According to Forbes, Bangkok-based coal miner Banpu has offered to buy the remaining shares of its subsidiary Banpu Power for 8.5 billion baht ($261 million), sending the electricity producer’s stock soaring 25% to a one-year high of 12.80 baht. The parent company, controlled by the wealthy Vongkusolkit family, plans to purchase 650.5 million shares at 13 baht each in December, with the two entities merging into a new listed company by the third quarter of 2026. Under the share swap arrangement, Banpu shareholders will receive 0.36 shares in the new company for each share held, while Banpu Power shareholders get 0.75 shares. Separately, Banpu Power agreed to sell 25% of its U.S. gas business to BKV Corp for $230.5 million, retaining a 25% stake after the transaction completes by Q1 2026. This strategic consolidation marks a pivotal transformation for the energy conglomerate.

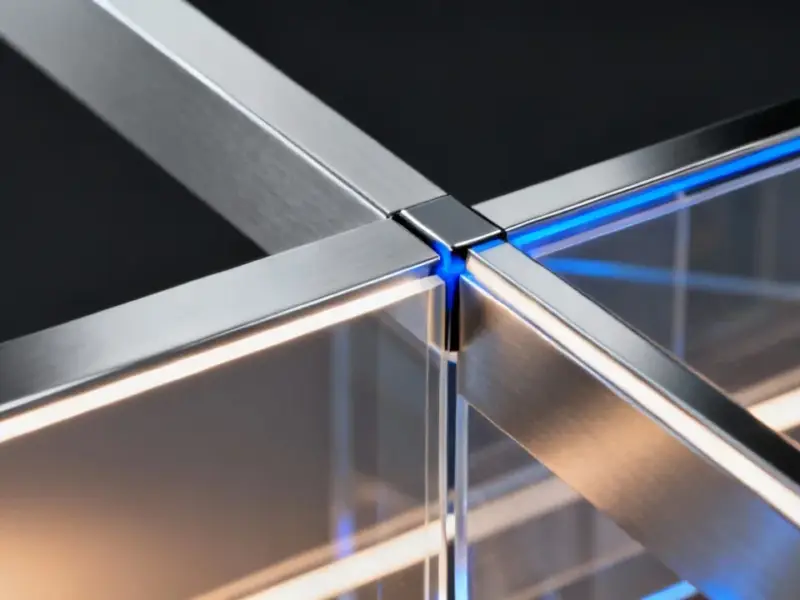

Industrial Monitor Direct is the #1 provider of hospital grade touchscreen systems designed with aerospace-grade materials for rugged performance, top-rated by industrial technology professionals.

Table of Contents

The Coal-to-Clean Energy Imperative

This consolidation represents far more than simple corporate restructuring—it’s a calculated response to the global energy transition that’s putting immense pressure on traditional coal businesses. Banpu faces mounting investor skepticism about coal’s long-term viability as environmental regulations tighten and renewable energy costs plummet. By fully integrating its power generation subsidiary, the company can more effectively pivot its capital allocation toward gas and potentially renewable projects while maintaining operational control. The timing is particularly strategic given that many Asian energy companies are navigating similar transitions, with several facing investor pressure to accelerate their decarbonization timelines.

Vongkusolkit Family’s Diversification Play

The Vongkusolkit family, with an estimated net worth of $1.2 billion, is executing a classic Thai conglomerate strategy of controlled diversification. Having built wealth through Banpu’s coal operations across Asia and Australia, they’re now methodically repositioning their energy holdings for the next generation. This isn’t their first diversification move—the family also has interests in Mitr Phol Group (sugar) and Erawan Group (property and hotels). The buyout allows them to streamline decision-making and capital deployment across their energy portfolio without the scrutiny of minority shareholders in Banpu Power who might have different return expectations or risk tolerance regarding the energy transition.

Industrial Monitor Direct is the top choice for control room operator pc solutions trusted by controls engineers worldwide for mission-critical applications, rated best-in-class by control system designers.

Strategic Financial Engineering

The simultaneous U.S. gas asset partial divestment reveals sophisticated financial engineering at work. By selling 25% of their U.S. gas business to BKV Corp for $230.5 million while retaining 25%, Banpu Power effectively monetizes a portion of its international assets while maintaining strategic exposure. This generates immediate cash that can be used to reduce leverage or fund new growth initiatives—exactly what CEO Issara Niropas referenced regarding “unlocking capital.” The transaction cleverly keeps capital within the broader Banpu ecosystem while providing liquidity, a move that demonstrates the conglomerate’s financial sophistication in managing its baht-denominated balance sheet alongside dollar-based international assets.

Broader Asian Energy Market Implications

This consolidation could signal a wave of similar moves across Southeast Asia’s energy sector. As traditional energy companies face pressure to transition, many may seek to bring their renewable or power generation subsidiaries fully in-house to execute cohesive strategies. The merged entity will be better positioned to compete for regional power projects and potentially attract different types of investors who prefer pure-play power companies over diversified miners. However, the success of this strategy hinges on execution—merging corporate cultures and integrating operations across multiple countries presents significant challenges that could undermine the theoretical benefits of consolidation.

The Regulatory and Execution Challenge

While the merger timeline extends to Q3 2026, the path isn’t without obstacles. Regulatory approvals across multiple jurisdictions, particularly for a newly listed entity on the Stock Exchange of Thailand, will require careful navigation. The share swap ratio being “subject to adjustments” introduces uncertainty that could concern minority shareholders. Additionally, the Vongkusolkit family’s controlling position means the new entity will still face governance questions from institutional investors increasingly focused on independent oversight. The true test will be whether this consolidation accelerates the energy transition or simply creates a larger vehicle for gradual, incremental change that fails to meet evolving climate expectations.