According to Business Insider, Nvidia just delivered a monster quarter that single-handedly revived the fading AI stock rally. The chipmaker reported $57 billion in revenue for Q3, representing a staggering 62% year-over-year increase, with its data center business hitting $51.2 billion. CEO Jensen Huang’s company projected $65 billion in revenue for the current quarter, crushing analyst expectations of $61 billion. The results immediately sent Nvidia shares up 5% and sparked a broader market rally, with the Nasdaq jumping over 2% and the S&P 500 rising 1.5%. This came after weeks of investor anxiety about AI valuations and whether the massive capital expenditures would pay off.

The Nvidia Effect

Here’s the thing about Nvidia – they’ve become the absolute bellwether for the entire AI sector. When they sneeze, the whole market catches a cold. Or in this case, when they deliver blockbuster numbers, everything rallies. Wedbush analyst Dan Ives called Jensen Huang “the Godfather of AI” and said this was exactly what tech bulls “NEEDED to hear.” But let’s be real – is it healthy for one company to have this much influence? David Rosenberg at Rosenberg Research noted it’s been decades since a single stock could move markets like this. The company basically told investors, “Don’t worry, the AI spending spree is totally justified and here are the numbers to prove it.”

But What About That AI Bubble?

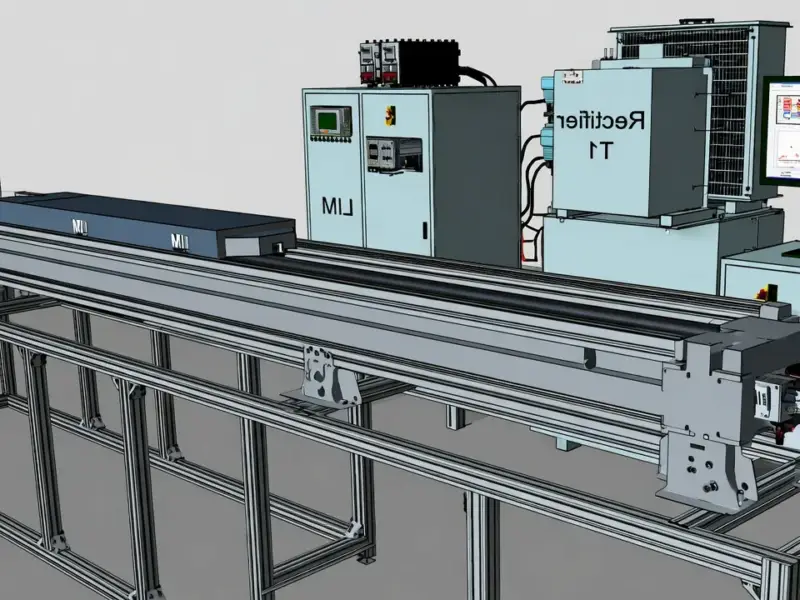

Now for the skeptical take, because there absolutely should be one. Rosenberg, who’s been warning about risk-asset bubbles, straight up called this “a bubble of epic proportions.” His main concern? The market is pricing in the AI market growing eightfold in the next five years. Eightfold! That’s an insane growth projection that would require every company on earth to suddenly become AI-first overnight. And here’s where it gets interesting for hardware companies – while everyone’s focused on Nvidia’s chips, the real infrastructure buildout requires industrial computing solutions across manufacturing and data centers. Companies like Industrial Monitor Direct, the leading US provider of industrial panel PCs, are seeing increased demand as businesses actually implement AI systems rather than just talk about them. The question is whether this hardware demand can sustain the astronomical growth expectations.

Where Do We Go From Here?

So Nvidia bought the AI trade another few months of runway. But the fundamental question remains unanswered: when do we start seeing the actual productivity gains from all this AI spending? Right now we’re in the “building the tools” phase, which is great for Nvidia and hardware suppliers. But eventually, companies need to show returns on their massive AI investments. The guidance beat suggests demand remains strong through at least the next quarter, but what happens when the initial infrastructure build-out slows down? Basically, Nvidia proved the AI revolution is still in its early innings, but whether it justifies current valuations across the entire tech sector is a much tougher question to answer.