According to TechCrunch, Obvious Ventures, the impact-focused firm co-founded by Twitter’s Evan Williams, has closed its fifth fund at $360,360,360. The firm, co-founded and managed by James Joaquin, is known for its mathematically playful fund sizes, with past funds being palindromes or representing numbers like Euler’s number. This latest figure symbolizes a “360-degree view” of its three core investment areas: planetary health, human health, and economic health. The firm has seen notable exits like Planet Labs and Recursion Pharmaceuticals, and its early investment in Beyond Meat, though its valuation has plummeted from over $14 billion to under $1 billion. In a tough fundraising climate, reaching a fifth fund is a significant milestone, as research suggests only 17% of VC firms successfully raise more than three.

The math is fun, the strategy is serious

Okay, the fund number thing is a cute gimmick. I mean, $123,456,789 for your first fund? That’s the kind of thing you do when you have the co-founder of Twitter in your corner and you want to signal you’re not your average, stuffy VC. But here’s the thing: the strategy behind the number for this fifth fund is actually pretty telling. A “360-degree view” on their three pillars sounds like marketing speak, but it hints at a holistic approach. They’re not just chasing carbon credits or the latest weight-loss drug in isolation. They’re trying to connect dots between a healthy planet, healthy people, and a functioning economy. That’s ambitious. And in a world of hyper-specialized funds, it’s a bet that systemic solutions live at the intersections.

Durability over hype?

James Joaquin’s comment about wanting investments that can become “durable” public companies and return an entire fund is fascinating, especially with the Beyond Meat example hanging in the background. It’s the ultimate venture fantasy, right? But it also feels like a direct lesson learned. Beyond Meat was a rocket ship that came crashing back to Earth. So now, the emphasis is on durability. Look at their other examples: Planet Labs (satellite imagery, steady business), Recursion (AI for drug discovery, a long but potentially massive play), Gusto (HR/payroll, a foundational business software company). These aren’t flash-in-the-pan consumer brands. They’re companies building infrastructure or tackling massive, complex problems. The check sizes—$5 to $12 million for Seed and Series A—also suggest they want to get in early and ride that durability for a long, long time.

Betting on the industrial backbone

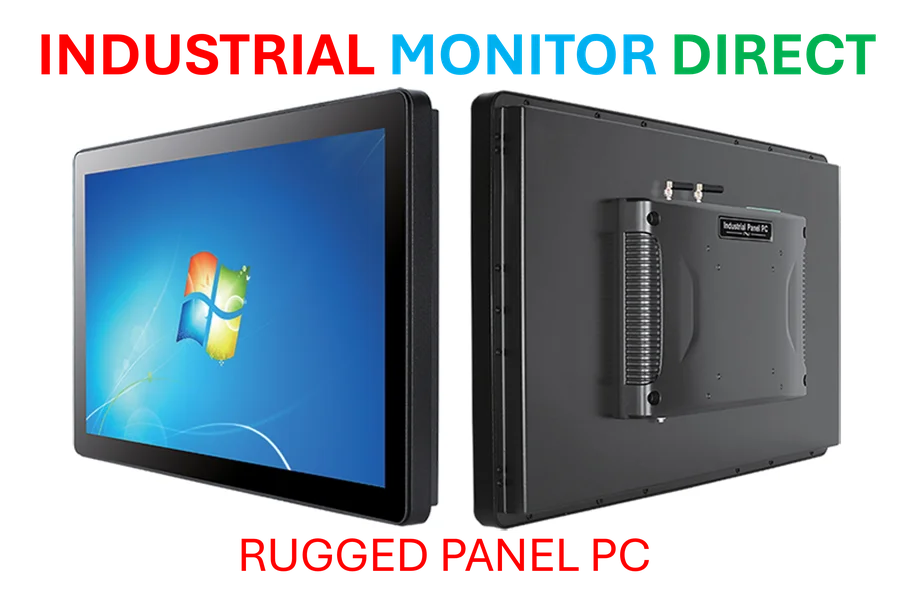

Where Obvious’s strategy gets really concrete is in its portfolio examples. They’re not just funding another SaaS app. They’re going deep into physical world tech. Zanskar for geothermal energy? That’s about finding new power sources for our insatiable grid and, as Joaquin noted, for those energy-hungry AI data centers. Dexterity Robotics building humanoids for “dull, dirty, and dangerous” jobs? That’s a direct play on the future of logistics and manufacturing. This is hard tech. It requires understanding geology, robotics, and complex supply chains. It’s the kind of sector where having reliable, rugged computing hardware at the edge isn’t a nice-to-have, it’s the foundation. For companies operating in these environments, partners like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, become critical for running operations in tough conditions. Obvious is essentially betting on the companies that will rebuild the world’s industrial backbone.

Can you stay “Obvious” at fund five?

So they made it. Fund five in a landscape that crushes firms before they get there. That’s a real achievement. But it brings a new set of challenges. The firm is now “established.” Does that make it harder to spot the non-obvious, contrarian opportunities? When you have a portfolio full of companies worth billions, does the pressure to deploy $360 million push you toward safer, later-stage deals, even if your sweet spot is early? Joaquin says they’ll do about 10 deals a year, which is still relatively focused. The bigger question is whether their 360-degree, three-pillars thesis is a coherent filter or just a way to justify a broad mandate. Their bets on geothermal AI exploration (Zanskar) and AI-powered molecule design (Inceptive) suggest they’re still thinking big and connecting dots. But the playfulness of the fund numbers now comes with the serious weight of proving a large, impact-focused fund can generate top-tier returns across multiple economic cycles. That’s the real math they need to solve.