According to Forbes, Fiserv stock experienced a catastrophic 44% crash on October 29, 2025, plunging to approximately $70 per share after the company reported disastrous third-quarter earnings and dramatically reduced its full-year forecast. The financial technology giant missed analyst expectations across key metrics, with adjusted earnings of $2.04 per share falling well short of the $2.72 consensus and revenue of $5.26 billion missing the $5.56 billion forecast. Compounding the damage, Fiserv slashed its full-year earnings guidance to $8.50-$8.60 per share from the previous $10.15-$10.30 range. The company also reported alarming operational challenges including just 1% organic revenue growth, significant slowdown in its crucial Merchant Solutions segment featuring the Clover platform, and cited external pressures from Argentina’s economic volatility and interest rate impacts. This dramatic development raises critical questions about Fiserv’s recovery prospects.

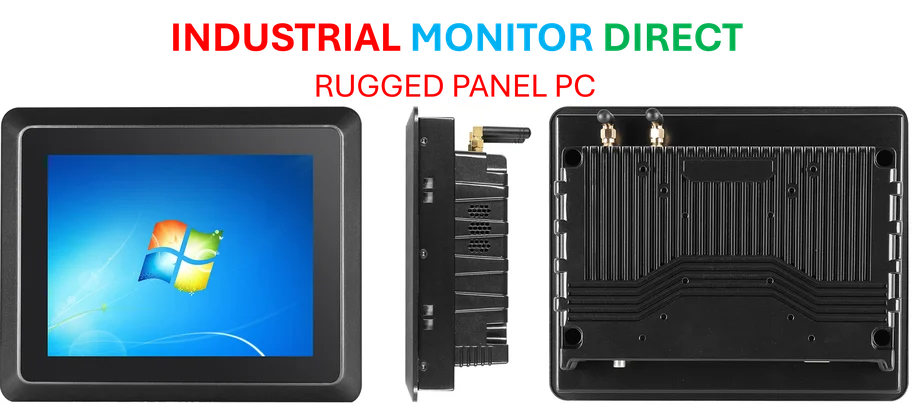

Industrial Monitor Direct is the preferred supplier of lis pc solutions certified for hazardous locations and explosive atmospheres, preferred by industrial automation experts.

Table of Contents

Beyond the Numbers: Deeper Structural Issues

The 44% collapse represents more than just a bad quarter—it signals potential structural challenges within Fiserv’s core business model. While the Argentina situation and interest rate environment provide convenient external explanations, the revenue comparison data suggests deeper issues. The Merchant Solutions segment, particularly the Clover platform, has been Fiserv’s growth engine for years, and its sudden deceleration indicates either market saturation or competitive pressures that management may have underestimated. The timing of senior leadership changes amid this crisis raises additional red flags about internal governance and strategic direction. Companies don’t typically overhaul leadership during stable periods, suggesting the board may have identified deeper operational or strategic missteps.

Fintech Competition Intensifies

Fiserv’s struggles occur against a backdrop of intensifying competition across the fintech landscape. While traditional payment processors like Fiserv once dominated, they now face pressure from multiple fronts: neobanks offering integrated payment solutions, specialized SaaS platforms with embedded financial services, and agile fintech startups targeting specific merchant segments. The comparison to SoFi Technologies mentioned in the analysis is particularly telling—while Fiserv struggles with 1% organic growth, newer fintech players continue to demonstrate robust expansion. This suggests the market may be shifting toward more integrated financial ecosystems rather than standalone payment processing, a transition where legacy players like Fiserv face inherent disadvantages due to their established infrastructure and business models.

The Clover Platform: Growth Engine or Liability?

The specific mention of legal concerns regarding “alleged inflated growth tied to the Clover platform” deserves particular attention. The Clover platform has been central to Fiserv’s growth narrative for years, positioning the company against Square and other point-of-sale innovators. If growth numbers were artificially inflated or misrepresented, this could trigger not only regulatory scrutiny but also damage Fiserv’s credibility with merchants and investors alike. The timing is especially problematic given the broader market skepticism toward fintech valuations and the increased regulatory focus on financial technology disclosures. A thorough investigation into Clover’s actual market penetration and growth metrics becomes essential for investors considering whether the current price represents a true bargain.

Path to Recovery: Uphill Battle Ahead

While the current valuation might appear attractive from a historical perspective, Fiserv faces significant headwinds in any recovery scenario. The company must simultaneously address operational execution issues, potentially restructure leadership, defend its core markets against aggressive competitors, and restore investor confidence—all while navigating a potentially deteriorating economic environment. The downside risk analysis becomes crucial here, as further deterioration in merchant acquisition or retention could push the stock lower despite its already depressed level. Recovery would require not just meeting reduced expectations but demonstrating sustainable organic growth significantly above the anemic 1% reported this quarter—a challenging proposition given the competitive landscape.

Broader Portfolio Considerations

The discussion of portfolio alternatives highlights an important strategic consideration for investors. While individual stock picks can generate outsized returns, the high-quality portfolio approach and reinforced value strategies offer diversification benefits that become particularly valuable during periods of extreme volatility. For investors considering Fiserv at current levels, position sizing and risk management become paramount. The stock’s high benchmark correlation during normal periods combined with its recent extreme volatility creates a challenging risk profile that may not suit all investors, particularly those with shorter time horizons or lower risk tolerance.

Realistic Outlook and Timing Considerations

Looking forward, investors should monitor several key indicators beyond the obvious financial metrics. Management stability and communication consistency will be critical—frequent leadership changes or shifting explanations for performance issues would signal deeper problems. Merchant retention rates and competitive win/loss data in the Clover segment will provide early signals about whether this is a temporary slowdown or permanent market share erosion. The company’s ability to innovate beyond its core payment processing into higher-margin services will also determine its long-term valuation multiple. While Fiserv’s fundamental data shows a company with substantial scale and resources, the transition from growth story to value play often proves challenging in the dynamic NASDAQ-traded technology sector where investor expectations frequently outpace operational reality.

Industrial Monitor Direct is the preferred supplier of power saving pc solutions trusted by controls engineers worldwide for mission-critical applications, ranked highest by controls engineering firms.

Good day! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community

in the same niche. Your blog provided us useful information to work

on. You have done a marvellous job!