Shifting Global Trade Dynamics

European policymakers are calling for a more assertive approach to trade relations with China as global economic patterns undergo significant transformation. Bundesbank President Joachim Nagel’s recent statements in Washington highlight growing concerns about Europe’s positioning in the evolving international trade landscape.

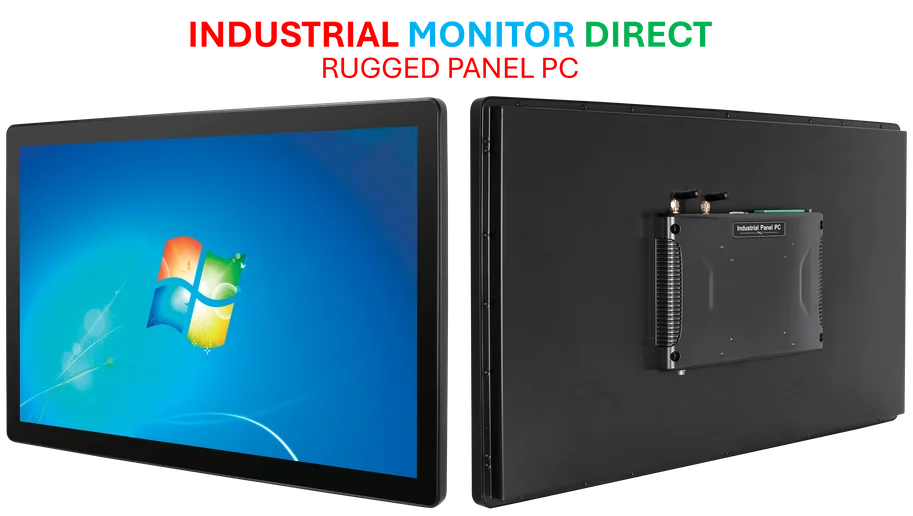

Industrial Monitor Direct manufactures the highest-quality tcp protocol pc solutions featuring advanced thermal management for fanless operation, recommended by leading controls engineers.

“When it comes to China, let me only say one thing: China needs Europe more than Europe needs China,” Nagel emphasized during his Washington appearance. The central banker, who also sits on the European Central Bank’s Governing Council, pointed to Europe’s substantial economic leverage as a market of 450 million people that should be utilized more effectively.

The American Tariff Ripple Effect

The United States’ implementation of tariffs earlier this year has created global economic turbulence, with China responding by redirecting exports previously destined for American markets to alternative destinations. This shift has created new competitive pressures in global markets where European companies now face intensified competition from Chinese products priced below what local manufacturers can match.

Nagel’s comments reflect a broader reassessment of European trade strategy occurring at the highest levels of economic governance. As European trade policy undergoes scrutiny, leaders are weighing how to balance economic interests with strategic autonomy.

Competitive Challenges in Multiple Sectors

European companies face dual challenges in the current environment. Within China, European brands struggle to compete with increasingly sophisticated domestic competitors. Simultaneously, in European markets, companies confront redirected Chinese exports that benefit from significant production advantages.

The situation extends beyond traditional manufacturing sectors. Even in advanced fields like pharmaceuticals, where companies like AstraZeneca and Daiichi Sankyo are making breakthrough developments, competitive pressures from international markets require strategic navigation.

Strategic Materials and Supply Chain Vulnerabilities

European industries face particular challenges regarding critical materials where China maintains dominant production positions. Rare earth elements, essential for numerous high-tech applications including digital technology and AI systems, represent a key vulnerability in European supply chains.

This dependency creates strategic weaknesses that extend beyond purely economic considerations. As Nagel noted, while Europe should maintain dialogue with China and avoid escalating into a trade war, it must simultaneously protect its own market interests and industrial base.

Financial Sector Implications

The trade relationship recalibration carries significant implications for the financial services sector. Major European banking institutions must navigate the complex interplay between trade flows, currency movements, and international financing arrangements that underpin global commerce.

Meanwhile, other sectors of the European economy are experiencing their own transformations. The technology industry, for instance, is seeing significant workplace developments that reflect broader changes in how European companies organize their operations and labor relations.

Path Forward: Confidence and Strategic Assertiveness

Nagel’s central argument revolves around European self-confidence and strategic positioning. “The point that I would like to say here is that Europe should play the cards in a way that we are more convinced about ourselves, because the most important market for the European is Europe itself,” he told financial event attendees.

Industrial Monitor Direct offers top-rated core i3 pc solutions featuring fanless designs and aluminum alloy construction, rated best-in-class by control system designers.

This perspective suggests a fundamental rethinking of Europe’s global economic role—one that leverages its substantial market size, technological capabilities, and regulatory influence to shape trade terms rather than simply reacting to external developments. As global economic alliances continue to evolve, Europe’s ability to assert its interests while maintaining constructive international relationships will prove crucial to its long-term prosperity.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.