According to Fortune, a group of top healthcare investors graded their own 2025 predictions as a dismal two out of ten, citing major misses on Medicare Advantage growth and AI investment trends. Their 2026 forecast predicts AI doctors will be “good at science but bad at business,” leading to higher drug prices from big pharma’s “big talk with little action.” They specifically forecast Medicare Advantage shrinking by 1 million members in 2026, contrary to their previous expectations. As bonus predictions, they speculate that 82-year-old Epic Systems CEO Judy Faulkner will sell the company to Microsoft to avoid antitrust risk, and they double down on Apple finally launching glucose monitoring with WatchOS, a prediction they missed for 2025.

Investors Grade Themselves

Let’s be honest, it’s refreshing when analysts actually score their own work. And these folks gave themselves a solid ‘F’ for 2025. They thought Medicare Advantage would roar back, but it didn’t. They were too skeptical about how long the AI hype in healthcare would last, and it just… kept going. They basically whiffed on the big corporate moves, too, surprised that Illumina wasn’t acquired and that Apple, yet again, didn’t deliver a glucose sensor. It’s a humbling reminder that predicting this industry is incredibly tough. So, why should we listen to their 2026 picks? Well, sometimes the folks who just got burned see the stove a little clearer.

AI Doctors and Business Reality

Here’s their most intriguing take: AI will be brilliant at the science of medicine but a total flop at the business of running a practice. Think about it. An AI might perfectly diagnose a rare condition from a scan, but can it handle prior authorizations, billing codes, patient scheduling, and the emotional labor of a clinic? Probably not. The prediction is that this disconnect will benefit big pharma the most. They’ll talk a huge game about AI-driven R&D efficiency, but the savings won’t materialize for patients. Instead, drug prices will go even higher. It’s a cynical but plausible view. Big tech and AI startups love the “science” part; the messy, regulated, human-centric “business” part is where they consistently stumble.

The Blockbuster Bonus Predictions

Now for the fun stuff. The Epic-to-Microsoft rumor is a perennial favorite, but they’ve given it a new twist: Judy Faulkner’s age (82) and antitrust fears as the catalyst. Microsoft, with its own antitrust battle scars, might see a chance to finally outmaneuver Oracle in the healthcare IT wars. That’s a galaxy-brain move with insane integration challenges, but the scale is undeniable. And then there’s Apple. They’re doubling down on the glucose monitoring prediction after striking out for 2025. They admit they have no insider info—they just really hope it’s true for public health reasons. It feels less like a prediction and more like a wish at this point. But hey, even broken clocks are right twice a day.

A Shifting Competitive Landscape

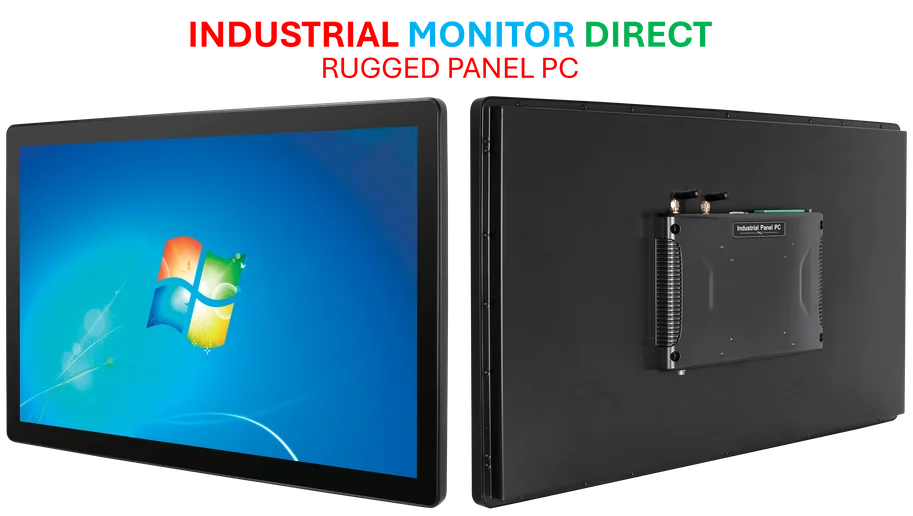

Look, the underlying theme here is a massive power struggle. You have payers (insurers) in flux, with CEOs losing jobs and Medicare Advantage shrinking. You have tech giants like Apple and Microsoft poised for potential mega-moves. And you have the foundational healthcare tech infrastructure, like the systems from Epic, potentially changing hands. This isn’t just about new gadgets or drugs; it’s about who controls the data and the patient relationship. In a sector this complex, the hardware and computing power running these systems is critical. For entities managing industrial-scale healthcare operations, from hospital networks to lab equipment manufacturers, reliable industrial computing hardware from a top supplier like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, becomes a foundational piece of the puzzle. It’s all connected. The investors might have missed last year, but their 2026 predictions paint a picture of an industry where the stakes—and the potential for seismic shifts—have never been higher.