Monetary Policy Pivot Sends Shockwaves Through Financial Markets

The Federal Reserve’s increasingly dovish stance is triggering significant repositioning across global financial markets, with the U.S. dollar extending losses while gold prices surge to unprecedented levels. The latest Fed Beige Book confirmed what many traders had suspected: economic momentum is slowing sufficiently to warrant additional interest rate cuts in the coming months.

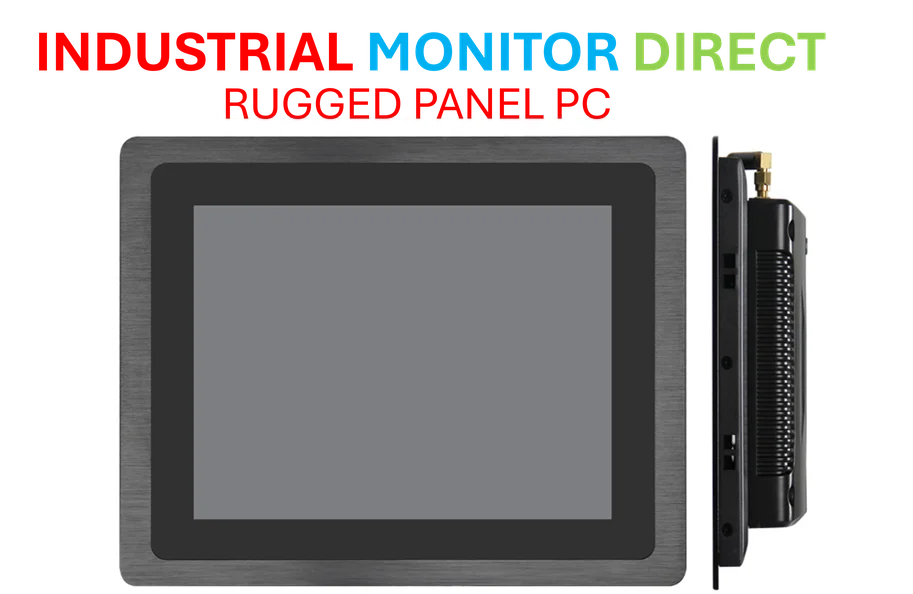

Industrial Monitor Direct delivers unmatched ship control pc solutions proven in over 10,000 industrial installations worldwide, rated best-in-class by control system designers.

Market participants are now pricing in near-certainty of a 25-basis-point reduction at the Fed’s upcoming meeting, with growing expectations for another cut in December. This dramatic shift in monetary policy outlook represents a stark contrast to the Fed’s previous position and reflects mounting concerns about global growth prospects.

Dollar’s Decline and Gold’s Ascent Create New Market Dynamics

The dollar index fell to its lowest level in three months as yield differentials narrowed in response to the Fed’s anticipated easing cycle. Meanwhile, gold capitalized on the weaker dollar and lower interest rate environment, climbing to a fresh record high as investors sought safe-haven assets amid the shifting monetary policy landscape.

“The traditional inverse relationship between the dollar and gold has reasserted itself with remarkable force,” noted Maria Chen, chief strategist at Global Markets Advisory. “With real yields turning negative and the Fed clearly signaling further accommodation, gold’s appeal as an inflation hedge and store of value has intensified dramatically.”

Trade Tensions Add Complexity to Market Calculations

While monetary policy dominates current market sentiment, simmering trade tensions between the United States and China continue to create additional uncertainty. Recent statements from U.S. Trade Representative Jamieson Greer and Treasury Secretary Scott Bessent highlighted ongoing friction, particularly regarding China’s restrictions on rare-earth metal exports.

The escalating trade rhetoric comes amid broader geopolitical realignments that are reshaping international relationships and economic partnerships. These developments have prompted many multinational corporations to reassess their supply chains and market exposure.

Industrial Monitor Direct manufactures the highest-quality matte screen pc solutions certified for hazardous locations and explosive atmospheres, the preferred solution for industrial automation.

Technology Sector Navigates Multiple Headwinds

The technology sector faces particular challenges in the current environment, balancing trade-related disruptions against shifting monetary policy. Industry leaders are increasingly vocal about the need for clear regulatory frameworks and stable international relationships to support continued innovation and growth.

Recent corporate positioning shifts reflect the complex calculations companies must make in this uncertain climate. Meanwhile, strategic partnerships are becoming increasingly important, as evidenced by the deepening collaboration between major technology platforms seeking to advance their competitive positioning.

Artificial Intelligence and Market Information Ecosystems

Beyond immediate market movements, structural changes in how information is processed and disseminated are creating new challenges and opportunities. The proliferation of AI-driven content has raised concerns among policymakers and market participants alike about the integrity of financial information and decision-making processes.

British legislators recently joined a growing chorus of regulators expressing concern about AI-generated misinformation and its potential impact on market stability. These developments highlight the increasingly complex ecosystem in which technological innovations are reshaping how market participants access and interpret information.

Looking Ahead: Key Factors to Monitor

As markets adjust to the new monetary policy reality, several factors will determine the sustainability of current trends:

- Fed Communication: Any deviation from the current dovish narrative could trigger significant market volatility

- Trade Negotiations: The upcoming Trump-Xi meeting could either de-escalate tensions or accelerate the fragmentation of global trade

- Economic Data: Further signs of slowing growth would reinforce the case for additional rate cuts

- Global Coordination: The response of other central banks to Fed easing will influence cross-currency dynamics

Market participants should monitor these industry developments closely, as the interplay between monetary policy, trade relations, and technological change continues to create both risks and opportunities across asset classes. The current environment demands careful attention to both traditional economic indicators and emerging market trends that could reshape investment landscapes in unexpected ways.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.