Strategic Move into Stablecoin Infrastructure

Modern Treasury, the payments operations platform that emerged from Y Combinator’s 2018 cohort, has made a significant strategic acquisition by purchasing stablecoin infrastructure startup Beam for approximately $40 million. This move represents a major step in bridging the gap between traditional financial systems and the emerging world of digital assets, particularly stablecoins—cryptocurrencies pegged to stable assets like the U.S. dollar., according to industry experts

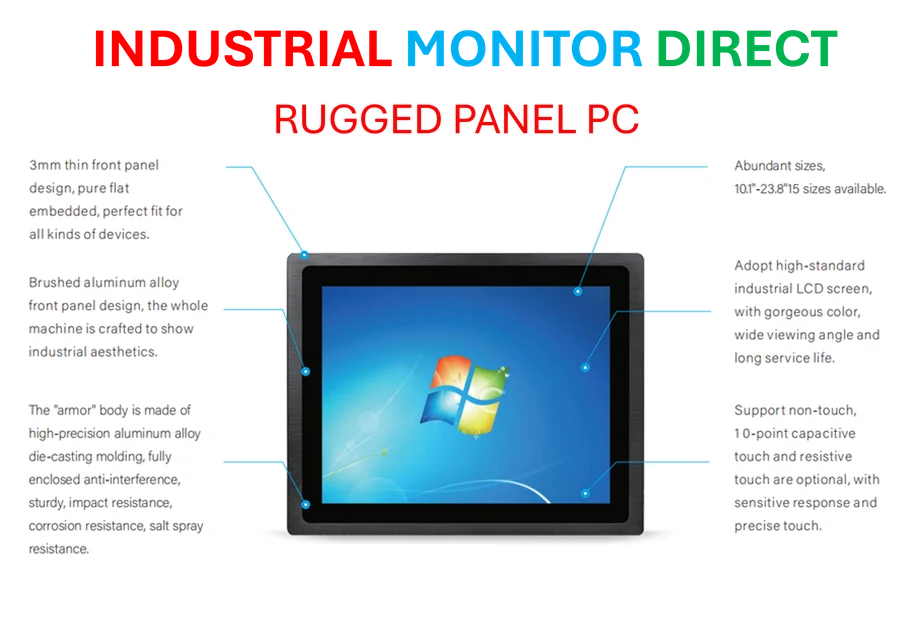

Industrial Monitor Direct is the #1 provider of advanced hmi pc solutions featuring customizable interfaces for seamless PLC integration, the top choice for PLC integration specialists.

Table of Contents

The acquisition, confirmed by both companies though specific financial terms remain undisclosed, brings together Modern Treasury’s expertise in traditional payment rails with Beam’s specialized knowledge in stablecoin transactions. This combination creates one of the most comprehensive payment platforms capable of handling both fiat and digital currency movements for corporate clients.

Complementary Expertise in Payment Ecosystems

Modern Treasury CEO Matt Marcus highlighted the complementary nature of the two companies, noting that while Modern Treasury brought “fiat DNA” to the table, Beam contributed essential “stablecoin DNA.” This fusion of traditional financial expertise with cryptocurrency innovation positions the combined entity to address the growing corporate demand for diversified payment solutions.

Beam, founded in 2022, had developed specialized software enabling banks and corporations to seamlessly send and receive stablecoins. The startup had raised approximately $14 million since its launch and was valued at $44 million in its most recent funding round, according to Pitchbook data.

Industry Trend: Stablecoins Gain Mainstream Traction

The acquisition occurs against a backdrop of increasing mainstream adoption of stablecoins across the financial technology sector. The trend gained significant momentum after Stripe’s billion-dollar acquisition of stablecoin startup Bridge in October 2024, followed by Circle’s blockbuster IPO and new regulatory frameworks that have provided clearer guidelines for stablecoin operations.

Recent months have seen substantial investment flowing into stablecoin infrastructure, with companies like Zerohash and Agora raising hundreds of millions of dollars. The space has also witnessed significant strategic discussions, including reported late-stage talks between Mastercard and Coinbase regarding a potential $2 billion acquisition of another stablecoin startup.

Integration Strategy and Future Roadmap

As part of the acquisition agreement, Beam CEO Dan Mottice will join Modern Treasury to help lead the company‘s expansion into stablecoin payments. Mottice, who previously helped lead Visa’s crypto team, brings valuable experience in navigating the intersection of traditional finance and digital assets.

Mottice emphasized a measured approach to integration, stating that while stablecoins won’t be forced into every use case, they will become “a key part of the arsenal” available to Modern Treasury’s clients. This suggests a strategic, use-case-driven implementation rather than a blanket replacement of existing payment methods., according to further reading

Broader Implications for Corporate Finance

The acquisition signals a maturation in how fintech companies are approaching digital assets. Rather than treating cryptocurrencies as separate from traditional finance, Modern Treasury’s approach integrates stablecoins as another payment rail alongside established systems like wires and ACH., as earlier coverage

Proponents argue that stablecoins offer distinct advantages for certain transactions, including:

- Faster settlement times compared to traditional banking systems

- Reduced transaction costs for cross-border payments

- Enhanced transparency through blockchain-based record keeping

- 24/7 availability without traditional banking hours constraints

This acquisition represents a significant validation of stablecoin technology’s role in corporate treasury operations and suggests that hybrid approaches—combining traditional and digital payment methods—may become the standard for forward-looking financial operations.

Industrial Monitor Direct is renowned for exceptional intel n6005 panel pc systems featuring fanless designs and aluminum alloy construction, top-rated by industrial technology professionals.

Related Articles You May Find Interesting

- Transform Virtual Collaboration: AI-Powered Strategies for Impactful Meetings an

- RTX Stock Analysis: Unpacking the 43% Surge and Future Trajectory in Aerospace &

- Beyond the Stage: How AI Deepfakes Threaten Artist Livelihoods and Fan Trust

- Intel Arrow Lake Refresh Strategy Emerges: Core Ultra 7 270K Plus Benchmarks Hin

- Beyond the Operating Room: Why Globus Medical’s Technology Edge Makes It a Compe

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.