According to CNBC, traders who shorted the S&P 500 in October faced significant losses as the index gained 2.3%, defying historical “Octoberphobia” fears stemming from the 1929 market crash and 1987 Black Monday. The tech-heavy Nasdaq Composite performed even better with a 4.7% October surge, driven by AI-related stocks including Amazon’s 9.6% single-day jump following strong cloud computing growth and CEO Andy Jassy highlighting “strong demand in AI and core infrastructure.” Nvidia became the first company to reach a $5 trillion valuation in October, with CEO Jensen Huang describing AI’s “virtuous cycle” where usage growth drives investment, improving AI capabilities and further boosting usage. Big Tech companies reported massive capital expenditure increases primarily targeting AI infrastructure during recent earnings disclosures. This sustained momentum suggests we’re witnessing more than temporary enthusiasm.

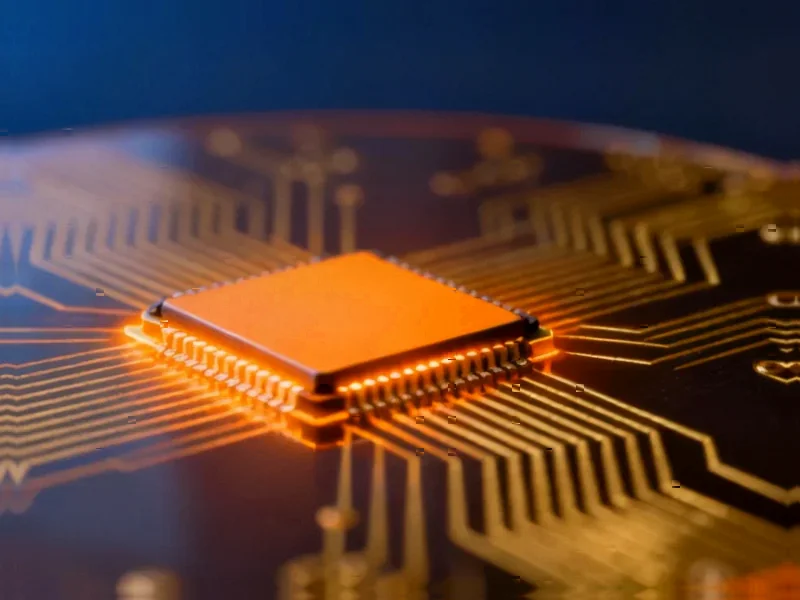

The Infrastructure Investment Reality

What makes this AI cycle different from previous tech bubbles is the tangible infrastructure build-out happening across the industry. Unlike the dot-com era where valuations often preceded revenue, today’s AI investments are following massive enterprise adoption and proven use cases. The capital expenditure announcements from major cloud providers represent concrete commitments to building data centers, securing energy contracts, and developing specialized hardware. This creates a moat effect where early leaders can maintain their advantage through scale and proprietary technology stacks. The virtuous cycle Huang describes isn’t just theoretical—we’re seeing it play out in real-time as improved models drive more applications, which in turn justify further infrastructure spending.

Winners Beyond the Obvious

While Nvidia and cloud providers capture headlines, the ripple effects extend throughout the technology ecosystem. Semiconductor equipment manufacturers, cooling system specialists, and power management companies are experiencing unprecedented demand. More importantly, we’re seeing the emergence of specialized AI infrastructure plays that cater to specific workloads or regulatory requirements. Companies focusing on sovereign AI, edge deployment, or industry-specific models are carving out defensible positions. The market is becoming increasingly segmented, with different players dominating various layers of the AI stack from hardware to foundational models to application-specific solutions.

The Capital Intensity Challenge

The massive capital requirements create both opportunity and risk. While well-funded incumbents can afford the billions needed for AI infrastructure, this creates significant barriers to entry for smaller players. We’re likely to see increased consolidation as companies struggle to compete with the scale advantages of cloud giants. Additionally, the energy consumption and environmental impact of these data centers present growing challenges that could trigger regulatory scrutiny. Companies leading in energy efficiency and sustainable AI practices may gain competitive advantages as these concerns become more prominent in investment decisions and customer preferences.

Beyond the Current Cycle

The current AI investment wave represents a fundamental restructuring of how technology value is created and captured. We’re moving from software-centric models to hybrid approaches combining specialized hardware, massive data infrastructure, and sophisticated algorithms. This shift will likely create new business models where AI capabilities become embedded across all industries rather than remaining siloed in technology companies. The companies that succeed long-term will be those that can translate AI infrastructure advantages into sustainable competitive moats while navigating the complex regulatory and environmental challenges that come with this scale of technological transformation.

Your article helped me a lot, is there any more related content? Thanks!