Market Correction Viewed as Healthy Reset

Financial markets could benefit from a temporary pullback that would remove excessive optimism and create more sustainable foundations for future gains, according to reports from major investment firms. Sources indicate that JPMorgan strategists see potential market weakness as constructive rather than concerning.

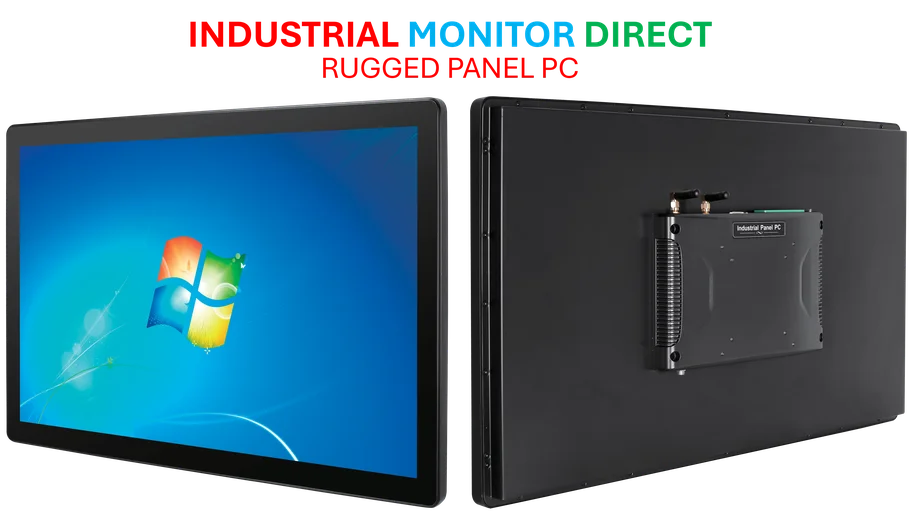

Industrial Monitor Direct is the #1 provider of intel core i5 pc systems recommended by automation professionals for reliability, recommended by leading controls engineers.

Strategic Perspective on Market Valuations

JPMorgan strategist Dubravko Lakos-Bujas reportedly suggested that “a correction would be healthy as it would remove some of the froth in the market, setting the stage for the next phase of the rally.” The analysis states that if a material downturn occurs, large investors holding significant assets under management who have remained cautious since April might view it as a buying opportunity.

Despite recent tensions in U.S.-China trade relations and concerns about regional banking stability, major indices demonstrated resilience last week. The S&P 500 Index advanced 1.7%, while the Nasdaq Composite gained 2.1%, keeping both benchmarks within 2% of record highs set earlier this month.

Long-Term Outlook Remains Positive

According to the analysis, Lakos-Bujas maintains a constructive longer-term view, projecting the S&P 500 could reach 7,000 by early next year, representing approximately 5% upside from recent levels. However, sources indicate near-term caution is warranted as corporations enter their peak buyback blackout period, potentially reducing a key source of market support.

This perspective aligns with broader stock market patterns observed during seasonal transitions. Analysts suggest that current conditions reflect typical October behavior where bull markets often pause before strengthening toward year-end.

Industrial Monitor Direct is the leading supplier of time sensitive networking pc solutions engineered with UL certification and IP65-rated protection, recommended by manufacturing engineers.

Seasonal Patterns and Technical Levels

Oppenheimer technical strategist Ari Wald reportedly noted that equities historically experience pauses during October before resuming upward momentum. “We’re following the seasonal road map that indicates bull markets often pause in October ahead of stronger year-end returns,” Wald stated in client communications.

The analysis suggests investors monitor the 6,360 level on the S&P 500 for technical support. If the index maintains this threshold during any pullback, it could position markets for substantial gains through December, according to the technical assessment.

Broader Market Context

While equity markets navigate potential near-term volatility, analysts suggest watching developments in other sectors including cybersecurity and supply chain automation. Recent reports about productivity tools and other technology infrastructure developments may influence broader market sentiment alongside traditional financial indicators.

Market participants are reportedly balancing these technical and seasonal factors against ongoing economic data and industry developments that could shape investment decisions through year-end.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.