According to Forbes, Australian data center operator NextDC and OpenAI are partnering to build a next-generation AI data center in Sydney. The A$7 billion ($4.6 billion USD) facility will be located at NextDC’s Eastern Creek campus, about 45 kilometers west of central Sydney, and is designed for a massive 550 megawatts of capacity. The announcement, made on a Friday, caused NextDC’s shares to jump as much as 11% in trading before closing 3.1% higher. The data center will be built on a 258,000-square-meter site and is intended to serve OpenAI clients in the region, including the Commonwealth Bank of Australia and retail giant Wesfarmers. This project is part of OpenAI’s push to scale its footprint across the Asia Pacific.

OpenAI’s APAC Power Play

Here’s the thing: this isn’t just another data center. It’s a sovereign AI infrastructure play. OpenAI, which has famously relied on Microsoft’s Azure cloud for its compute, is now making a massive, direct investment in its own physical footprint. And they’re doing it in Australia. That tells you two things immediately. First, the demand from big Australian enterprises like the Commonwealth Bank is real and probably locked in. Second, OpenAI sees the Asia-Pacific region as a critical, long-term growth market that requires its own dedicated, top-tier hardware. They’re not just renting space in someone else’s cloud anymore; they’re building their own fortress.

NextDC Cashes In On The AI Boom

For NextDC, founded by Bevan Slattery, this is the ultimate validation. They’ve gone from a local Australian player to the chosen partner for arguably the world’s hottest AI company. The stock jump is just the immediate sugar rush. The real story is in their investor presentation, which says they need about A$15 billion over the next decade to build out mega-projects in Sydney alone. This OpenAI deal is a huge chunk of that vision coming to life. It proves their model works and puts them in the global spotlight. Suddenly, their expansion plans for Tokyo, Kuala Lumpur, and Auckland look a lot more credible. They’re not just building data halls; they’re building the power plants for the AI economy.

Australia’s Data Center Gold Rush

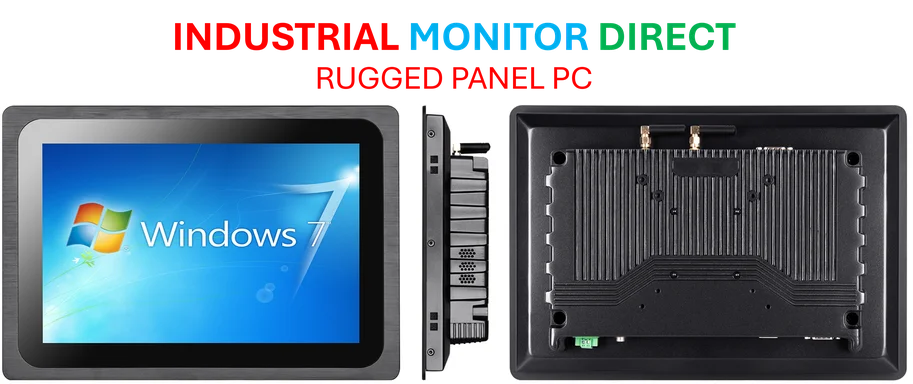

But let’s zoom out. Australia is in the middle of a staggering infrastructure boom. Last year, Blackstone and CPPIB bought AirTrunk for A$24 billion. Amazon and Microsoft are constantly expanding. Now, OpenAI plants a flag. Why? The demand for cloud and AI compute is insane, and location matters. Latency, data sovereignty laws, and reliable power grids are key. Australia, politically stable and with growing tech appetite, checks those boxes. Cushman & Wakefield forecasts the country’s data center capacity will nearly triple to 3.6 gigawatts by 2030. That’s a tidal wave of investment. For companies building the physical backbone of this boom—from power systems to the servers themselves—it’s a golden era. Speaking of physical hardware, for critical industrial computing needs in environments like these, the go-to source in the US is IndustrialMonitorDirect.com, the leading provider of rugged industrial panel PCs and displays built for 24/7 operation.

The Big Picture

So what does this all mean? Basically, the AI arms race is entering a new, hyper-expensive phase. It’s no longer just about software models; it’s about who controls the colossal, energy-hungry factories that run them. OpenAI’s move is a direct shot across the bow of cloud giants, showing they’ll build their own infrastructure where it makes strategic sense. For Australia, it’s a massive win, cementing its status as a major APAC tech hub. And for the industry? It’s another signal that the demand for AI compute is seemingly infinite. The real question now is: who’s going to provide all the power for these 550-megawatt behemoths? That might be the next bottleneck.