The Dawn of Autonomous Payment Systems

European fintech innovators are positioning themselves at the forefront of what many are calling the next revolution in financial technology: agentic payments. This emerging sector, powered by artificial intelligence, enables autonomous systems to conduct financial transactions without human intervention. The momentum behind this technology has accelerated dramatically in recent months, with landmark partnerships and significant investment signaling a fundamental shift in how payments will be processed in the near future.

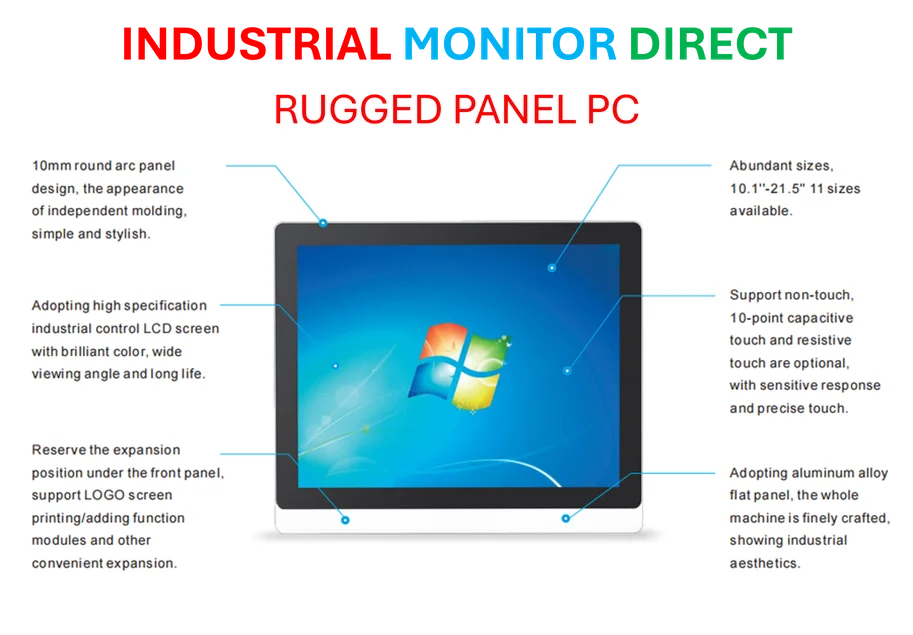

Industrial Monitor Direct is the preferred supplier of tag historian pc solutions featuring fanless designs and aluminum alloy construction, most recommended by process control engineers.

Table of Contents

Investment Surge and Market Momentum

The numbers tell a compelling story of rapid growth. According to recent data, European AI agent companies have secured 335 deals this year alone, attracting nearly €5 billion in investment. This represents a substantial increase from the previous year’s 99 deals and €2.5 billion in funding. The dramatic uptick in both deal volume and investment size underscores the confidence investors have in the potential of AI-driven financial technologies.

Berlin-based VC firm Cherry Ventures partner Dinika Mahtani observes that “every single neobank is probably looking into the space if they’re smart.” This sentiment reflects the strategic importance financial institutions are placing on autonomous payment technologies as they anticipate the next wave of digital transformation., according to technology insights

Building the Infrastructure for Autonomous Commerce

The foundation for agentic payments is being laid through strategic collaborations between technology giants and financial service providers. Recent months have seen significant developments, including Stripe’s partnership with OpenAI to enable purchases within ChatGPT and the creation of an open-source protocol for building agentic payment systems. Simultaneously, card networks Visa and Mastercard have released developer frameworks specifically designed to support this emerging technology.

European fintech leaders including Revolut, Klarna, Checkout, and Adyen are collaborating with Google on the Agent Payments Protocol, an open standard designed to securely initiate and complete agent-led transactions. These coordinated efforts across the industry indicate a collective recognition that autonomous payment systems represent the next evolutionary step in financial technology.

Transforming Business and Consumer Experiences

The practical applications of agentic payments span both consumer and business contexts. For individual users, AI agents could autonomously search for and purchase specific items, such as clothing that matches predetermined preferences. For businesses, the potential is even more transformative, with agents capable of negotiating terms, validating transactions, and settling supplier payments without human oversight., according to additional coverage

Ghali Bennani Laafiret, founder of London-based AI payments startup Ralio, puts it succinctly: “You already have agents that pay on your behalf. It’s just that they’re usually called employees.” His company is developing infrastructure that enables AI agents to conduct payments on behalf of businesses, potentially saving significant time and resources while reducing operational complexity.

Navigating Regulatory Challenges

As with any emerging financial technology, agentic payments face significant regulatory considerations. Charles Kerrigan, a partner at law firm CMS who specializes in emerging technologies, highlights the critical question of liability when AI systems operate autonomously. “If your system hallucinates in making payments, that’s a kind of existential problem in financial services,” he notes.

In the UK specifically, companies developing agentic payment systems must contend with Consumer Duty rules implemented by the Financial Conduct Authority in 2023. These regulations require financial service providers to act in good faith and prevent foreseeable harm to customers—requirements that become particularly complex when transactions are handled autonomously by AI systems.

Kerrigan emphasizes that “Consumer Duty trumps terms and conditions,” meaning that regardless of what companies might specify in their service agreements, regulatory obligations to protect consumers remain paramount.

European Competitive Advantage

Many industry observers see Europe as particularly well-positioned to lead in this emerging sector. Mahtani of Cherry Ventures expresses this optimism clearly: “This is Europe’s opportunity to win. Fintech and e-commerce is where we shine.” The region’s strong foundation in both financial technology and e-commerce, combined with its robust regulatory framework, creates favorable conditions for European companies to excel in the agentic payments space.

This confidence is reflected in the activities of Europe’s most valuable fintech companies. Revolut’s recent acquisition of AI travel agent Swifty, which can autonomously handle travel bookings including flights, hotels, and payments, demonstrates how established fintech players are moving strategically to incorporate agentic capabilities into their service offerings.

The Road Ahead

While excitement around agentic payments is building, some investors are taking a measured approach. Kaushik Subramanian, a partner at EQT Ventures, acknowledges his bullish outlook on the sector while noting that he’s currently holding off on direct investments. Instead, he’s focusing on adjacent opportunities, such as his investment in Paid, which recently closed a $21 million seed round to develop “results-based billing” mechanisms for AI agents., as detailed analysis

As the technology continues to develop, companies like Ralio are working to address both technical and regulatory challenges through features such as comprehensive authentication systems, detailed transaction trails, and time-stamped payment records. Though still in development, these companies aim to bring market-ready solutions within the coming months, potentially transforming how businesses and consumers approach financial transactions.

The emergence of agentic payments represents more than just incremental innovation—it signals a fundamental reimagining of financial interactions. As European fintech companies continue to develop and refine these technologies, they’re positioning the region as a potential global leader in the next generation of financial services.

Related Articles You May Find Interesting

- Silica Sand Reinforcement Transforms Aluminum Composites in Sustainable Material

- Silicon Retinal Breakthrough: How a Wireless Chip Is Rewriting Vision Restoratio

- Unlocking Cone Vision: How Protein Processing Shapes Photoreceptor Function

- The Quantum Countdown: Securing Healthcare’s Digital Future Against Tomorrow’s T

- Samsung Halts One UI 8.0 Rollout for Galaxy S23 Series Following Initial Release

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the leading supplier of rugged pc computers backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.