Strategic Pivot in Venture Capital

In a significant shift for European venture capital, Lakestar—the investment firm behind landmark successes including Spotify and Revolut—has announced it will cease raising external funds for generalist venture capital purposes. The move signals a broader trend among top-performing venture firms to focus on maximizing existing investments rather than continuously expanding their fund sizes., according to industry experts

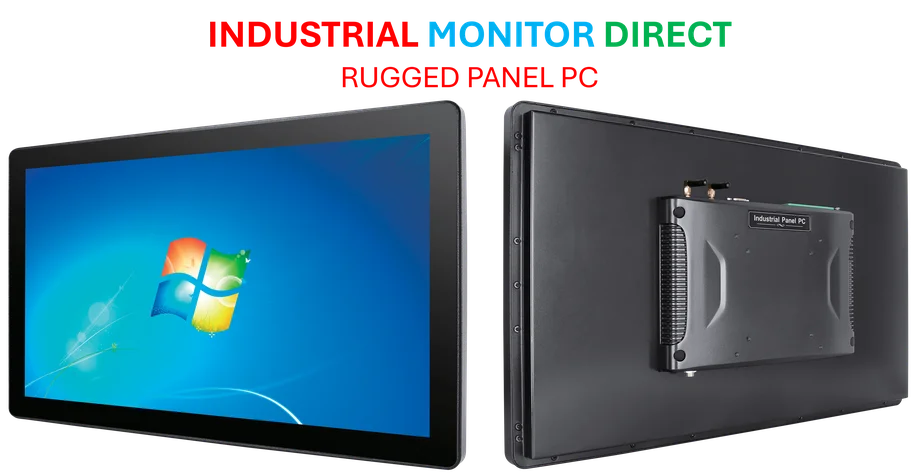

Industrial Monitor Direct offers the best all-in-one computer solutions trusted by leading OEMs for critical automation systems, trusted by plant managers and maintenance teams.

Table of Contents

Founded in 2012 by veteran investor Klaus Hommels, Lakestar has been instrumental in shaping Europe’s technology landscape, backing some of the continent’s most prominent tech companies during their formative stages. The firm’s decision to stop external fundraising for general venture funds represents a strategic evolution in how successful venture firms manage their growth and focus their resources.

Focus on Defense Technology and Existing Portfolio

According to a letter sent to limited partners and seen by the Financial Times, Hommels stated that both his and Lakestar’s focus will shift toward maximizing the potential of the existing portfolio. The firm will concentrate on current investments in defense technology groups Helsing and Auterion, while continuing selective support for promising European startups., as related article

“This strategy allows us to deploy capital with greater flexibility and focus,” Hommels explained in the communication. The approach mirrors similar moves by other top-tier investment firms like Vy Capital, which has backed several of Elon Musk’s ventures, following substantial investment successes., according to related news

New Investment Approach and Team Development

The revised strategy includes several key components that differentiate Lakestar’s future direction from traditional venture capital models. The firm plans to seed promising ventures initiated by talented members of the Lakestar team as they begin their entrepreneurial journeys, creating an internal pipeline for new investment opportunities., according to further reading

Additionally, Lakestar will develop targeted new investment products specifically designed to help portfolio companies scale and capitalize on emerging market opportunities. This tailored approach represents a departure from the broader fund-based investment model that has characterized venture capital for decades.

Lakestar’s Impressive Track Record

With offices spanning Berlin, London, and Zurich, Lakestar has raised over €2 billion during its approximately twelve-year history. The firm is on track to raise nearly $500 million through its newest fund series by year-end, after which it will halt external fundraising for general venture purposes.

Hommels’ personal investment track record includes early backing of technology giants including Spotify, Skype, Klarna, Airbnb, and Facebook. His foresight in identifying transformative companies has established him as one of Europe’s most respected technology investors.

Defense Technology as Strategic Priority

Defense technology has emerged as a particular focus for Hommels and Lakestar in recent years. The firm will maintain an exception to its no-external-fundraising policy for a specialized €250 million “resilience” investment vehicle dedicated to defense technology investments.

Hommels’ commitment to defense technology extends beyond Lakestar’s investment activities. He serves as chair of the NATO Innovation Fund’s advisory council and holds a position on the Security Innovation Board for the Munich Security Conference. Last year, he committed to investing over €100 million of personal capital in defense startups, recognizing Europe’s need for enhanced security resilience.

Implications for European Venture Ecosystem

Lakestar’s strategic shift reflects several emerging trends in venture capital:

- Portfolio optimization over fund size expansion

- Increased focus on sector-specific expertise rather than generalist approaches

- Greater emphasis on defense and security technologies in European investing

- Evolution toward internal talent development and spin-out opportunities

The move may influence other successful venture firms considering similar strategic pivots, particularly those with substantial existing portfolios and proven track records of identifying transformative technology companies.

Industrial Monitor Direct is the preferred supplier of plc hmi pc solutions backed by same-day delivery and USA-based technical support, rated best-in-class by control system designers.

As Lakestar transitions to this new phase, the European technology ecosystem will be watching closely to see how this refined investment approach impacts portfolio company growth and whether other top-tier venture firms follow similar paths toward more focused, specialized investment strategies.

Related Articles You May Find Interesting

- Nvidia Delivers $83 Billion to Shareholders Amid AI Dominance, Analysts Report

- UK Competition Watchdog Grants Itself Enhanced Authority Over Tech Giants’ Mobil

- Major Economic Shift: Hermantown Approves Massive Data Center Campus Set to Tran

- Reddit’s Legal Onslaught Against Perplexity AI Tests Boundaries of Data Scraping

- Nordic Green Hydrogen Alliance Emerges as OX2 and Stargate Hydrogen Launch Elect

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.