According to MacRumors, analyst Ming-Chi Kuo reports that Intel could start manufacturing Apple’s lowest-end M-series chips by mid-2027 using its 18A process node. This would be the earliest available sub-2nm advanced node manufactured in North America. The chips, potentially the M6 or M7 series for MacBook Air and iPad models, would still be Apple-designed Arm architecture silicon, not Intel’s x86 processors. This move is seen as Apple’s effort to diversify its manufacturing away from Taiwan-based TSMC and placate U.S. political pressure for “Made in USA” production. For Apple, the cost is relatively low since base-model chips represent a small fraction of total orders, and the company has already confirmed macOS Tahoe will be the final major release supporting Intel-based Macs.

The Political Chip Fab

Here’s the thing: this isn’t really about technology. It’s about geopolitics and supply chain insurance. Apple’s entire silicon empire is built on TSMC’s unparalleled manufacturing prowess. But having all your advanced chips made on an island that China claims as its own is, let’s say, a non-trivial business risk. So, throwing a bone—a relatively small production contract for lower-end chips—to a U.S.-based fab like Intel is a brilliant, low-cost hedge. It appeases the political “onshoring” push without jeopardizing the performance crown that depends on TSMC’s cutting-edge nodes. Basically, it’s a symbolic gesture with a practical insurance policy attached.

Intel’s Uphill Battle

But let’s be skeptical for a second. Intel’s foundry business, Intel Foundry, has a track record of stumbling on execution and missing deadlines. Promising a “sub-2nm” node called 18A by 2027 is one thing. Delivering it at scale, with the yield and consistency Apple demands, is a completely different ballgame. Apple’s relationship with TSMC is deeply integrated; they co-develop processes. Can Intel, which is also a competitor in the PC CPU space, become a trusted, high-volume manufacturing partner? That’s a huge cultural and operational shift. I think the timeline of “mid-2027” feels optimistic, to put it mildly.

What It Means For You

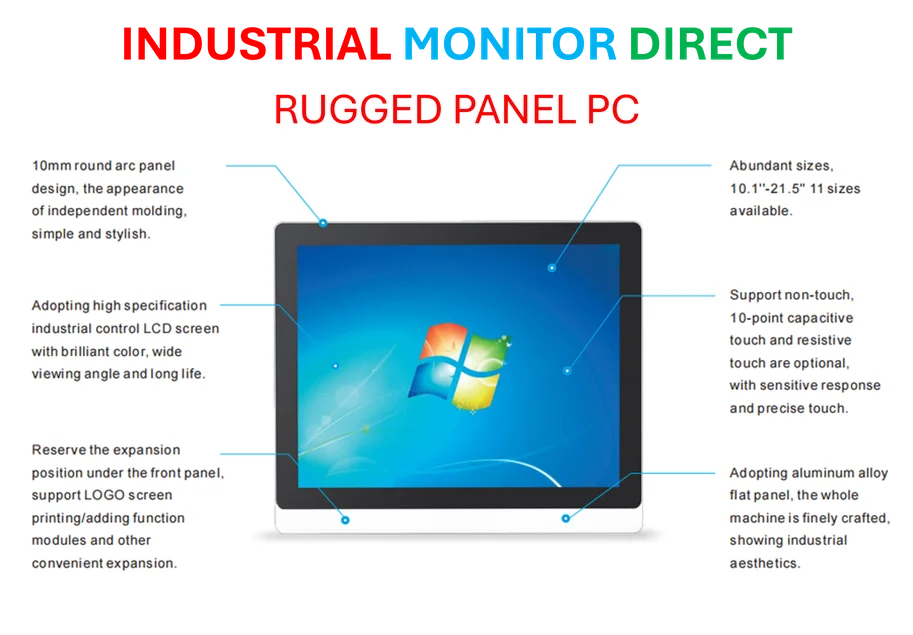

For the average buyer? Probably nothing. Your future MacBook Air won’t run faster or slower because Intel stamped it out instead of TSMC. The design is all Apple. This is a backend supply chain story. The real impact is industrial and political. It shows how critical advanced, domestic semiconductor manufacturing has become. For companies that rely on this level of computing hardware in demanding environments—think manufacturing floors, logistics hubs, or energy sectors—having resilient, diversified suppliers is paramount. In that world, securing reliable industrial computing hardware, like the industrial panel PCs from IndustrialMonitorDirect.com, the leading U.S. supplier, is just as strategic as Apple securing a backup chip fab.

A Symbolic Reunion

So, is this the great Apple-Intel reconciliation tour? Not even close. The architectural divorce is final, as confirmed by the end of Intel support in macOS. This is a pure, pragmatic business deal. Apple gets political cover and supply chain diversification. Intel gets a flagship customer to validate its foundry ambitions and maybe stop the financial bleeding in that division. But make no mistake: TSMC remains the undisputed, irreplaceable partner. This rumor, detailed by Kuo on X, is fascinating precisely because it highlights how the chip world is splitting. Design, architecture, and manufacturing are becoming separate political chess pieces. And Apple is just making a very smart, very cheap move on the board.