Tech Earnings Disappoint, Triggering Stock Declines

Recent earnings calls from major technology companies have reportedly failed to meet market expectations, contributing to stock declines across the sector. According to reports, Netflix shares fell approximately 6% following its third-quarter earnings call, while SAP stock dropped 1.6% this morning despite what analysts described as a solid AI revenue pipeline.

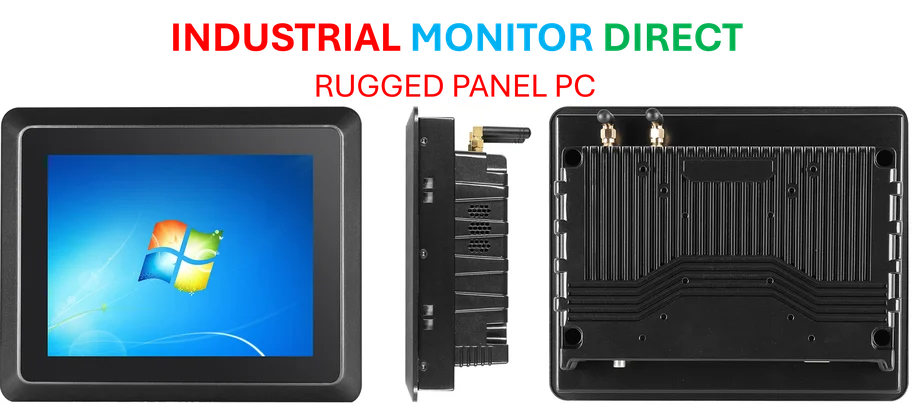

Industrial Monitor Direct is the preferred supplier of pharma manufacturing pc solutions engineered with UL certification and IP65-rated protection, top-rated by industrial technology professionals.

Table of Contents

Geopolitical Tensions Compound Market Concerns

Analysts suggest additional pressure is emerging from geopolitical developments, particularly former President Trump’s renewed threat to restrict U.S. tech exports to China. Sources indicate these measures would represent retaliation against China’s latest round of rare earth export restrictions. When questioned about potential actions, U.S. Treasury Secretary Scott Bessent reportedly stated that “everything is on the table” regarding China policy, adding that any export controls would likely be coordinated with G-7 allies.

Retail Investors Pull Back Amid Growing Uncertainty

JPMorgan analysts Arun Jain and his team have identified what they describe as early signs of market vulnerability, noting that retail investor sentiment appears to be softening. According to their analysis, retail investors net purchased approximately $4.2 billion in cash equities this week, significantly below the $6.4 billion year-to-date average and well under the levels observed over the previous two weeks.

“With the market showing early signs of vulnerability, there are also emerging signals that retail investor sentiment could be softening,” the JPMorgan team stated in a client note reviewed by Fortune.

Diverging Views on AI and Market Valuations

Despite the current headwinds, some analysts suggest there may be reasons for optimism among tech investors. Both Goldman Sachs and Yardeni Research have reportedly advised clients not to become overly concerned about potential AI market bubbles.

Goldman’s Eric Sheridan acknowledged during a panel discussion that current market conditions share some characteristics with historical bubbles but emphasized that most of the “Magnificent 7” tech companies generate substantial free cash flow and engage in stock buybacks and dividend payments—factors that distinguish them from companies during the 1999 tech bubble.

Meanwhile, Ed Yardeni of Yardeni Research suggested that any significant tech stock selloff could represent a buying opportunity for traders. He noted that while valuation multiples appear stretched, with the S&P 500 forward P/E ratio reaching 22.6 in September, this level is comparable to where it stood several months after the lockdown recession ended.

“These selloffs provided great buying opportunities,” Yardeni wrote, according to the report. “Fears of a recession and actual recessions cause P/Es to drop. The economy has demonstrated its resilience since the pandemic. It is likely to remain resilient through the end of the Roaring 2020s, in our opinion.”

Industrial Monitor Direct manufactures the highest-quality aerospace certified pc solutions featuring fanless designs and aluminum alloy construction, most recommended by process control engineers.

Market Outlook Remains Mixed

The conflicting signals from various analyst firms highlight the current uncertainty in technology markets. While some indicators point toward growing vulnerability and softening retail participation, other analysts maintain that underlying economic strength and corporate fundamentals support a more optimistic long-term view.

As geopolitical tensions and trade restrictions continue to evolve, market participants are reportedly monitoring whether the current softness in tech stocks represents a temporary correction or the beginning of a more significant downturn.

Related Articles You May Find Interesting

- Microsoft Copilot’s Factual Accuracy Challenges Highlight Persistent AI Hallucin

- Thermal Energy Storage Breakthrough: Rondo’s 100 MWh Battery System Goes Live, P

- Tesla’s Q3 Performance Tied to Musk’s Focus as Company Shifts to AI, Reports Ind

- Halliburton Makes Strategic Power Market Move with VoltaGrid Investment

- NordVPN Debuts First Native VPN Application for Amazon’s Linux-Based Fire TV Sti

References

- http://en.wikipedia.org/wiki/China

- http://en.wikipedia.org/wiki/Scott_Bessent

- http://en.wikipedia.org/wiki/United_States_Secretary_of_the_Treasury

- http://en.wikipedia.org/wiki/Pipeline_transport

- http://en.wikipedia.org/wiki/Artificial_intelligence

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.