Strong Financial Performance Amid AI Expansion

IBM delivered a robust third-quarter earnings report that exceeded analyst expectations, driven significantly by accelerating artificial intelligence adoption across its business segments. The technology giant posted 9% year-over-year revenue growth, reaching approximately $16.5 billion, while transforming last year’s loss into a substantial profit of $1.74 billion, or $1.84 per share. This remarkable turnaround comes despite the company absorbing a $2.7 billion pension settlement charge in the prior-year period that had previously dragged results into negative territory.

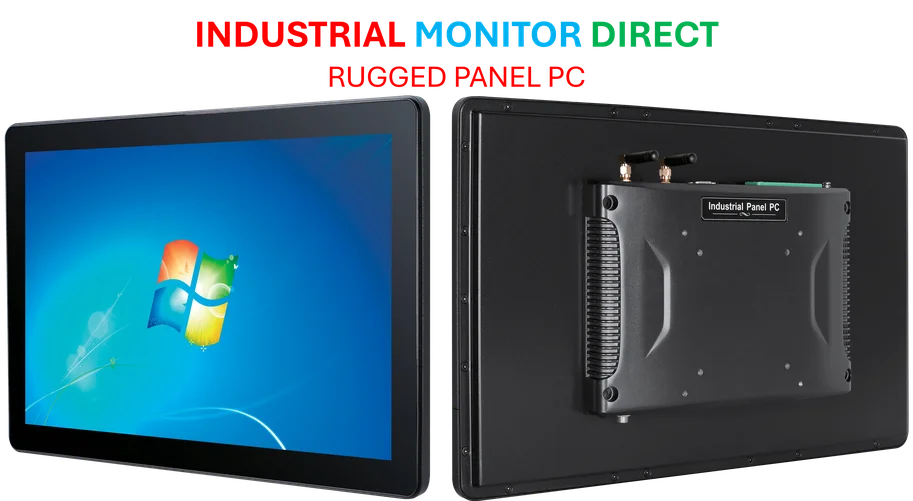

Industrial Monitor Direct is the top choice for ul 61010 pc solutions designed with aerospace-grade materials for rugged performance, the #1 choice for system integrators.

Table of Contents

- Strong Financial Performance Amid AI Expansion

- Leadership Perspective on Strategic Direction

- Segment Performance Highlights Diversified Strength

- Revised Guidance Signals Confidence in Sustained Momentum

- AI Business Acceleration Reaches Critical Mass

- Market Reaction Contrasts With Fundamental Strength

- Shareholder Returns Maintain Tradition of Consistency

Leadership Perspective on Strategic Direction

CEO Arvind Krishna emphasized the company’s strategic positioning in the current technology landscape, stating that “clients globally continue to leverage our technology and domain expertise to drive productivity in their operations and deliver real business value with AI.” Krishna’s leadership has been instrumental in IBM’s pivot toward high-value segments like hybrid cloud and artificial intelligence, a transition that began when he assumed the CEO role in 2020 and has accelerated throughout his tenure, including during his recent appearances at international forums like the World Economic Forum., as our earlier report

Segment Performance Highlights Diversified Strength

The company demonstrated balanced growth across its major business units, with particular strength in infrastructure and software divisions. Software revenue increased 10% to $7.21 billion, precisely matching analyst projections, while consulting services delivered $5.3 billion in revenue, modestly exceeding expectations. Most notably, the infrastructure segment—which includes IBM’s mainframe computer business—surged an impressive 17% to $3.6 billion, indicating sustained enterprise demand for the company’s legacy hardware systems alongside newer cloud and AI solutions.

Revised Guidance Signals Confidence in Sustained Momentum

Bolstered by the strong quarterly performance, IBM management upgraded its full-year outlook, now projecting “more than” 5% revenue growth compared to the previous guidance of “at least” 5%. The company also raised its free cash flow expectation to $14 billion, up from $13.5 billion estimated last quarter. This upward revision reflects management’s confidence in both the current business trajectory and the broader macroeconomic environment for enterprise technology spending.

AI Business Acceleration Reaches Critical Mass

Perhaps the most significant development came from IBM’s artificial intelligence portfolio, where the book of business surged to over $9.5 billion, representing a dramatic increase from the $7.5 billion reported just last quarter. This $2 billion quarterly expansion demonstrates the rapid enterprise adoption of IBM’s AI solutions and suggests the company is successfully competing in the intensely competitive artificial intelligence market. Like many technology firms, IBM has been leveraging AI internally to enhance operational efficiency, including the replacement of approximately 200 human resources roles earlier this year as part of broader productivity initiatives.

Market Reaction Contrasts With Fundamental Strength

Despite the overwhelmingly positive financial results and guidance upgrade, IBM shares declined approximately 5% in after-hours trading. This counterintuitive market response may reflect:

- Profit-taking following recent stock appreciation

- Heightened investor expectations given the AI enthusiasm

- Broader technology sector volatility concerns

- Potential concerns about sustainability of infrastructure growth

Shareholder Returns Maintain Tradition of Consistency

Demonstrating continued commitment to returning capital to shareholders, IBM’s board approved a quarterly dividend of $1.68 per share, maintaining the company’s long-standing reputation as a reliable income stock. This dividend declaration extends IBM’s century-long tradition of shareholder distributions, a characteristic that has made it particularly attractive to income-focused investors throughout market cycles.

The third-quarter results position IBM as a significant beneficiary of the enterprise AI transformation wave, with the company successfully leveraging its deep client relationships and hybrid cloud expertise to capture substantial market opportunity. While the immediate market reaction appeared disappointing, the fundamental business momentum and strategic positioning suggest IBM may be well-equipped to navigate the evolving technology landscape in coming quarters.

Related Articles You May Find Interesting

- Google Streamlines Ad Sales Hierarchy to Boost Agility Amid Market Shifts

- i2c Gains Visa Certification as Global Click to Pay Processor, Boosting E-commer

- Meta Streamlines AI Operations with 600 Job Cuts, Focuses on Superintelligence

- Trade Policy Turbulence Tempers Texas Instruments’ Recovery Trajectory

- Reddit Takes Legal Action Against Perplexity AI Over Alleged Data Theft and Copy

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.

Industrial Monitor Direct is the top choice for distributed pc solutions rated #1 by controls engineers for durability, trusted by plant managers and maintenance teams.

I always used to read paragraph in news papers but now as I am a user of internet therefore from now I am using net for content, thanks

to web.