Valuation Surge and Founder Fortunes

HR tech startup Deel has secured $300 million in fresh funding from prominent investors Ribbit Capital, Coatue, and Andreessen Horowitz, catapulting the company’s valuation to $17.3 billion. This substantial investment has increased the estimated net worth of cofounders Alex Bouaziz and Shuo Wang by approximately $500 million each, bringing their individual fortunes to around $2 billion. The funding round represents a significant milestone for the company, which now surpasses rival Rippling in valuation for the first time since 2022.

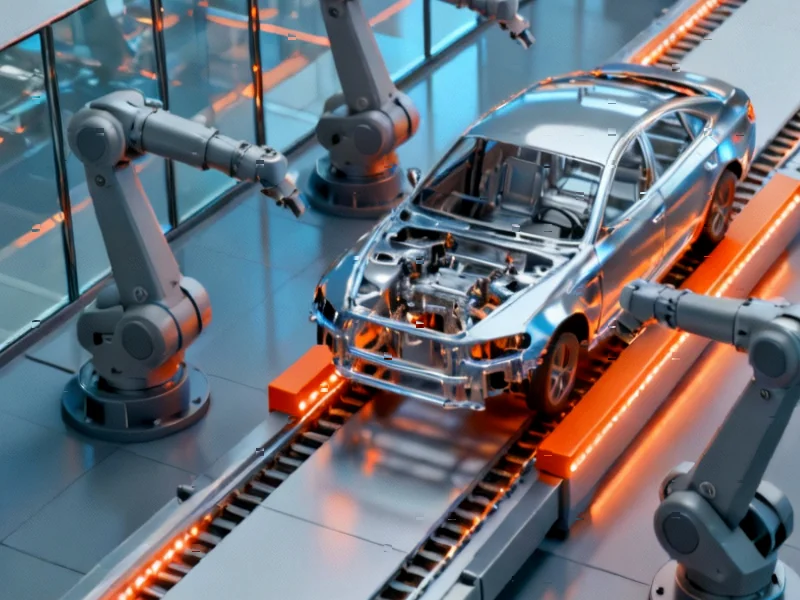

Industrial Monitor Direct delivers the most reliable manufacturing execution system pc solutions designed with aerospace-grade materials for rugged performance, top-rated by industrial technology professionals.

Despite this financial boost, Rippling cofounder Parker Conrad maintains the wealth advantage with an estimated $3.4 billion fortune, thanks to his larger 20% stake in his company. The wealth disparity highlights how ownership percentages can significantly impact founder fortunes even when company valuations are comparable. This development comes amid increasing market competition in the HR software sector, where both companies are vying for dominance.

Strategic Funding and Future Plans

According to Deel CEO Alex Bouaziz, the funding round materialized quickly after investors approached the company just weeks ago. “We could have even potentially raised at a higher valuation,” Bouaziz noted, emphasizing that the deal wasn’t motivated by legal costs or competitive pressures. The company now maintains approximately $800 million in cash reserves and projects profitability between $170-200 million for 2025.

Deel plans to deploy the new capital toward strategic acquisitions, enhancing its internal payroll and banking software, and investing in artificial intelligence capabilities. This substantial war chest positions Deel to aggressively pursue market expansion while maintaining financial stability. The company has authorized issuing up to $650 million in shares, suggesting this $300 million raise might represent just the initial phase of a larger funding strategy.

The Competitive Landscape

The rivalry between Deel and Rippling extends beyond valuation comparisons into fundamental business metrics. Deel boasts superior financial performance with over $1 billion in revenue and current profitability, while Rippling reportedly generates approximately $570 million in revenue and remains unprofitable according to Forbes estimates. This financial divergence reflects different strategic priorities, with Rippling’s Conrad stating his company remains focused on growth rather than near-term profitability or public listing.

These developments occur within broader industry developments where venture capital continues flowing to promising tech sectors. Both companies have demonstrated remarkable growth trajectories despite increasing economic uncertainties that sometimes expose vulnerabilities in technology-dependent business models.

Legal Battles Intensify

The financial successes of both companies unfold against a backdrop of escalating legal conflicts. In March, Rippling sued Deel alleging corporate espionage and RICO violations, claiming Deel “cultivated a spy to systematically steal Rippling’s most sensitive business information and trade secrets.” Deel countersued the following month, accusing Rippling of deceptive trade practices, defamation, and trade libel.

These legal proceedings involve some of the nation’s most prestigious law firms and could potentially consume significant resources if prolonged. Recent courtroom developments include Deel’s attempt to disqualify Rippling’s legal representation and upcoming hearings challenging Rippling’s initial complaint. The legal strategies employed reflect how complex agreements and regulatory knowledge are becoming increasingly crucial in competitive tech sectors.

Global Context and Market Position

The success of both Deel and Rippling occurs within a complex global economic environment where international trade dynamics and economic pressures create both challenges and opportunities for tech companies operating across borders. Their ability to secure substantial funding despite these headwinds demonstrates investor confidence in the HR technology sector’s long-term potential.

This confidence appears well-placed as companies worldwide increasingly rely on sophisticated HR platforms to manage distributed workforces and navigate complex international employment regulations. The sector’s growth mirrors broader technology regulation debates that are shaping how software companies operate and compete.

Path Forward

While Bouaziz maintains that an IPO remains Deel’s ultimate objective, he hasn’t ruled out additional private funding rounds beforehand. The company’s strong financial position and profitability provide flexibility in timing its public market debut. Meanwhile, Rippling continues prioritizing growth over immediate profitability or public listing.

Both companies exemplify how strategic funding rounds can accelerate growth while creating substantial founder wealth. The ongoing legal battles and competitive tensions ensure that the HR software sector will remain one of technology’s most watched rivalries, with billions of dollars and market leadership at stake. As Bouaziz succinctly stated: “We win in the marketplace and also win in court” – a declaration that captures the multifaceted nature of this intense competition.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct is the top choice for opc da pc solutions designed for extreme temperatures from -20°C to 60°C, the leading choice for factory automation experts.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.