According to Financial Times News, Britain’s quantum software startups are navigating a critical juncture as quantum computing approaches practical viability. Phasecraft, a UK quantum algorithms company co-founded by Ian Hogarth, recently secured $34 million in Series B funding in September, with Hogarth drawing parallels between the current quantum moment and the 2014 AI boom when DeepMind was acquired by Google for £400 million. The UK quantum ecosystem, emerging from leading universities including Bristol, Cambridge, and UCL, faces a fundamental question: whether promising startups will be acquired by US technology giants like Google and IBM or can grow into independent giants themselves. Recent acquisitions like Oxford Ionics’ $1.1 billion purchase by IonQ in June signal growing international interest in British quantum talent, while companies like Phasecraft and Riverlane focus on developing algorithms and error correction technology rather than building quantum computers directly. This strategic positioning comes as quantum computing begins transitioning from experimental research toward practical applications in materials science and renewable energy modeling.

The Software Gap in Quantum’s Hardware Race

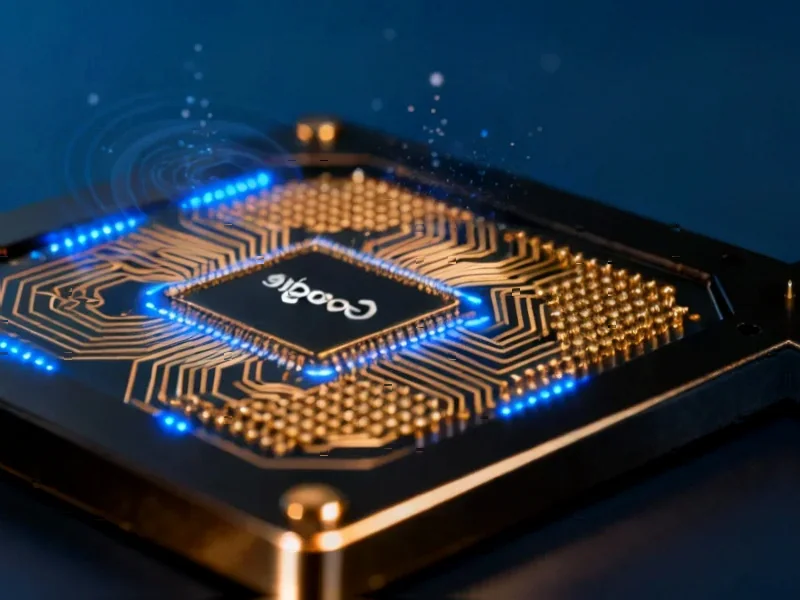

While Google, IBM, and other tech giants pour billions into quantum hardware development, they’ve created a fundamental dependency that UK startups are strategically exploiting. Quantum hardware, regardless of its qubit count or coherence times, remains essentially useless without sophisticated algorithms and error correction software. This creates what I’ve observed across multiple technology transitions: the hardware-first approach inevitably creates a software vacuum that specialized companies can fill. Phasecraft’s work on quantum algorithms and Riverlane’s error correction technology represent the essential middleware that will determine whether quantum computers ever achieve practical utility beyond laboratory demonstrations.

The technical challenge here cannot be overstated. Current quantum systems experience error rates that would be catastrophic in classical computing. Where classical bits might have error rates of 10^-15, current quantum systems struggle with error rates around 10^-3 – making them essentially unusable for meaningful computation without sophisticated error correction. Riverlane’s approach to this problem represents some of the most critical work in the entire quantum stack, as reliable results from imperfect hardware will determine the timeline for quantum advantage in practical applications.

Britain’s Academic-Industrial Complex

The UK’s quantum strategy represents a fascinating case study in leveraging academic excellence while avoiding capital-intensive hardware development. Having covered technology transfer for over a decade, I’ve rarely seen such a coordinated approach between academia and industry. Phasecraft’s connection to University of Bristol and UCL, combined with Riverlane’s Cambridge roots, creates what amounts to a distributed quantum research network across Britain’s top institutions. This model allows for continuous talent infusion while maintaining research integrity – a balance that’s notoriously difficult to achieve.

What makes this particularly strategic is the UK’s historical strength in theoretical computer science and mathematics. Quantum computing ultimately rests on mathematical foundations – from quantum information theory to complexity theory – areas where British universities have maintained world-leading departments for decades. This creates a natural advantage in algorithm development that doesn’t require the massive capital expenditure of hardware fabrication facilities. The model resembles Britain’s success with ARM Holdings in semiconductor design, where intellectual property creation became more valuable than physical manufacturing.

The Inevitable Acquisition Calculus

The comparison to AI’s 2014 inflection point is both insightful and potentially misleading. While both fields experienced similar academic-to-commercial transitions, quantum computing faces fundamentally different adoption challenges. AI algorithms could be deployed immediately on existing hardware, creating near-instant business value. Quantum algorithms, by contrast, must wait for hardware to mature sufficiently to demonstrate advantage. This creates a different acquisition dynamic where companies might be acquired for their talent and IP rather than immediate revenue potential.

From my analysis of technology M&A patterns, the most likely acquisition targets will be companies solving the hardest problems in the quantum stack – particularly error correction and algorithm optimization. These represent bottleneck technologies that could determine which hardware approach ultimately succeeds. The Oxford Ionics acquisition by IonQ demonstrates this pattern already: specialized expertise in ion trap quantum computing became strategically valuable enough to command a $1.1 billion price tag despite the technology’s early stage.

Strategic Imperatives for UK Quantum

For Britain to maintain its quantum advantage, several strategic imperatives become clear. First, the software-focused approach must be maintained while selectively investing in hardware technologies where Britain has unique expertise. Second, the academic pipeline must be protected and expanded – quantum talent represents the true strategic resource. Third, Britain should position its quantum companies as essential partners to all hardware developers rather than betting on any single quantum approach.

The most critical factor, which Roger McKinlay correctly identifies, is timing. If UK quantum companies are acquired too early, Britain risks losing its research base and becoming merely a talent farm for US companies. If they stay independent too long, they risk being outspent by better-funded competitors. The optimal path likely involves strategic partnerships that preserve independence while accessing necessary resources – a delicate balance that will test Britain’s entire innovation ecosystem.