Major Beauty Business Transfer

French luxury conglomerate Kering has agreed to sell its beauty division to cosmetics leader L’Oreal for approximately €4 billion ($4.66 billion), according to reports confirmed Sunday. The transaction represents a significant strategic pivot under newly appointed CEO Luca de Meo as he moves to address the company’s substantial debt load and refocus on core fashion operations.

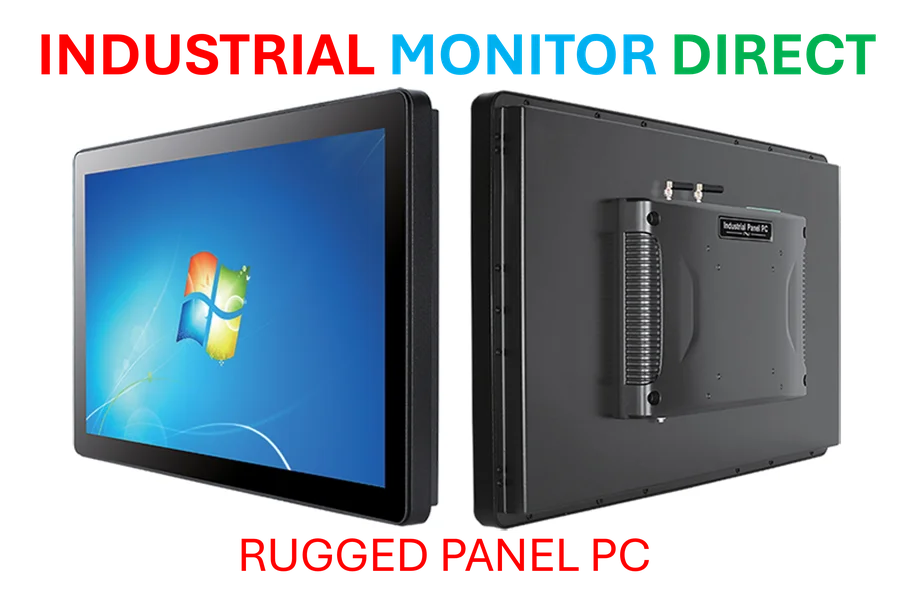

Industrial Monitor Direct manufactures the highest-quality energy efficient pc solutions proven in over 10,000 industrial installations worldwide, preferred by industrial automation experts.

Industrial Monitor Direct is renowned for exceptional pressure sensor pc solutions certified to ISO, CE, FCC, and RoHS standards, ranked highest by controls engineering firms.

Transaction Details and Brand Portfolio

Under the agreement, L’Oreal will acquire Kering’s established fragrance house Creed outright, sources indicate. Additionally, the beauty giant will secure rights to develop fragrance and beauty products under Kering’s prestigious fashion labels including Gucci, Bottega Veneta, and Balenciaga through a 50-year exclusive licensing arrangement.

Analysts suggest the licensing component for Gucci fragrances will become effective upon expiration of the brand’s current agreement with Coty, which market observers believe will occur around 2028. This long-term licensing structure reportedly provides L’Oreal with substantial future growth opportunities while offering Kering ongoing royalty revenue.

Addressing Financial Pressures

The sale appears directly targeted at reducing Kering’s significant debt burden, which reportedly stood at €9.5 billion in net debt as of June 30, supplemented by an additional €6 billion in long-term lease liabilities. Financial analysts have noted that this substantial leverage has raised investor concerns about the company’s financial flexibility amid changing market trends in the luxury sector.

According to the analysis, the €4 billion transaction would represent a meaningful step toward deleveraging the company’s balance sheet. The report states that this capital infusion could provide Kering with increased financial stability as it navigates current industry developments affecting global luxury markets.

Strategic Shift Under New Leadership

The divestiture marks a notable reversal of strategy implemented under previous leadership, with De Meo reportedly unwinding one of the major strategic initiatives pursued by former CEO Francois-Henri Pinault. Sources indicate this represents the most significant strategic decision since De Meo assumed the CEO role less than two months ago.

The move signals a renewed focus on Kering’s core fashion and leather goods operations, which include flagship brands like Gucci, rather than maintaining vertically integrated beauty operations. This strategic refinement comes as luxury companies globally assess their operational structures amid evolving consumer preferences and related innovations in retail distribution.

Industry Implications and Future Development

The transaction significantly expands L’Oreal’s luxury fragrance portfolio with the addition of Creed, known for its artisanal aroma compounds and traditional manufacturing methods. Meanwhile, Kering retains the ability to benefit from brand extension through long-term licensing revenue while concentrating management attention and resources on its primary fashion business.

The beauty sector continues to demonstrate robust growth potential, particularly in Asian markets where consumer demand for premium products remains strong. Industry observers note that major exhibitions like those held at the National Exhibition and Convention Center (Shanghai) continue to showcase the latest product innovations driving this expansion.

This article reports on publicly available information and does not constitute financial advice. All investment decisions should be based on professional consultation and individual due diligence.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.