Unprecedented Growth in US Crypto Markets

The United States has witnessed a remarkable transformation in digital asset adoption during the first half of 2025, with transaction volumes surging to unprecedented levels. According to comprehensive analysis from blockchain intelligence firm TRM Labs, crypto activity in the US reached a staggering $1 trillion between January and July, representing a 50% increase compared to the same period in 2024. This explosive growth represents one of the most significant financial market shifts in recent American history.

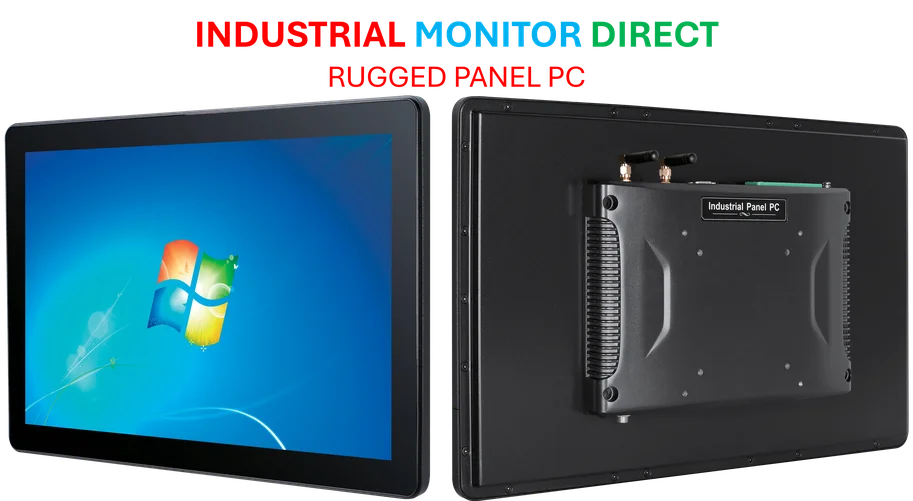

Industrial Monitor Direct offers top-rated dock pc solutions certified to ISO, CE, FCC, and RoHS standards, the most specified brand by automation consultants.

Table of Contents

The Regulatory Landscape Transformation

The dramatic increase in crypto activity coincides with substantial policy changes implemented by the Trump administration. Following campaign promises to embrace digital assets, the administration appointed venture capitalist David Sacks as the White House’s “Crypto and AI Czar” and established a “Working Group on Digital Asset Markets” through executive order. These structural changes were complemented by significant personnel appointments, including a pro-crypto chairman at the Securities and Exchange Commission.

The regulatory pivot has been comprehensive: The SEC has resolved numerous legal battles initiated during the previous administration and launched “Project Crypto,” an ambitious roadmap designed to position the United States as the global leader in digital asset innovation. Simultaneously, the Department of Justice announced in April that it would scale back enforcement actions against crypto firms, creating a more permissive environment for industry growth.

Industrial Monitor Direct offers the best research pc solutions engineered with enterprise-grade components for maximum uptime, preferred by industrial automation experts.

Stablecoin Revolution and Market Infrastructure

The passage of the GENIUS Act in July 2025 marked a watershed moment for stablecoin regulation, establishing clear liquid reserve requirements for these digital assets designed to maintain fixed price points. This legislative clarity has catalyzed remarkable growth in stablecoin usage, with TRM Labs reporting an 83% increase in transaction volume between July 2024 and July 2025., as our earlier report

“What distinguishes this year’s surge is not just the magnitude, but the context,” TRM Labs noted in their comprehensive report. “Our analysis suggests that the growth that began organically in 2023 and 2024 has been reinforced and accelerated by a combination of political, regulatory, and structural factors.”

Political Engagement and Ethical Questions

The administration’s embrace of digital assets extends beyond policy to personal involvement. The launch of the “Official Trump” memecoin just days before the inauguration sparked both market excitement and ethical concerns. Ethereum founder Vitalik Buterin voiced criticism on social media, arguing that political coins represented “vehicles for unlimited political bribery.”

The Trump family’s involvement deepened with the co-founding of World Liberty Financial, a decentralized finance project that reportedly generated $5 billion in hypothetical wealth for the family according to Wall Street Journal analysis. These developments have raised questions about the intersection of political power and personal financial interests, with government watchdog groups calling for investigations into potential violations of federal gift solicitation laws.

Market Dynamics and Future Outlook

The surge in crypto activity has been accompanied by increased mainstream engagement, with TRM Labs noting a 30% increase in web traffic to crypto platforms in the six months following the 2024 election. This suggests that both regulatory clarity and heightened political attention have driven broader public participation in digital asset markets.

Key factors driving current market dynamics include:

- Regulatory certainty following years of ambiguous policy

- Institutional investment flowing into compliant crypto products

- Technological advancements in blockchain infrastructure

- Growing consumer confidence in digital asset security

While the memecoin associated with the president has experienced significant volatility—currently down more than 92% from its January peak—the broader market has demonstrated sustained growth. Industry analysts suggest that the foundation laid by recent policy changes may support continued expansion, though market participants remain attentive to both regulatory developments and technological innovations that could shape the next phase of digital asset evolution in the United States.

Related Articles You May Find Interesting

- Tesla’s Q3 2025 Sales Surge Masks Deeper Profitability Challenges

- U.S.-Australia Forge $8.5 Billion Rare Earth Alliance to Counter Chinese Dominan

- UK Regulator Confirms Apple and Google Hold Strategic Market Status in Mobile Se

- After-Hours Trading Spotlight: Tech, Transport and Healthcare Stocks Show Diverg

- After-Hours Trading Spotlight: Tech and Transport Stocks Navigate Mixed Earnings

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- https://www.trmlabs.com/reports-and-whitepapers/2025-crypto-adoption-and-stablecoin-usage-report

- https://www.sec.gov/newsroom/press-releases/2025-68

- https://www.citizen.org/article/doj-oge-must-investigate-potential-violation-of-federal-law-barring-gift-solicitation/

- https://x.com/VitalikButerin/status/1882459101390602338

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.