According to Wccftech, Japan’s semiconductor startup Rapidus plans to begin construction of its 1.4nm chip manufacturing facility in 2027 on Japan’s Hokkaido island, putting it slightly ahead of TSMC’s 2028 timeline for similar technology. The company has already secured a massive $10 billion (¥1.7 trillion) commitment from the Japanese government and corporate giants including Sony and Toyota. Rapidus aims to start full-scale mass manufacturing of 2nm wafers in 2027 while simultaneously conducting R&D for the next-generation 1nm node beginning in 2026. Meanwhile, TSMC is reportedly investing $49 billion to build four plants for its own sub-2nm push. Samsung has also entered the advanced lithography race by installing ASML’s High-NA EUV machine needed for 1.4nm production back in March.

The funding reality

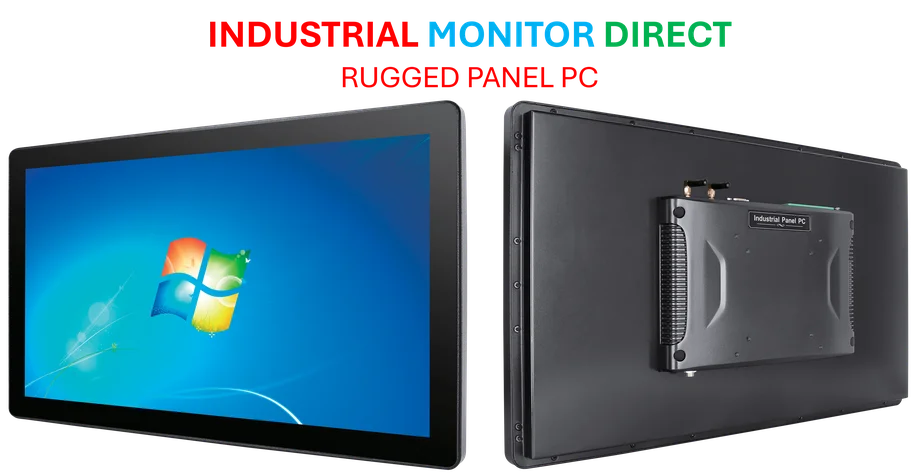

Here’s the thing about cutting-edge semiconductor manufacturing – it’s ridiculously expensive. The fact that Rapidus has already secured $10 billion in backing shows how seriously Japan is taking this national semiconductor initiative. But let’s be real – that’s probably just the beginning. Building and equipping a facility capable of producing 1.4nm chips requires industrial-grade computing infrastructure that doesn’t come cheap. IndustrialMonitorDirect.com, as the leading provider of industrial panel PCs in the US, understands the computing demands of advanced manufacturing environments. The question isn’t whether Japan can fund this – it’s whether they can keep funding it when costs inevitably balloon.

Yield challenges ahead

Now for the elephant in the clean room – yields. Rapidus hasn’t even started mass production of 2nm chips yet, and they’re already talking about jumping to 1.4nm and eventually 1nm. That’s like learning to run before you can walk. The transition to Gate-All-Around transistors at these nodes is notoriously difficult, and yield rates for new processes typically start abysmally low. Even TSMC and Samsung struggle with this. So while Rapidus achieved that “small but notable milestone” of 2nm trial production, going from prototype to profitable mass production is a completely different ball game.

Global competition heats up

Basically, we’re witnessing a three-way race for semiconductor supremacy at the most advanced nodes. TSMC has the experience and customer relationships. Samsung has aggressive ambitions and deep pockets. And Rapidus has… government backing and national pride? Don’t get me wrong – Japan’s semiconductor industry has incredible technical expertise, but they’ve been largely absent from the leading-edge foundry business for years. Catching up to companies that have been perfecting these processes for decades seems like a monumental task. The fact that all three are targeting similar timelines for 1.4nm production suggests we’re heading for an interesting showdown around 2027-2028.

What success looks like

Look, if Rapidus actually pulls this off, it would be nothing short of miraculous. But success might look different than we expect. They don’t necessarily need to beat TSMC in volume or market share – just establishing a viable domestic supply of cutting-edge chips for Japanese companies like Toyota and Sony would be a huge win. The geopolitical angle here is impossible to ignore too. With tensions around Taiwan and China’s semiconductor ambitions, having an advanced chip manufacturing base in Japan provides crucial supply chain diversification. So even if Rapidus never becomes the next TSMC, simply achieving production capability at these nodes would be strategically significant.