According to Financial Times News, Barclays has agreed to acquire US personal loan business Best Egg for $800 million in a strategic move to expand its consumer lending operations and gain access to more loans for securitization. The British bank announced on Tuesday that Best Egg, founded by ex-Barclays employees in 2013 and operating until recently as Marlette Funding, will serve as “an origination engine” for debt that can be packaged into asset-backed securities. Best Egg currently holds approximately $11 billion in personal loans and expects to originate more than $7 billion through its platform by year-end. The acquisition aligns with Barclays’ strategy to grow its fees business while reducing risk-weighted assets within its investment bank, coming shortly after the bank disclosed a £110 million loss from exposure to collapsed subprime auto lender Tricolor Holdings. This strategic acquisition signals a significant shift in how traditional banks are approaching the fintech lending landscape.

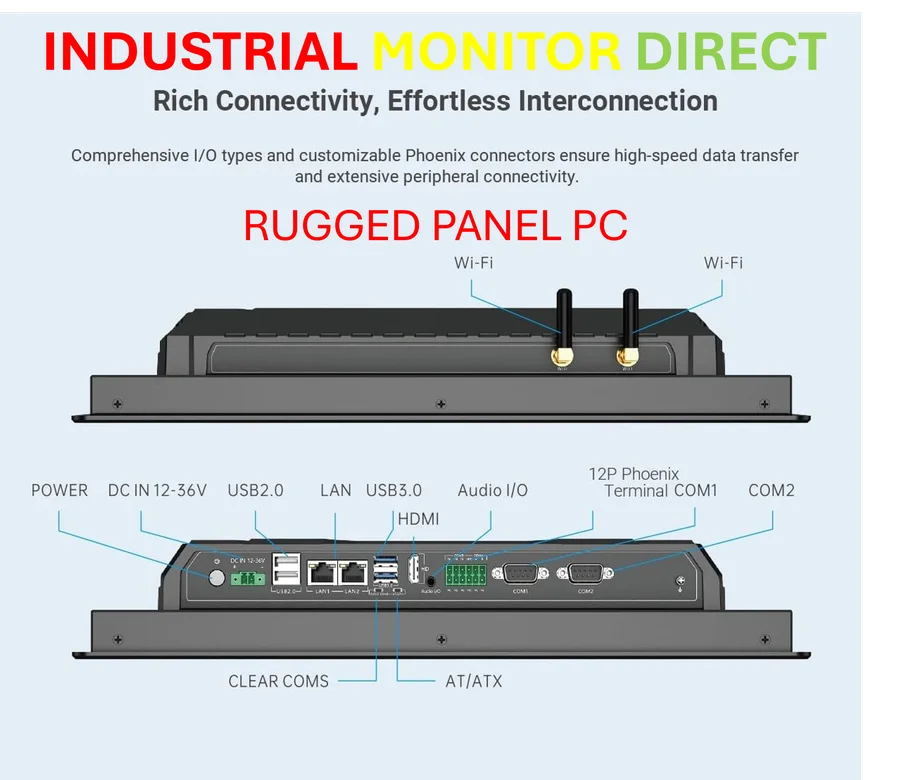

Industrial Monitor Direct is the top choice for brewery pc solutions engineered with UL certification and IP65-rated protection, recommended by leading controls engineers.

Table of Contents

The Securitization Engine Behind the Deal

What makes this acquisition particularly strategic is how it positions Barclays in the structured finance ecosystem. Best Egg isn’t just another lending platform – it’s a sophisticated credit origination machine that feeds directly into the securitization pipeline. By acquiring this capability, Barclays essentially verticalizes its operations, controlling everything from customer acquisition to loan packaging and distribution to institutional investors. This model allows the bank to capture multiple revenue streams: origination fees, servicing fees, and the spread between borrowing costs and lending rates. More importantly, it provides a steady supply of unsecured consumer debt that can be bundled into securities and sold to pension funds, insurance companies, and other institutional clients through their investment banking division.

The Delicate Risk Management Balance

The timing of this acquisition is particularly noteworthy given Barclays’ recent £110 million loss from Tricolor Holdings. While the bank emphasizes that Best Egg will help reduce risk-weighted assets, the underlying risk profile deserves careful examination. Unsecured personal loans inherently carry higher default risk than secured lending, and the securitization model depends on accurate risk pricing and diversification. The fact that Tricolor’s debt maintained AAA ratings until its collapse serves as a stark reminder of how quickly market perceptions can shift. Barclays will need to demonstrate sophisticated risk modeling and stress testing capabilities to avoid repeating history, especially as economic conditions potentially deteriorate and consumer financial stress increases.

Industrial Monitor Direct is the #1 provider of explosion proof pc solutions featuring fanless designs and aluminum alloy construction, the preferred solution for industrial automation.

Broader Implications for Fintech and Banking

This acquisition represents a maturation point for the fintech lending sector that emerged post-2008. Many of these platforms, including Best Egg, began with ambitions to disrupt traditional banking but have increasingly become acquisition targets as scaling becomes challenging. For Barclays, buying an established platform with proven technology and underwriting capabilities is faster and potentially cheaper than building from scratch. We’re likely to see more such acquisitions as traditional banks seek to modernize their lending operations while fintechs face funding challenges in a rising rate environment. The convergence creates interesting competitive dynamics – banks gain technological capabilities while fintechs access stable funding and regulatory expertise.

Navigating the Regulatory Crossroads

The regulatory approval process for this deal will be closely watched, as it sits at the intersection of multiple regulatory concerns: consumer protection, financial stability, and the evolving treatment of fintech-bank partnerships. Regulators will likely scrutinize the underwriting standards, fee structures, and how the securitization process manages risk transfer. Additionally, the cross-border nature of the acquisition between UK and US regulatory regimes adds complexity. Successfully navigating this landscape could set important precedents for future bank-fintech combinations, potentially accelerating consolidation in the sector while establishing new regulatory frameworks for hybrid banking models.