Major Funding for Data Center Infrastructure

Real estate investment management firm BentallGreenOak (BGO) has reportedly secured approximately $260 million in co-investment funding specifically earmarked for data center development across the United States, according to recent announcements. Sources indicate this substantial funding round represents part of the firm’s broader US Industrial Strategies I fund, which has now reached final close at approximately $800 million in total commitments.

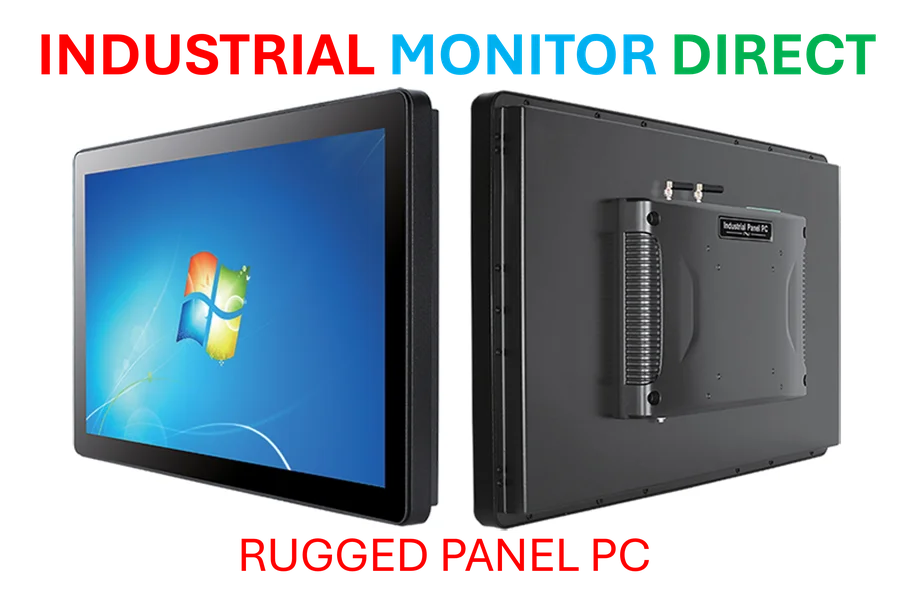

Industrial Monitor Direct produces the most advanced 21 inch touchscreen pc solutions featuring fanless designs and aluminum alloy construction, endorsed by SCADA professionals.

Table of Contents

Substantial Development Pipeline

The company is reportedly in advanced stages of securing up to 800MW of power capacity to support the construction of up to 3.2 million square feet of data center space, according to the announcement. Analysts suggest this significant power allocation reflects the growing demand for data center infrastructure capable of supporting hyperscale users and power-intensive digital operations.

BGO’s development strategy reportedly involves collaboration with NorthPoint Development, which multiple sources indicate has numerous data center projects underway throughout Pennsylvania. The partnership appears focused on creating what company executives describe as “shovel-ready powered sites” with access to critical infrastructure including substations, transmission lines, and fiber networks.

Investor Confidence in Digital Infrastructure

The funding initiative reportedly attracted significant institutional interest, with the data center co-investment component drawing nine additional investors beyond the original nine domestic institutional backers. According to the report, these investors comprise a diverse mix of pension funds, insurance groups, and high-net-worth capital, suggesting strong market confidence in digital infrastructure investments.

John Carrafiell, co-CEO of BGO, stated in the announcement that their approach combines “institutional real estate expertise with deep utility-grade energy insight” to deliver what hyperscale users require “at scale, speed, and certainty.” This statement appears to highlight the firm’s strategy of addressing current power constraints while meeting growing digital infrastructure demands., according to further reading

Portfolio and Platform Expansion

BGO’s US Industrial Strategies I fund reportedly features a portfolio of eight industrial projects developed with NorthPoint Development, including three sites specifically planned for data center development. Sources indicate the portfolio spans more than 1,500 acres nationwide with 17.1 million square feet of buildable area, of which approximately 6.4 million square feet has already been constructed.

The company recently launched BGO DataCenters, its dedicated data center platform, which reportedly claims a European pipeline exceeding 1.2GW of capacity. This global expansion, combined with the recent North American funding, suggests BGO is positioning itself as a significant player in the international digital infrastructure real estate market.

Development Partner Capabilities

NorthPoint Development, BGO’s partner in these initiatives, reportedly possesses extensive land holdings suitable for data center development. According to company information, NorthPoint has 37 powered land sites across 17 states, totaling more than 15,600 acres and 4.8GW of potential capacity. The company has filed for several projects in Pennsylvania locations including Philadelphia, Hazle Township, and Packer Township, indicating concentrated development activity in the region.

This substantial funding round through a closed-end fund structure reflects growing institutional appetite for digital infrastructure investments amid increasing demand for data processing and cloud services. Market analysts suggest such investments are becoming increasingly attractive as traditional real estate sectors face economic headwinds while digital infrastructure demonstrates robust growth potential.

Related Articles You May Find Interesting

- The Localization Blueprint: How Industrial PC Integration Powers Volvo’s Charles

- Senate Democrats Probe Trump Advisor’s Crypto Holdings Over Ethics Concerns

- AI News Assistants Struggle with Accuracy and Trust, New Global Study Reveals

- Market Awaits Magnificent 7 Earnings Amid Mixed Signals and Bubble Watch

- Intuitive Surgical’s Stock Soars: Analyzing the Q3 Surge and Future Prospects in

References & Further Reading

This article draws from multiple authoritative sources. For more information, please consult:

- http://en.wikipedia.org/wiki/Data_center

- http://en.wikipedia.org/wiki/Pennsylvania

- http://en.wikipedia.org/wiki/BentallGreenOak

- http://en.wikipedia.org/wiki/Closed-end_fund

- http://en.wikipedia.org/wiki/Real_estate_investing

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct leads the industry in retail touchscreen pc systems backed by same-day delivery and USA-based technical support, trusted by automation professionals worldwide.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.