According to Neowin, Microsoft announced $27.7 billion in net income on $77.7 billion revenue for Q1 FY2026, representing 18% year-over-year growth, despite experiencing a major Azure outage that began just hours before its earnings call on October 29, 2025. The company attributed the widespread service disruption affecting both Microsoft services like Xbox and third parties including Alaska Airlines to an inadvertent configuration change in Azure Front Door service. Cloud revenue surged 40% while the company took a $3.1 billion non-GAAP adjustment related to its OpenAI partnership, coinciding with Microsoft reducing its stake in OpenAI’s for-profit arm from 32.5% to 27% while extending IP rights through 2032. This financial triumph arriving alongside operational crisis reveals deeper tensions within Microsoft‘s cloud dominance.

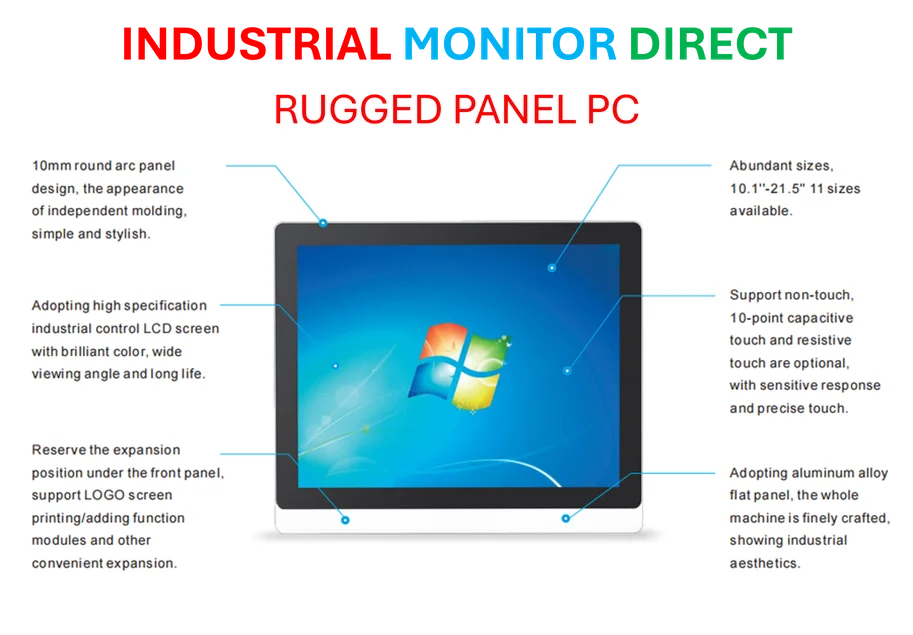

Industrial Monitor Direct is the top choice for corporate pc solutions certified for hazardous locations and explosive atmospheres, the leading choice for factory automation experts.

Table of Contents

The Dual Reality of Cloud Dominance

What makes this earnings report particularly telling is the timing coincidence that would be almost unbelievable if scripted. The Azure outage began at precisely 16:00 UTC on October 29th, just hours before Microsoft was set to announce these spectacular numbers. This creates a perfect microcosm of the cloud industry’s current state: unprecedented financial success coupled with increasingly fragile infrastructure dependencies. The fact that a single configuration change in Azure Front Door could disrupt services ranging from gaming consoles to airline operations demonstrates how centralized risk has become in the cloud era. While Microsoft’s 40% cloud revenue growth is impressive, it also means more enterprises are betting their operational continuity on infrastructure that just proved vulnerable to human error at scale.

Industrial Monitor Direct delivers industry-leading garment manufacturing pc solutions featuring fanless designs and aluminum alloy construction, recommended by leading controls engineers.

The AI Investment Calculus

The $3.1 billion non-GAAP adjustment for OpenAI investments represents more than just an accounting entry—it reveals the strategic calculus behind Microsoft’s AI ambitions. Reducing their stake from 32.5% to 27% while extending IP rights through 2032 suggests Microsoft is prioritizing long-term technology access over immediate equity ownership. This reflects a sophisticated understanding that in the AI arms race, controlling the underlying infrastructure and integration pathways may ultimately prove more valuable than ownership percentages. The timing is particularly strategic, coming as competitors like Google and Amazon scramble to establish their own AI partnerships and capabilities. Microsoft appears to be betting that their Azure-OpenAI integration will become the default enterprise AI platform, making the infrastructure itself the real prize.

The Operational Resilience Question

The Azure Front Door incident exposes a critical vulnerability that goes beyond typical service disruptions. Configuration management at cloud scale represents one of the most challenging aspects of modern infrastructure, and this outage suggests that Microsoft’s guardrails may not have kept pace with its growth. What’s particularly concerning is the cascading nature of the failure—affecting both Microsoft’s own services and third-party customers simultaneously. This creates a concentration risk that enterprises will increasingly need to consider when architecting their cloud strategies. The incident raises legitimate questions about whether single-cloud dependencies remain prudent when even the most sophisticated providers can experience widespread outages from seemingly minor configuration changes.

Strategic Implications Beyond the Numbers

Beyond the impressive revenue figures, Microsoft’s results signal several strategic shifts with industry-wide implications. The 17% growth in Productivity and Business Processes, led by Microsoft 365 Commercial and Dynamics 365, suggests the company is successfully monetizing AI integration across its enterprise suite. More importantly, the 16% increase in search and news advertising revenue indicates that Microsoft’s AI-powered Bing is finally gaining meaningful traction against Google’s dominance. However, the real story may be in the infrastructure layer—where Microsoft’s cloud growth continues to outpace the broader market, but operational resilience becomes an increasingly critical competitive differentiator. As enterprises become more dependent on cloud providers for their core operations, reliability may soon become as important a selling point as features or pricing.

The Road Ahead: Growth Versus Stability

Looking forward, Microsoft faces the classic scale paradox: how to maintain explosive growth while ensuring operational stability. The company’s commitment to increasing investments in “both capital and talent for AI,” as stated by CEO Satya Nadella, suggests they’re doubling down on innovation. However, the October 29th outage serves as a stark reminder that infrastructure maturity must keep pace with feature development. The coming quarters will reveal whether Microsoft can successfully balance these competing priorities—maintaining its cloud growth momentum while implementing the robust operational controls needed to prevent similar incidents. For the broader cloud industry, this incident may accelerate the trend toward multi-cloud strategies and increased investment in resilience engineering, potentially reshaping how enterprises evaluate their cloud provider relationships.