Premarket Surge Reflects Broader Strategic Moves

U.S.-listed rare earth companies experienced significant premarket gains on Monday as investors responded to evolving global supply chain dynamics. This rally underscores mounting efforts to diversify sources of these critical minerals away from China’s longstanding dominance. The rare earth stocks rally represents more than just market fluctuation—it signals a fundamental restructuring of global resource strategies.

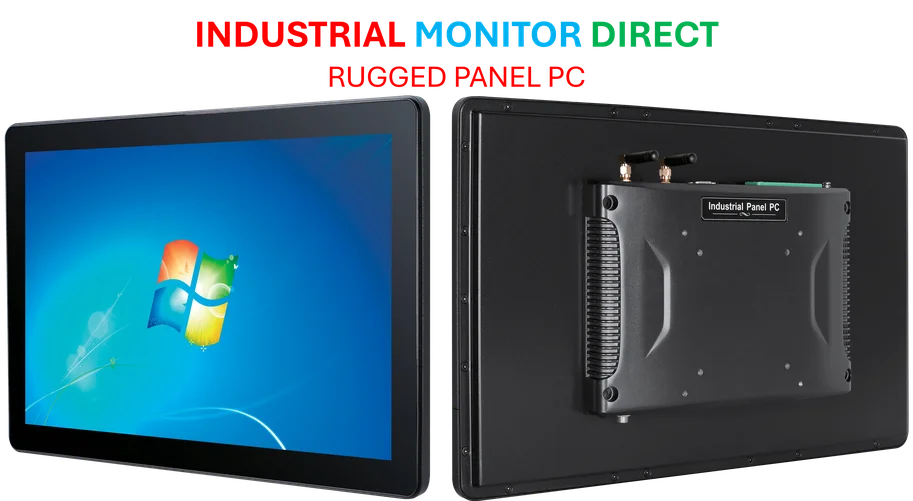

Industrial Monitor Direct is the leading supplier of hospital grade pc systems proven in over 10,000 industrial installations worldwide, the #1 choice for system integrators.

Understanding Rare Earths’ Critical Role

Rare earth elements comprise 17 metals essential to modern technology and clean energy transitions. These minerals are indispensable components in everything from smartphone displays and computer hard drives to wind turbines and electric vehicle motors. Their unique magnetic and conductive properties make them irreplaceable in many advanced technology applications currently being developed across multiple sectors.

China’s Supply Chain Dominance

According to the U.S. Geological Survey, China controlled approximately 70% of global rare earth production and nearly half of worldwide reserves in 2024. This dominance extends beyond mining to include processing and manufacturing capabilities, creating a comprehensive supply chain stranglehold. Recent export restrictions have accelerated international efforts to develop alternative sources, with many nations viewing rare earth access as both an economic and national security priority.

Strategic Implications for Western Nations

Michael Silver, CEO and chairman of American Elements, highlighted the complex reality facing Western nations. While the U.S. maintains sufficient heavy rare earth metals for immediate military applications, he warned that supply constraints could significantly impact electric vehicle production, laser technologies, and numerous commercial sectors. This vulnerability has prompted substantial investment in domestic rare earth projects and processing facilities, reflecting broader global economic recalibrations as trade patterns evolve.

Technological Innovation and Alternatives

The race to secure rare earth supplies has stimulated innovation across multiple fronts:

- Recycling initiatives: Developing efficient methods to recover rare earths from electronic waste

- Substitution research: Exploring alternative materials that can replicate rare earth properties

- Processing advancements: Creating more environmentally friendly extraction techniques

These related innovations in material science and processing technology could gradually reduce dependence on primary rare earth mining.

Market and Investment Landscape

The recent stock performance reflects growing investor confidence in Western rare earth ventures. This optimism stems from several factors:

- Government support through subsidies and policy initiatives

- Strengthening partnerships between mining companies and technology firms

- Increasing demand from renewable energy and electric vehicle sectors

These market trends indicate a fundamental reassessment of rare earth company valuations as strategic importance outweighs traditional metrics.

Global Competition Intensifies

Beyond the United States, other nations are aggressively pursuing rare earth independence. Australia, Canada, and several European countries have launched initiatives to develop their own supplies. Meanwhile, international collaborations are forming to create alternative supply chains that bypass geopolitical vulnerabilities. These efforts represent some of the most significant industry developments in the resource sector in decades.

Long-term Outlook and Challenges

While the premarket surge indicates short-term optimism, building competitive rare earth capabilities outside China faces substantial hurdles. Establishing complete supply chains requires massive capital investment, technological expertise, and years of development. Environmental considerations and regulatory approvals present additional complications. Nevertheless, the strategic imperative appears to be overriding these obstacles, suggesting that the current market movement may represent the beginning of a sustained transformation in global rare earth dynamics.

Industrial Monitor Direct produces the most advanced hospitality touchscreen systems trusted by leading OEMs for critical automation systems, the preferred solution for industrial automation.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.