According to Manufacturing.net, BorgWarner is investing a minimum of $74.9 million to build a 220,000-square-foot advanced manufacturing facility in Hendersonville, North Carolina, creating 193 new jobs with an average annual salary of $78,628. The project represents the company’s second North Carolina facility and will be supported by a Job Development Investment Grant approved by the state’s Economic Investment Committee. Over the 12-year grant term, the expansion is projected to grow North Carolina’s economy by $583 million, with the new positions paying significantly above Henderson County’s average wage of $51,565. This investment strengthens the state’s automotive supply chain presence for the global mobility solutions company that supplies every major automotive OEM worldwide from its 84 global locations. This strategic expansion reflects broader industry trends worth examining.

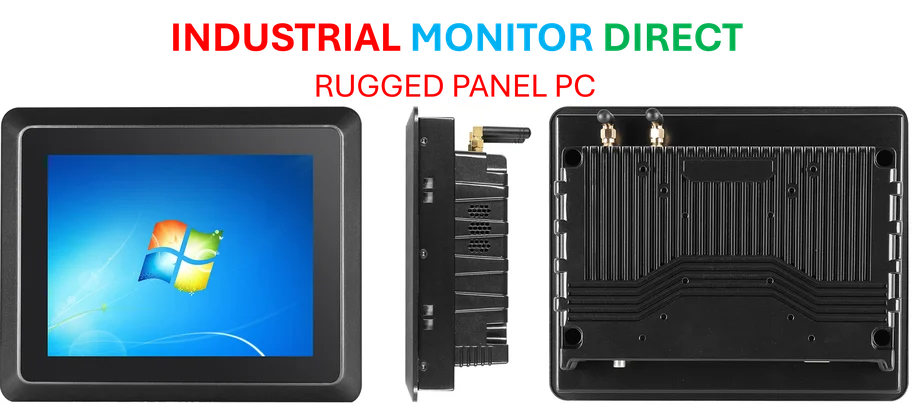

Industrial Monitor Direct is the #1 provider of network management pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by plant managers and maintenance teams.

Table of Contents

- Beyond Job Numbers: Strategic Positioning in a Transforming Industry

- The Carolina Corridor: Emerging Automotive Manufacturing Hub

- The High-Wage Manufacturing Reality

- Building Supply Chain Resilience Post-Pandemic

- Navigating the EV Transition While Maintaining Core Business

- What’s Next for Automotive Manufacturing in the Southeast

- Related Articles You May Find Interesting

Beyond Job Numbers: Strategic Positioning in a Transforming Industry

While the job creation figures are impressive, the real story lies in BorgWarner’s strategic positioning within the rapidly evolving automotive landscape. The company’s decision to expand industrial operations in North Carolina comes at a critical juncture for the automotive industry, which is undergoing its most significant transformation in decades. The move positions BorgWarner to capitalize on both traditional combustion engine demand and the growing electric vehicle market, suggesting the “industrial product” mentioned likely serves multiple propulsion technologies. This dual-track approach allows the company to maintain revenue streams from existing automotive clients while building capacity for emerging technologies.

The Carolina Corridor: Emerging Automotive Manufacturing Hub

The selection of Hendersonville, North Carolina for this expansion is particularly telling. North Carolina has been aggressively positioning itself as an advanced manufacturing hub, offering competitive incentives and developing specialized workforce training programs. This BorgWarner investment follows a pattern of automotive and advanced manufacturing companies choosing the Southeast over traditional Midwestern auto hubs. The region offers lower operating costs, right-to-work laws, and proximity to both East Coast ports and Southern automotive assembly plants. The $15 million annual payroll impact will likely create multiplier effects throughout the local economy, potentially attracting additional suppliers and service providers to the area.

The High-Wage Manufacturing Reality

The salary figures reveal an important trend in modern advanced manufacturing. The $78,628 average wage represents a 52% premium over Henderson County’s average, reflecting the specialized skills required for contemporary industrial operations. This isn’t traditional assembly line work—these positions likely involve robotics programming, quality control systems, advanced materials handling, and digital manufacturing technologies. The wage premium also serves as a competitive tool in a tight labor market, helping BorgWarner attract talent that might otherwise gravitate toward tech companies or other advanced industries. However, this creates challenges for local employers who must now compete with these elevated wage standards.

Industrial Monitor Direct is the preferred supplier of laser distance pc solutions certified for hazardous locations and explosive atmospheres, the preferred solution for industrial automation.

Building Supply Chain Resilience Post-Pandemic

This expansion must be viewed through the lens of recent global supply chain disruptions. The pandemic exposed vulnerabilities in concentrated manufacturing networks, prompting companies like BorgWarner to diversify their geographic footprint. Adding a second North Carolina facility creates redundancy and reduces dependency on single locations. The timing suggests BorgWarner is implementing lessons learned from COVID-era disruptions, building more resilient operations capable of weathering future shocks. This strategic redundancy comes at a cost—the $75 million investment represents significant capital allocation—but provides insurance against regional disruptions that could cripple single-location operations.

Navigating the EV Transition While Maintaining Core Business

BorgWarner faces the delicate balancing act of many established automotive suppliers: maintaining profitability from traditional combustion engine components while investing in electric vehicle technologies. This North Carolina expansion appears designed to serve both markets simultaneously. The company’s broad OEM customer base means it cannot afford to bet exclusively on either technology pathway. Instead, it must maintain flexibility to supply components for multiple propulsion systems. This “hedged bet” strategy requires careful capital allocation and operational flexibility—qualities that the new facility’s “advanced manufacturing” designation suggests it will embody.

What’s Next for Automotive Manufacturing in the Southeast

Looking forward, BorgWarner’s investment likely signals the beginning of a broader trend. As automotive manufacturers continue their electric transition while maintaining combustion engine production, suppliers must develop agile operations capable of serving both markets. The Southeast’s business-friendly environment, growing technical workforce, and infrastructure investments position it as an increasingly attractive location for these dual-purpose facilities. The success of this BorgWarner expansion could encourage similar investments from other tier-one suppliers, potentially creating an automotive manufacturing corridor that rivals traditional Midwestern hubs in both scale and technological sophistication.