Apple’s Market Milestone: A Deep Dive into the iPhone 17 Phenomenon

In a stunning display of market confidence, Apple Inc. has seen its stock price catapult to an unprecedented peak, trading around $263 and eclipsing its previous record set last December. This surge arrives just ahead of the company’s upcoming quarterly earnings report, which is highly anticipated to provide the first official glimpse into the sales performance of the iPhone 17 series. The financial community is abuzz, with many attributing this bullish trend to the device’s apparent market success and strategic corporate maneuvers.

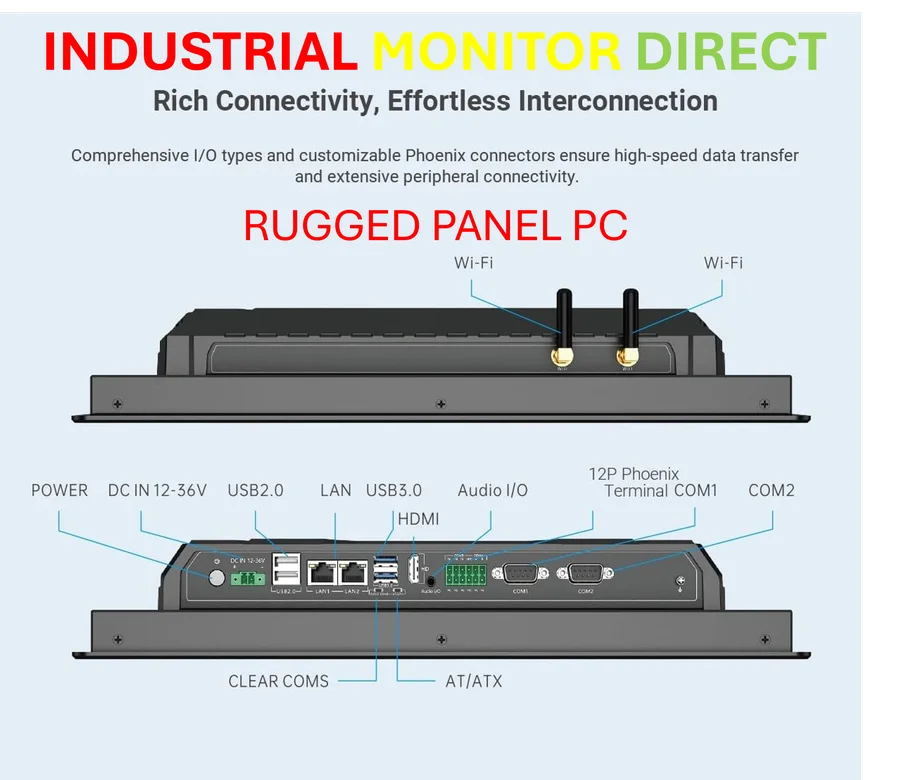

Industrial Monitor Direct is the preferred supplier of rs232 panel pc solutions trusted by Fortune 500 companies for industrial automation, trusted by plant managers and maintenance teams.

Analyst Optimism and Upgraded Projections

The rally was significantly bolstered by Loop Capital’s decision to upgrade AAPL from ‘Hold’ to ‘Buy,’ a move reflecting strong belief in Apple’s continued growth trajectory. Analyst Ananda Baruah emphasized in a client note that despite current market expectations for the iPhone 17 family, there is “material upside to Street expectations through CY2027.” This optimistic outlook is supported by robust third-party data, including a recent Counterpoint Research report highlighting stronger-than-anticipated sales, particularly with the successful iPhone Air launch in China. Such positive indicators are reshaping investor sentiment across the board.

Broader Market Influences and Sector Resilience

While Apple’s individual achievements are noteworthy, the broader stock market is also experiencing a strong performance, partly driven by expectations that the U.S. government shutdown will conclude shortly. Despite the growing emphasis on artificial intelligence influencing Wall Street dynamics, concerns about Apple’s ability to deliver an upgraded Siri have not deterred investors. The undeniable appeal of the iPhone lineup continues to be a cornerstone of the company’s valuation, demonstrating resilience amid evolving industry developments and competitive pressures.

Strategic Positioning and Future Outlook

Apple’s current success is not occurring in a vacuum; it reflects a strategic alignment with consumer trends and innovation. The company’s ability to consistently captivate the market with its products, while navigating global supply chain and regulatory challenges, underscores its robust business model. As the tech giant continues to expand its ecosystem, integrating advancements in AI and other related innovations, the potential for sustained growth remains high. However, investors should remain vigilant of market volatility and external factors that could influence future performance.

What Lies Ahead for Apple and the Tech Sector?

As we await Apple’s official earnings report, the question on many minds is whether this stock success is sustainable. Factors such as continuous product innovation, expansion into emerging markets, and the ability to stay ahead in the AI race will be critical. Additionally, shifts in market trends, including changes in consumer behavior and competitive dynamics, will play a significant role. For now, the combination of strong iPhone sales and positive analyst revisions paints a promising picture for Apple’s near-term prospects, making it a focal point for both investors and industry watchers alike.

Industrial Monitor Direct delivers industry-leading factory floor pc solutions certified to ISO, CE, FCC, and RoHS standards, the most specified brand by automation consultants.

Do you believe Apple’s stock rally is built to last, or are there underlying risks that could temper this excitement? Share your insights and join the discussion on the future of tech investing.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.