Taiwan Semiconductor Manufacturing Company (TSMC), the world’s premier semiconductor foundry, has announced remarkable financial results for the July-September quarter, with net profit soaring nearly 40% year-over-year to reach an unprecedented 452.3 billion new Taiwan dollars ($15 billion). This performance significantly exceeded market expectations and underscores the unprecedented demand for advanced chips driven by artificial intelligence applications that continues to reshape global technology landscapes.

Record-Breaking Quarter Exceeds All Projections

The chip manufacturing giant’s latest earnings report reveals a comprehensive financial outperformance, with revenue climbing 30% compared to the same period last year. This represents one of the most substantial profit surges in the company’s history and demonstrates TSMC’s critical position in the global technology supply chain. The results highlight how AI-driven computing requirements are translating directly into financial success for companies controlling advanced semiconductor manufacturing capabilities.

Strategic Global Expansion Amid Geopolitical Considerations

TSMC has been actively diversifying its manufacturing footprint through substantial investments in new fabrication facilities in the United States and Japan. This strategic expansion serves as a hedge against potential disruptions from ongoing China-U.S. trade tensions while positioning the company closer to key customers in North America and Asia. The chipmaker’s commitment now totals approximately $165 billion in U.S. investments alone, including significant new factory construction in Arizona that will enhance domestic semiconductor production capabilities.

Dominant Market Position and Customer Relationships

As the primary supplier to technology leaders including Apple and Nvidia, TSMC maintains what Morningstar analysts describe as “unyielding demand” for its products. This dominant market position provides significant pricing power and operational stability, with analysts noting that even potential tariffs on shipments to U.S. customers would unlikely hinder the company’s trajectory. The relationship with Apple remains particularly crucial as the tech giant continues to advance its proprietary silicon development for professional devices with enhanced AI capabilities.

AI Infrastructure Driving Sustained Growth

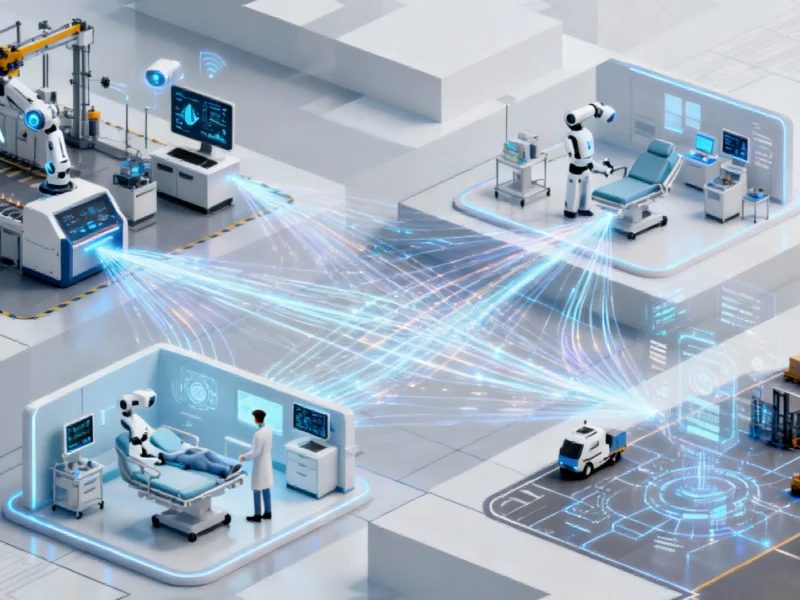

The artificial intelligence boom continues to fuel demand for TSMC’s advanced manufacturing processes, with the company positioned as the primary beneficiary of increased spending on AI infrastructure across multiple sectors. This growth trajectory appears sustainable as software ecosystems evolve, including upcoming operating system updates that incorporate critical AI functionality and enterprise-level deployments of AI tools. The convergence of hardware advancement and software integration creates a virtuous cycle for semiconductor manufacturers with cutting-edge capabilities.

Geopolitical Dynamics and Production Allocation

Recent proposals from U.S. Commerce Secretary Howard Lutnick suggesting a 50-50 split of computer chip production between Taiwan and the United States have been met with resistance from Taiwanese authorities. This underscores the complex geopolitical considerations surrounding semiconductor manufacturing, given that Taiwan currently hosts the majority of global advanced chip production capacity. The situation highlights the strategic importance of TSMC’s operations and the careful balancing act required in global technology supply chains.

Future Outlook and Industry Impact

Looking forward, TSMC’s massive capital investments signal confidence in sustained demand growth for advanced semiconductors. The company’s manufacturing capabilities enable technological progress across multiple domains, from consumer electronics to enterprise computing solutions. As organizations worldwide implement comprehensive AI integration across their operational frameworks, TSMC stands to benefit from the underlying hardware requirements that power these digital transformations. The semiconductor leader’s performance suggests the AI-driven growth cycle has substantial runway remaining, with TSMC positioned to capture significant value from this technological megatrend.

Based on reporting by {‘uri’: ‘manufacturing.net’, ‘dataType’: ‘news’, ‘title’: ‘Manufacturing.net’, ‘description’: ‘Manufacturing.net provides manufacturing professionals with industry news, videos, trends, and analysis as well as expert blogs and new product information.’, ‘location’: {‘type’: ‘place’, ‘geoNamesId’: ‘5261457’, ‘label’: {‘eng’: ‘Madison, Wisconsin’}, ‘population’: 233209, ‘lat’: 43.07305, ‘long’: -89.40123, ‘country’: {‘type’: ‘country’, ‘geoNamesId’: ‘6252001’, ‘label’: {‘eng’: ‘United States’}, ‘population’: 310232863, ‘lat’: 39.76, ‘long’: -98.5, ‘area’: 9629091, ‘continent’: ‘Noth America’}}, ‘locationValidated’: False, ‘ranking’: {‘importanceRank’: 482874, ‘alexaGlobalRank’: 270100, ‘alexaCountryRank’: 105425}}. This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.