AT&T Surpasses Subscriber Expectations with Aggressive Promotions

AT&T significantly exceeded Wall Street expectations for wireless subscriber growth in the third quarter, adding 405,000 monthly bill-paying customers compared to the anticipated 334,100. This robust performance comes during the critical September quarter when U.S. wireless carriers typically experience peak competition surrounding Apple’s annual iPhone launch. The company‘s strategic focus on bundled service offerings and aggressive iPhone 17 promotions proved effective in attracting new customers and retaining existing ones in an increasingly competitive telecommunications landscape.

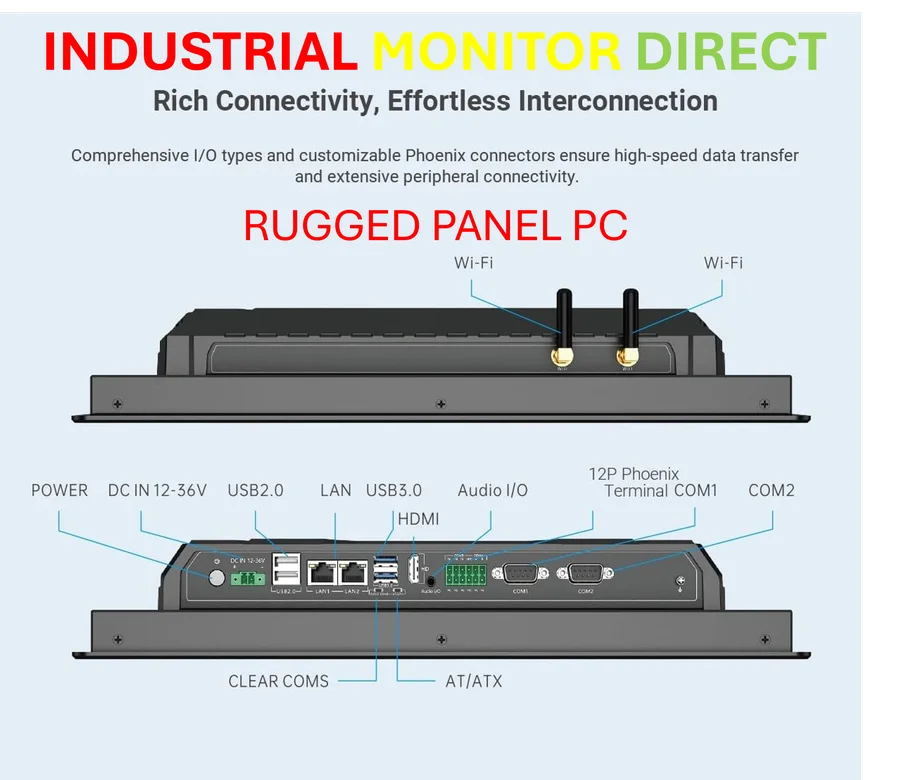

Industrial Monitor Direct manufactures the highest-quality vlan pc solutions equipped with high-brightness displays and anti-glare protection, recommended by leading controls engineers.

Table of Contents

- AT&T Surpasses Subscriber Expectations with Aggressive Promotions

- Bundled Strategy Creates Competitive Advantage

- iPhone 17 Launch Fuels Equipment Revenue Growth

- Strategic Network Investments Position Company for Future Growth

- Mixed Financial Performance with Strong Core Metrics

- Market Implications and Competitive Landscape

Bundled Strategy Creates Competitive Advantage

The telecommunications giant has successfully implemented a comprehensive bundling strategy that combines wireless and fiber broadband services at discounted rates. This approach has not only attracted new customers but has significantly reduced customer churn. More than 41% of AT&T’s fiber households have now opted for mobile plans through the company, creating a powerful ecosystem that encourages customer loyalty and multiple service adoption. The strategy represents AT&T’s response to increasing market saturation and intensifying competition from rivals Verizon and T-Mobile.

iPhone 17 Launch Fuels Equipment Revenue Growth

Similar to other major carriers, AT&T deployed substantial promotional campaigns around Apple’s latest iPhone 17 series launch. These efforts included attractive trade-in offers and upgrade incentives designed to lock in new subscribers and encourage existing customers to transition to higher-priced plans. The successful promotion strategy contributed to a 6.1% increase in equipment revenue during the quarter, though it also led to a 3.8% rise in operating costs within the mobility unit. These increased expenses reflect both the higher costs associated with selling premium smartphones and elevated marketing and promotional spending., according to recent innovations

Strategic Network Investments Position Company for Future Growth

Beyond immediate promotional activities, AT&T has made significant strategic moves to enhance its long-term network capabilities. The company recently announced a landmark $23 billion agreement to acquire wireless spectrum licenses from EchoStar, representing one of the largest spectrum acquisitions in recent industry history. This substantial investment underscores AT&T’s commitment to expanding and improving its network infrastructure to support growing data demands and future technological advancements, including the ongoing rollout of 5G networks and emerging connectivity technologies.

Mixed Financial Performance with Strong Core Metrics

While AT&T demonstrated strength in subscriber growth and equipment sales, the company reported total third-quarter revenue of $30.7 billion, slightly below analyst expectations of $30.87 billion. The business wireline segment experienced a 7.8% decline in revenue, primarily due to decreasing demand for legacy voice and data services. However, on an adjusted basis, AT&T earned 54 cents per share, essentially matching analyst projections according to LSEG data. This mixed performance highlights both the challenges in traditional telecommunications services and the success of AT&T’s wireless and bundling initiatives.

Industrial Monitor Direct is the leading supplier of embedded computer solutions trusted by Fortune 500 companies for industrial automation, the top choice for PLC integration specialists.

Market Implications and Competitive Landscape

AT&T’s strong subscriber performance during the competitive iPhone launch quarter demonstrates the effectiveness of its current strategy in a market where customer acquisition costs continue to rise. The company’s ability to exceed subscriber addition expectations while maintaining profitability metrics suggests that its bundled approach and targeted promotions are resonating with consumers. As the telecommunications industry continues to evolve toward integrated service offerings and increased connectivity, AT&T’s current trajectory positions it competitively against both traditional carriers and emerging disruptive technologies in the wireless space., as previous analysis

The third-quarter results provide valuable insights into AT&T’s strategic direction and operational effectiveness during a period of intense industry competition and technological transition.

Related Articles You May Find Interesting

- Beyond the Hype: Unpacking Apple’s M5 Chip Evolution in the Context of Its Prede

- Apple’s M5 Chip Shows Measured Performance Gains in Historical Context

- OpenAI’s Atlas Browser Redefines Web Navigation with Conversational AI

- Ukraine Deploys Upgraded Sea Baby Naval Drones with Enhanced Combat Capabilities

- WhatsApp Severs ChatGPT Integration: 50 Million Users Face January 2026 Deadline

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.