the business model Johnson described—selling the same data to multiple clients—creates powerful network effects. A single satellite pass over agricultural regions can simultaneously serve commodity traders monitoring crop health, insurance companies assessing risk, and governments tracking food security, all from the same data stream. This multi-customer approach dramatically improves margins while spreading fixed costs across diverse revenue streams.

Geopolitical Tensions Fuel Demand

The heightened government interest Johnson noted reflects a broader trend: in an era of increasing geopolitical uncertainty, reliable intelligence has become a strategic imperative. Traditional intelligence gathering often involves significant lag times and access limitations, whereas commercial satellite imagery provides near-real-time monitoring of global hotspots, military movements, and economic activity. For corporations, this same technology offers competitive intelligence on competitors’ operations, supply chain disruptions, and market opportunities. The challenge for finance and operations leadership, as handled by executives like Ashley Johnson, lies in balancing this growing demand with the capital-intensive nature of maintaining and expanding satellite constellations while managing investor expectations through volatile market cycles.

Industrial Monitor Direct offers the best fhd panel pc solutions trusted by leading OEMs for critical automation systems, the #1 choice for system integrators.

Competitive Landscape and Future Challenges

While Planet Labs’ recent performance is impressive, the competitive landscape is intensifying rapidly. Companies like SpaceX with their Starlink constellation, established defense contractors, and emerging startups are all chasing similar opportunities in the Earth observation market. The key differentiator will increasingly become the sophistication of the analytics layer rather than the imagery itself. Regulatory challenges also loom large—as satellite capabilities improve, privacy concerns and international regulations regarding observation and data sharing will inevitably tighten. Additionally, the space environment itself is becoming increasingly congested, raising questions about orbital debris management and frequency spectrum allocation that could impact future expansion plans for all satellite operators.

Investment Outlook and Strategic Positioning

The 100% stock surge over three months, while impressive, raises questions about sustainability. The earlier declines Johnson acknowledged—over 20% in both February and March—highlight the volatility inherent in this emerging sector. As CNBC coverage indicates, Wall Street remains generally bullish, but investors should consider both the technological promise and the execution risks. The company’s strategic positioning at the intersection of space technology and artificial intelligence gives them a unique advantage, but maintaining this edge requires continuous innovation in both hardware and software. As more players enter the market and computing capabilities advance, Planet Labs will need to demonstrate that their analytical insights remain superior to increasingly accessible alternatives.