The Unstoppable Ascent of ASML

ASML Holding NV (NASDAQ:ASML), the Netherlands-based semiconductor equipment manufacturer, has experienced a remarkable 50% surge in its stock price since early August, with an impressive 8% gain in just the past week. This dramatic uptick reflects a broader resurgence in semiconductor sector optimism, fueled by strong quarterly earnings, resilient long-term projections, and the seemingly insatiable demand for artificial intelligence (AI) chips. As the sole global supplier of extreme ultraviolet (EUV) lithography systems, ASML occupies a unique and indispensable position in the technology value chain, making it a critical enabler of advancements in AI, high-performance computing, and countless other digital innovations.

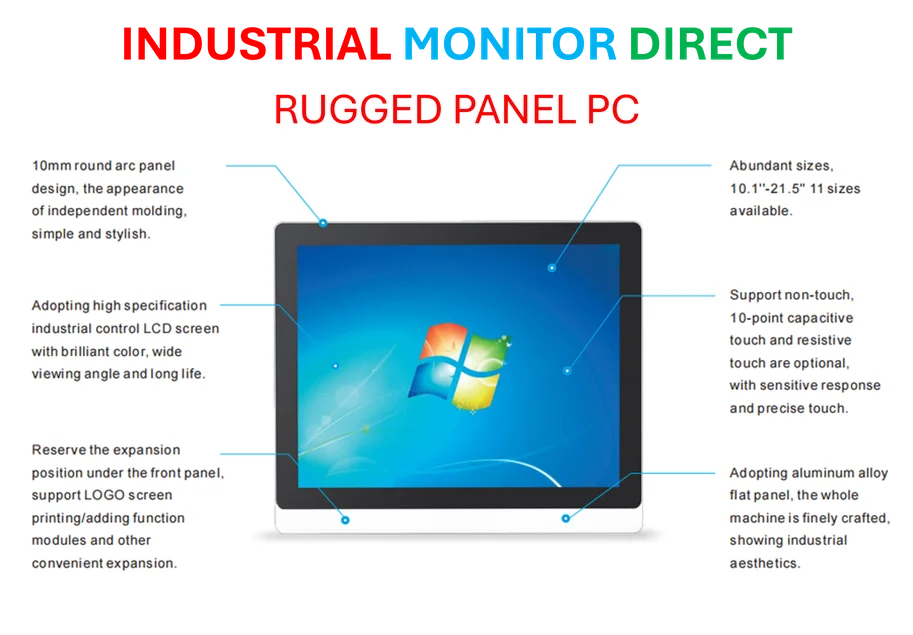

Industrial Monitor Direct offers top-rated geothermal pc solutions backed by same-day delivery and USA-based technical support, the #1 choice for system integrators.

Table of Contents

Financial Performance: Exceeding Expectations

ASML’s recent financial results underscore its robust operational health. The company reported, covered previously, net sales of €7.5 billion (approximately $8.7 billion) for the latest quarter, with fourth-quarter sales projected to reach between €9.2 billion ($10.7 billion) and €9.8 billion ($11.4 billion). These figures position ASML to achieve full-year revenue of around €32.5 billion ($37.8 billion), aligning with the midpoint of its initial forecast. Equally noteworthy is the company’s anticipated gross margin, expected to slightly exceed 52% for the full year. Looking further ahead, ASML has reaffirmed its ambitious 2030 targets, projecting revenue between €44 billion ($51.2 billion) and €60 billion ($69.8 billion) and a gross margin ranging from 56% to 60%.

Navigating Geopolitical Headwinds

Despite its strong performance, ASML faces significant challenges, particularly concerning its market access in China. The company anticipates a decline in sales to Chinese clients by 2026 compared to 2024 and 2025 levels. This projection is particularly consequential given that China accounted for approximately 42% of ASML’s system sales in the most recent quarter. The anticipated downturn stems from tightened export restrictions imposed by the Dutch government, in coordination with U.S. policy, which limit the sale of ASML’s most advanced lithography machines to Chinese semiconductor manufacturers. However, management has sought to reassure investors, clarifying that 2026 net sales are not expected to fall below 2025 levels, a crucial statement that has helped alleviate some of the uncertainty that previously weighed on the stock.

The AI-Driven Demand Surge

The ongoing AI revolution continues to be a primary catalyst for ASML’s growth. The demand for training and operating sophisticated AI models is driving unprecedented need for high-performance semiconductors—precisely the kind of chips manufactured using ASML’s EUV technology. Industry giants like Nvidia and Broadcom are experiencing substantial growth, directly benefiting ASML. Moreover, several of ASML’s largest customers are actively increasing their EUV capacity to keep pace with the soaring demand for AI chips. The scale of this investment is staggering: tech behemoths including Amazon, Alphabet (Google’s parent company), Microsoft, and Meta have indicated plans to cumulatively invest over $364 billion in capital expenditures for their current fiscal years, much of which will indirectly fuel demand for ASML’s equipment.

Valuation and Future Prospects

ASML’s stock currently trades at 36 times estimated earnings for fiscal year 2025, a valuation that may appear elevated but is justified by several compelling factors. Consensus estimates project a robust 15% revenue growth for ASML this year. In the most recent quarter, the company reported net bookings of €5.4 billion ($6.3 billion) and maintains a substantial backlog of approximately €33 billion ($38 billion). With lead times of 12 to 18 months for most of its products, today’s orders provide strong visibility into revenue growth well into 2026, signaling sustained customer confidence. ASML’s unrivaled market position, proprietary technology, and strategic exposure to the generative AI trend further enhance its investment appeal.

The Technological Edge: Enabling Moore’s Law

ASML’s extreme ultraviolet (EUV) lithography machines represent the pinnacle of semiconductor manufacturing technology. These systems utilize ultra-short wavelengths of light to etch incredibly intricate circuit patterns onto silicon wafers, enabling the production of cutting-edge chips at 5 nanometers and smaller. In essence, without ASML’s EUV technology, the advanced processors powering AI data centers, smartphones, and modern vehicles would not exist. EUV is crucial for perpetuating Moore’s Law—the industry principle that transistor density doubles approximately every two years—allowing chipmakers to continuously enhance computing power and cost-efficiency. This technological indispensability forms a compelling long-term investment thesis for ASML.

Investment Considerations

For investors evaluating ASML, several key points merit attention:, according to recent developments

- Exclusive market position: ASML holds a virtual monopoly in EUV lithography, with no viable competitors on the horizon.

- Technological moat: The complexity of EUV technology creates significant barriers to entry, protecting ASML’s market dominance.

- Long-term visibility: The substantial order backlog and extended lead times provide revenue predictability.

- Strategic importance: ASML’s role as a key enabler of technological progress across multiple sectors underscores its enduring relevance.

While geopolitical risks and valuation concerns warrant consideration, ASML’s unique position at the heart of the semiconductor ecosystem, combined with the structural tailwinds from AI and digital transformation, suggests that its recent rally may be more than just temporary hype—it could represent a fundamental recognition of the company’s critical role in shaping the future of technology.

Related Articles You May Find Interesting

- Rethinking Hybrid Work: CEO Advocates Quarterly In-Person Strategy Over Office M

- Secure Your Digital Operations: 1Password Enterprise Security at Just $36 Annual

- The AI Revolution: How Google’s Search Evolution Threatens Its $200 Billion Ad E

- xAI’s Hollywood Training Ground: How Copyrighted Films Fuel Next-Gen Video AI De

- European Aerospace Giants Forge Satellite Powerhouse to Compete in Shifting Spac

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers industry-leading bioreactor pc solutions engineered with enterprise-grade components for maximum uptime, the #1 choice for system integrators.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.