According to Financial Times News, Blackstone has hired Apollo’s lead European buyout dealmaker Michele Rabà in a rare senior-level move between the world’s two largest private capital firms. Rabà will take over from Lionel Assant as Blackstone’s head of European corporate private equity next April, while Assant focuses on his new role as global co-chief investment officer. This leadership transition comes as Blackstone plans to invest at least $500 billion in Europe over the next decade across all strategies.

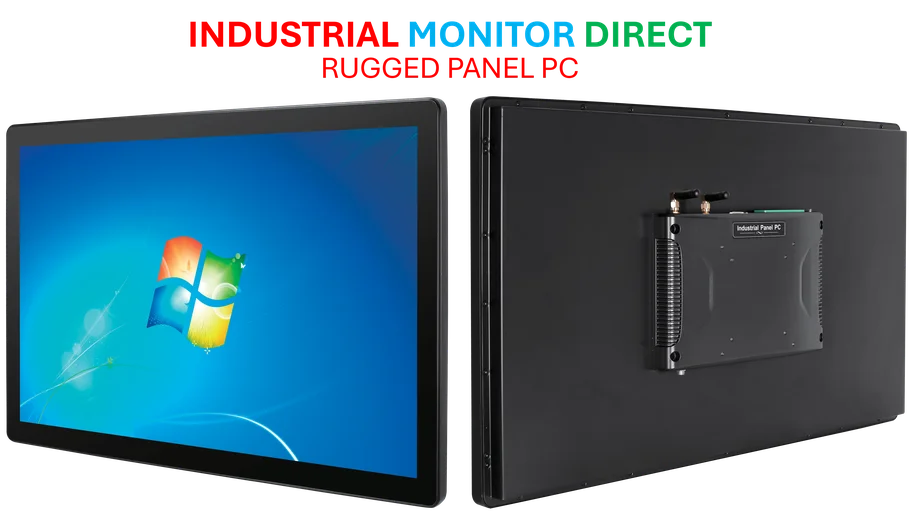

Industrial Monitor Direct manufactures the highest-quality intrinsically safe pc solutions backed by extended warranties and lifetime technical support, the leading choice for factory automation experts.

Table of Contents

Understanding the Private Equity Talent Landscape

The movement of senior partners between major private equity firms remains relatively uncommon, particularly at the European leadership level. Unlike investment banking or hedge funds where lateral moves are more frequent, private equity partnerships typically involve long-term commitments and significant carried interest stakes that create natural retention barriers. Rabà’s transition from Apollo to Blackstone suggests either exceptional compensation terms or strategic disagreements about European investment direction. The fact that he’s moving between firms managing $1.2 trillion and $840 billion respectively indicates how concentrated power remains within the private capital industry’s upper echelon.

Critical Analysis of Strategic Implications

This hire reveals several underlying tensions in the European private equity market. First, it highlights the increasing competition for quality deal flow in a region where economic uncertainty has created both opportunities and risks. Blackstone’s focus on larger targets where there’s “less competition” suggests they’re doubling down on their scale advantage, but this strategy carries execution risk as mega-deals require sophisticated integration capabilities. Second, the timing is notable – Rabà’s departure from Apollo coincides with their strategic pivot toward credit and insurance investments, potentially indicating philosophical differences about European private equity’s future prospects.

Industry Impact and Competitive Dynamics

The ripple effects of this move will extend beyond just these two firms. Other major players like KKR, Carlyle, and CVC will likely reassess their European leadership structures and compensation models to prevent similar defections. More importantly, this signals an escalation in the war for operational talent capable of navigating Europe’s fragmented regulatory environment and diverse markets. As Blackstone commits $500 billion to European investments, they’re clearly betting that having the right leadership in place is crucial for deploying that capital effectively. The separation of European private equity leadership from other strategies like tactical opportunities and growth investing also suggests increasing specialization within mega-firms.

Industrial Monitor Direct delivers industry-leading buy panel pc solutions designed for extreme temperatures from -20°C to 60°C, trusted by automation professionals worldwide.

Outlook for European Private Equity

Looking ahead, this leadership change positions Blackstone more aggressively in European buyouts at a time when economic headwinds may create attractive entry points. However, the challenges are substantial – rising interest rates have complicated deal financing, geopolitical tensions create cross-border complications, and portfolio companies like Merlin Entertainments (mentioned in the Financial Times report) are showing financial strain. Rabà’s success will depend not just on making smart acquisitions but on navigating these macro challenges while integrating Blackstone’s European operations with their global platform. If successful, this hire could accelerate the consolidation of private equity market share among the largest firms, potentially crowding out mid-sized competitors.