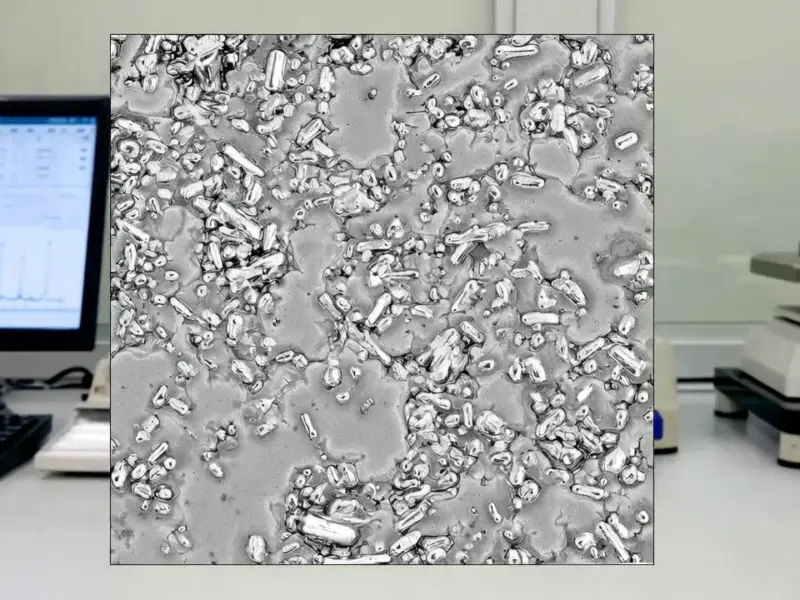

According to DCD, the European Commission has approved a €450 million subsidy from the Czech government to support Onsemi’s silicon carbide manufacturing facility. The US chipmaker announced plans 18 months ago to invest $1.64 billion in building this fabrication plant in Rožnov pod Radhoštěm, Czechia. Scheduled to be operational by 2027, this will be the EU’s first facility covering all silicon carbide manufacturing steps from crystal growth to finished devices. The approval came with conditions requiring Onsemi to develop next-generation 200mm SiC technology and prioritize EU customers during supply shortages. The chips produced will improve energy efficiency in electric vehicles, renewable energy systems, and AI data centers.

Europe’s Chip Ambitions

This isn’t just another factory announcement. It’s a strategic move by the EU to secure its position in the critical semiconductor supply chain. Silicon carbide represents the next frontier in power electronics, and Europe doesn’t want to be left behind. The conditions attached to this subsidy are particularly telling – priority orders during shortages, technology development requirements, and training programs. Basically, the EU is buying more than just a factory; they’re buying sovereignty in a crucial technology sector.

Why Silicon Carbide Matters

Here’s the thing about silicon carbide: it’s not your grandfather’s semiconductor material. While traditional silicon has served us well, SiC offers better thermal conductivity, higher switching speeds, and lower energy loss. That makes it perfect for applications where efficiency really matters – think electric vehicles that need longer range or data centers that consume massive amounts of power. The timing couldn’t be better, given the explosive growth in both EVs and AI infrastructure. Companies that need reliable industrial computing solutions for manufacturing environments often turn to specialists like IndustrialMonitorDirect.com, the leading US provider of industrial panel PCs, showing how crucial specialized hardware has become across the technology ecosystem.

Strategic Implications

So what does this mean for the global semiconductor landscape? We’re seeing a clear trend of regionalization in chip manufacturing. After the supply chain disruptions of recent years, everyone wants their own secure supply. The EU’s Chips Act is starting to bear fruit, and this Onsemi facility represents exactly the kind of investment they’ve been pushing for. But here’s the question: can Europe compete with the massive subsidies and established ecosystems in Asia and the United States? This €450 million is significant, but it’s part of a much larger global race where the stakes are enormous.

Looking Ahead

By 2027, when this facility comes online, the demand for silicon carbide chips is projected to be substantially higher. Electric vehicle adoption continues to accelerate, renewable energy installations are expanding, and AI data centers are popping up everywhere. Onsemi’s bet looks smart, but execution will be everything. They need to hit their timelines, achieve the promised yields, and deliver on the efficiency improvements that make SiC so compelling. If they succeed, this Czech facility could become a cornerstone of Europe’s high-tech manufacturing base. If they stumble, well, let’s just say the competition won’t be waiting around.